Table of Contents

Overview

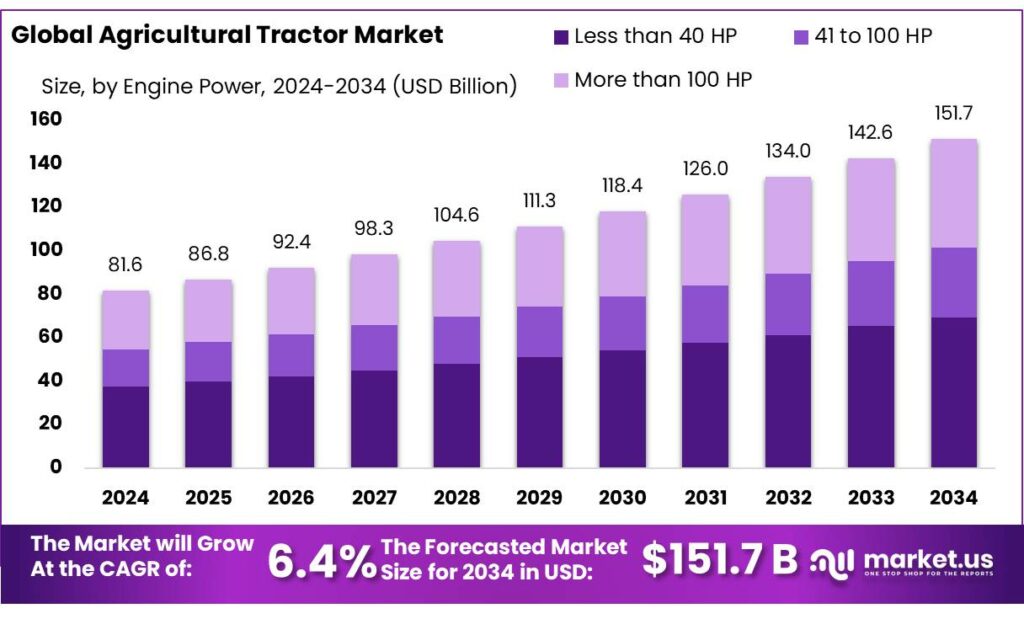

New York, NY – October 07, 2025 – The Global Agricultural Tractor Market is projected to reach USD 151.7 billion by 2034, rising from USD 81.6 billion in 2024, expanding at a CAGR of 6.4% from 2025 to 2034. In 2024, the Asia-Pacific led the market, accounting for over 48.2% share, valued at USD 39.3 billion.

India remains the world’s largest producer and consumer of tractors, with annual sales touching 10 lakh units in 2025. This growth reflects the country’s rapid mechanization of agriculture, driven by rising labor costs, the need for efficient sowing and harvesting, and a focus on sustainable farming.

Government policies have significantly strengthened this momentum. The Ministry of Agriculture and Farmers Welfare earmarked INR 1,27,470 crore in the FY2024–25 interim budget, prioritizing farm mechanization and rural infrastructure. Additionally, the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) scheme continues to boost farmers’ purchasing power, enabling investment in modern equipment. State initiatives like Maharashtra’s MahaAgri-AI Policy (2025–2029) further enhance digital adoption in agriculture, backed by an INR 500 crore allocation to promote AI and smart farming.

The Indian tractor market is dominated by domestic OEMs such as Mahindra & Mahindra, TAFE, and Escorts Kubota, who lead innovation with GPS-enabled and precision-farming tractors. The 30–50 HP segment holds the largest share due to its adaptability across diverse crops and terrains.

Furthermore, schemes like the Sub-Mission on Agricultural Mechanization (SMAM) have been vital. Between 2014–15 and 2020–21, the government invested ₹4,556.93 crore, distributing over 13 lakh machines and establishing 27,500+ Custom Hiring Centres (CHCs). The 2021–22 SMAM allocation increased to ₹1,050 crore, reaffirming India’s long-term commitment to farm modernization.

Key Takeaways

- The Global Agricultural Tractor Market size is expected to be worth around USD 151.7 billion by 2034, from USD 81.6 billion in 2024, growing at a CAGR of 6.4%.

- Less than 40 horsepower (HP) held a dominant market position in India, capturing more than a 45.8% share.

- Manual tractors held a dominant market position in India, capturing more than a 94.6% share.

- 2WD (two-wheel drive) tractors held a dominant market position in India, capturing more than a 74.3% share.

- Internal combustion engine (ICE) tractors held a dominant market position in India, capturing more than a 94.5% share.

- The Asia-Pacific region dominated the global agricultural tractor market, capturing a substantial 48.2% share, equivalent to approximately USD 39.3 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-agricultural-tractor-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 81.6 Billion |

| Forecast Revenue (2034) | USD 151.7 Billion |

| CAGR (2025-2034) | 6.4% |

| Segments Covered | By Engine Power (Less than 40 HP, 41 to 100 HP, More than 100 HP), By Operation Type (Manual Tractors, Autonomous Tractors), By Driveline (2WD, 4WD), By Propulsion (ICE, Electric) |

| Competitive Landscape | AGCO Corp., CNH Industrial N.V., Deere & Company, CLAAS KGaAmbH, Escorts Ltd., Sonalika, Yanmar, Ltd., KubotaCorp., Mahindra & Mahindra Ltd., Tractors and Farm Equipment Ltd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157685

Key Market Segments

Engine Power Analysis

In 2024, tractors with less than 40 horsepower (HP) commanded a 45.8% share of the Indian tractor market. Their dominance stems from their suitability for small, fragmented landholdings prevalent in states like Uttar Pradesh, Bihar, and Odisha. These compact tractors excel in tasks such as plowing, sowing, and hauling, making them essential for small-scale farmers.

Their affordability, versatility, and efficiency have fueled their popularity. Government programs, such as the Sub-Mission on Agricultural Mechanization (SMAM), have further boosted adoption by offering subsidies, making these tractors accessible to small and marginal farmers.

Operation Type Analysis

Manual tractors dominated the Indian market in 2024, holding a 94.6% share. Their affordability, ease of use, and widespread availability make them the preferred choice for small and marginal farmers. The popularity of manual tractors is driven by their low initial and maintenance costs, simplicity in operation, and ease of repair, which is critical in rural areas with limited technical expertise. A robust dealer network and readily available spare parts further enhance their appeal.

Driveline Analysis

In 2024, two-wheel drive (2WD) tractors captured a 74.3% share of the Indian market due to their affordability, fuel efficiency, and suitability for small to medium-sized farms, which dominate India’s agricultural sector.

The fiscal year 2024-25 saw record-breaking tractor sales of 10 lakh units in India, with 2WD models leading the surge. Increased farm mechanization, government subsidies, and favorable monsoons contributed to this growth.

Propulsion Analysis

Internal combustion engine (ICE) tractors held a 94.5% market share in India in 2024, driven by their affordability, reliability, and versatility across various terrains and agricultural tasks. ICE tractors dominated the record 10 lakh unit sales in the fiscal year 2024-25, supported by enhanced farm mechanization, government subsidies, and favorable monsoon conditions. In Uttar Pradesh, for instance, tractor ownership surged by over 62% from 2016-17 to 2024-25, with subsidies covering nearly 50% of the cost for tractor-operated equipment.

Regional Analysis

In 2024, the Asia-Pacific region emerged as the dominant force in the global agricultural tractor market, accounting for 48.2% of total revenue and reaching a valuation of around USD 39.3 billion. This commanding position reflects the region’s deep reliance on agriculture and its accelerating transition toward mechanized farming to enhance productivity and efficiency.

Countries such as India, China, and Japan are at the forefront of this growth, driven by rising population demands, shrinking agricultural labor availability, and supportive government programs promoting farm modernization. Increasing investments in rural infrastructure, precision farming technologies, and digital tools have further fueled tractor adoption across the region.

The Asia-Pacific’s strong market performance underscores its pivotal role in shaping the future of global agricultural mechanization, where innovation, affordability, and large-scale farming integration continue to define regional market dynamics.

Top Use Cases

- Plowing and Tilling: Agricultural tractors equipped with plows and tillers break up hard soil and create fine seedbeds, making it easier for farmers to prepare fields for planting. This task saves time and effort compared to manual methods, allowing even small farms to manage larger areas efficiently and improve crop growth conditions through better aeration and weed control.

- Seeding and Planting: Using seeders attached to tractors, farmers can sow seeds accurately across vast fields, ensuring even spacing and depth for optimal germination. This application boosts planting speed and precision, reducing waste and helping crops establish stronger roots, which leads to healthier yields without the need for excessive labor.

- Fertilizing and Spraying: Tractors pull spreaders and sprayers to distribute fertilizers, pesticides, and herbicides evenly over crops. This helps protect plants from pests and nutrient deficiencies while minimizing chemical overuse, promoting healthier fields and safer farming practices that support sustainable agriculture on various farm sizes.

- Harvesting Support: Tractors haul harvested crops like grains or vegetables from fields to storage using trailers, speeding up the collection process after combines or manual picking. Their power handles heavy loads over rough terrain, reducing post-harvest losses and enabling farmers to process produce quickly for better market freshness.

- Land Maintenance: For brush hogging and clearing, tractors mow weeds, remove debris, and level surfaces to keep fields tidy and ready for the seasons. Attachments like mowers make this versatile for ongoing farm upkeep, preventing overgrowth that could harm crops and ensuring smooth operations year-round, even in off-planting periods.

Recent Developments

1. AGCO Corp.

AGCO is advancing its “Farmer-First” strategy by launching the new Fendt Momentum planter, a cornerstone of its precision agriculture portfolio. The company is heavily investing in its Fendt e100 Vario, a compact, all-electric tractor, showcasing its commitment to a sustainable product line. These developments focus on integrating smart technology and alternative propulsion to boost productivity and reduce environmental impact.

2. CNH Industrial N.V.

CNH Industrial has launched the New Holland T4 Electric Power, the industry’s first all-electric utility tractor. The company is also deepening its partnership with Monarch Tractor, integrating its autonomous, electric capabilities. Furthermore, CNH has unveiled the new Case IH Quadtrac Series, featuring a novel suspension and drivetrain for enhanced power and efficiency, demonstrating a clear focus on both electrification and high-horsepower innovation.

3. Deere & Company

Deere is pushing autonomy with its fully autonomous 8R tractor and ExactShot planting system, which uses smart technology to reduce fertilizer use. The company is also expanding its digital ecosystem, launching new electric and hybrid-electric tractor concepts, and integrating advanced See & Spray technology for targeted weed control. These moves solidify John Deere’s position at the forefront of precision agriculture and automation.

4. CLAAS KGaA mbH

CLAAS recently introduced the new LEXION 8000 series combine harvesters with advanced automation and the TELEMATICS 4.2 data system. For tractors, the focus is on the modernized XERION 5000-4000 series, featuring the new C-MOS vision system for the front linkage. This enhances efficiency in material handling and mixed farming operations, emphasizing improved connectivity and driver assistance in their high-horsepower tractor range.

5. Escorts Ltd.

Escorts Kubota Limited has launched the new Farmtrac 60 series, featuring advanced Euro-technology engines for better fuel efficiency and lower emissions. The company is aggressively expanding its presence in the rice belt of India with specialized Powertrac tractors. A key recent development is the formalization of its joint venture with Kubota, aiming to accelerate technological innovation and expand its market share in the highly competitive Indian tractor sector.

Conclusion

The Agricultural Tractor sector stands as a cornerstone of modern farming, driven by the need for efficiency and sustainability. With rising focus on automation and eco-friendly tech, tractors continue to transform operations, empowering farmers to meet global food demands through versatile tools that enhance productivity and adapt to diverse landscapes without heavy reliance on manual work.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)