Table of Contents

Overview

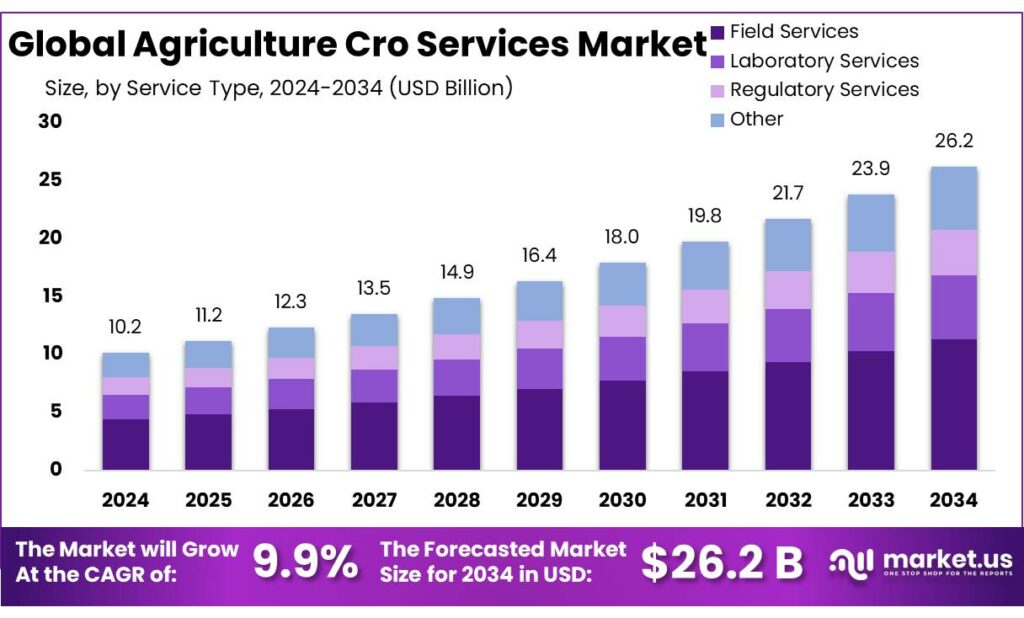

New York, NY – October 10, 2025 – The Global Agriculture CRO Services Market is projected to reach USD 26.2 billion by 2034, rising from USD 10.2 billion in 2024, reflecting a strong CAGR of 9.9% between 2025 and 2034. In 2024, North America dominated the market, securing a 43.9% share with revenue of USD 4.4 billion.

Agriculture Contract Research Organization (CRO) services encompass a broad range of outsourced research and development functions such as regulatory testing, field trials, laboratory analysis, toxicology, residue studies, seed validation, and biotechnology assessments. Agrochemical and seed companies increasingly rely on CROs to reduce operational costs, manage complex regulations, and accelerate time-to-market while accessing specialized scientific expertise.

Government policies and public investments are driving the expansion of this sector. The Government of India, for instance, allocated INR 1.75 trillion to the agricultural sector for FY 2025–2026, aimed at enhancing rural income and moderating inflation. Similarly, the Maharashtra government launched the ‘MahaAgri-AI Policy 2025–2029’, investing INR 500 crore to integrate AI and advanced digital technologies into agricultural systems.

Further, initiatives such as the Pradhan Mantri Krishi Sinchai Yojana (₹50,000 crore) support irrigation efficiency and resource optimization, indirectly benefiting CRO-based field research. Moreover, the Union Budget 2025–26 earmarked ₹1,61,965 crore (US$18.7 billion) for the Ministry of Chemicals and Fertilizers, reinforcing the synergy between agrochemical R&D and CRO partnerships. The deployment of AI-powered weather forecasting tools for 38 million farmers exemplifies how technology-backed public initiatives are fostering demand for precision research and agricultural innovation.

Key Takeaways

- The Global Agriculture Cro Services Market size is expected to be worth around USD 26.2 billion by 2034, from USD 10.2 billion in 2024, growing at a CAGR of 9.9%.

- Field Services held a dominant market position, capturing more than a 43.2% share of the Agriculture CRO Services market.

- Crop Protection Chemicals held a dominant market position, capturing more than a 48.7% share of the Agriculture CRO Services market.

- North America emerged as the dominant region in the Agriculture Contract Research Organization (CRO) Services market, capturing a substantial 43.9% share, equating to approximately USD 4.4 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/agriculture-cro-services-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 10.2 Billion |

| Forecast Revenue (2034) | USD 26.2 Billion |

| CAGR (2025-2034) | 9.9% |

| Segments Covered | By Service Type (Field Services, Laboratory Services, Regulatory Services, Other), By Sector (Crop Protection Chemicals, Fertilizers, Seeds, Others) |

| Competitive Landscape | Eurofins Scientific SE, SGS SA, Charles River Laboratories International, Inc., Syntech Research Group, Inc., Knoell Germany GmbH, ERM International Group Limited, Staphyt Group, Anadiag Group SAS, RIFCON GmbH, Smithers Group Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158257

Key Market Segments

Service Type Analysis

Field Services Lead with 43.2% Market Share in 2024

In 2024, Field Services commanded a leading 43.2% share of the Agriculture CRO Services market, underscoring their vital role in delivering on-site research and data collection for agrochemical firms, seed developers, and regulatory authorities. These services encompass site management, crop protection, testing, and pest management, all essential for validating the safety and effectiveness of agricultural products.

The surge in demand for localized trials and region-specific studies, requiring direct engagement with field conditions, drives this segment’s dominance. As the need for precise, region-tailored agricultural data grows, field services remain crucial for navigating complex regulatory frameworks and delivering reliable real-world insights.

Sector Analysis

Crop Protection Chemicals Hold 48.7% Market Share in 2024

In 2024, Crop Protection Chemicals secured a leading 48.7% share of the Agriculture CRO Services market, propelled by the rising need for effective pest control solutions in agriculture. With global efforts focused on boosting crop yields and safeguarding against pests, diseases, and weeds, these chemicals are integral to modern farming.

The segment’s growth is fueled by the demand for safer, eco-friendly chemicals that enhance productivity while minimizing environmental impact. The integration of innovative solutions and precision technologies further strengthens the dominant position of crop protection chemicals in 2024.

Regional Analysis

North America Dominates Agriculture CRO Services Market with 43.9% Share in 2024

In 2024, North America solidified its leadership in the Agriculture Contract Research Organization (CRO) Services market, holding a 43.9% share, equivalent to approximately USD 4.4 billion in market value. This prominence highlights the region’s critical role in global agricultural research and development.

The United States, in particular, benefits from advanced agricultural infrastructure, including cutting-edge research facilities, vast farmland, and a robust network of academic and private institutions. These assets support extensive field trials, regulatory compliance studies, and environmental assessments, reinforcing North America’s dominant position in the Agriculture CRO Services market.

Top Use Cases

- Agrochemical Testing: Agrochemical companies hire CROs to run field trials on new pesticides and herbicides, checking how well they fight pests without harming crops or the soil. This helps create safer products that boost farm yields while meeting strict safety rules, saving companies time and money on in-house testing.

- Seed Development Trials: Seed firms partner with CROs to test new seed varieties in different soils and weather conditions across regions. These trials measure growth speed, disease resistance, and harvest quality, allowing developers to pick the best seeds for farmers facing changing climates.

- Regulatory Compliance Support: Biotech innovators use CROs to gather data for government approvals of genetically modified crops. Experts handle safety studies on environmental impact and health risks, ensuring smooth registration and helping companies avoid delays in bringing innovations to market.

- Biostimulant Efficacy Studies: Crop nutrition providers rely on CROs for greenhouse and field tests of natural boosters that enhance plant health. These services track improvements in root strength and water use, proving the product’s value to farmers seeking eco-friendly ways to grow stronger crops.

- Pest Management Research: Fertilizer makers collaborate with CROs to evaluate integrated pest strategies combining chemicals and biology. Trials assess long-term effects on biodiversity and crop protection, guiding farmers toward balanced methods that reduce chemical use and promote sustainable farming.

Recent Developments

1. Eurofins Scientific SE

Eurofins is aggressively expanding its agricultural testing footprint through acquisitions and new lab openings, particularly in genomics and residue testing. A key development is the launch of advanced digital PCR and NGS solutions for more precise GMO and seed testing. Their Agroscience CRO services are also integrating new bioanalytical platforms to enhance environmental fate and ecotoxicology studies, supporting global regulatory submissions for clients.

2. SGS SA

SGS is focusing on digital innovation with its “SGS Digicomply” platform, which uses AI to streamline agri-food regulatory compliance and risk monitoring. They have also launched new services for sustainable agriculture, including carbon footprint verification and soil health analysis. Recent expansions in their field trial networks in Europe and South America strengthen their capacity for seed treatment and biological efficacy studies.

3. Charles River Laboratories International, Inc.

Charles River is enhancing its early-stage agriscience offerings by leveraging its expertise in discovery and safety assessment. Recent developments include applying their microbial solutions platform to develop novel biocontrols and biostimulants. They are also expanding their capacity for complex ecotoxicology and environmental fate studies to meet evolving global regulatory standards for agrochemicals and genetically modified crops.

4. Sintox Research Group, Inc.

Sintox continues to specialize in complex field research, recently investing in advanced application technology and data collection systems for high-precision field trials. They have expanded their capabilities in residue decline studies and efficacy testing for biopesticides and organic products. Their focus remains on providing tailored, full-service field study programs from their research farms in key agricultural regions.

5. Knoell Germany GmbH

Knoell, a specialist in global regulatory consulting, is expanding its scientific evaluation services for complex biologicals and novel fertilizer products. They have developed new integrated strategies to navigate the EU’s Green Deal regulations, particularly for the renewal of existing active substances. Their recent growth includes strengthening their expert teams in toxicology and environmental risk assessment to support global market access for clients.

Conclusion

Agriculture CRO Services as a vital backbone for modern farming innovation, bridging the gap between cutting-edge ideas and practical farm solutions. These services empower companies to tackle pressing challenges like climate shifts and food demands by offering expert testing, regulatory guidance, and real-world insights without the burden of building their own vast research networks. Their role will only grow, fostering greener practices and stronger global food systems through trusted partnerships that drive efficiency and sustainability across the board.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)