Table of Contents

Overview

New York, NY – August 28, 2025 –

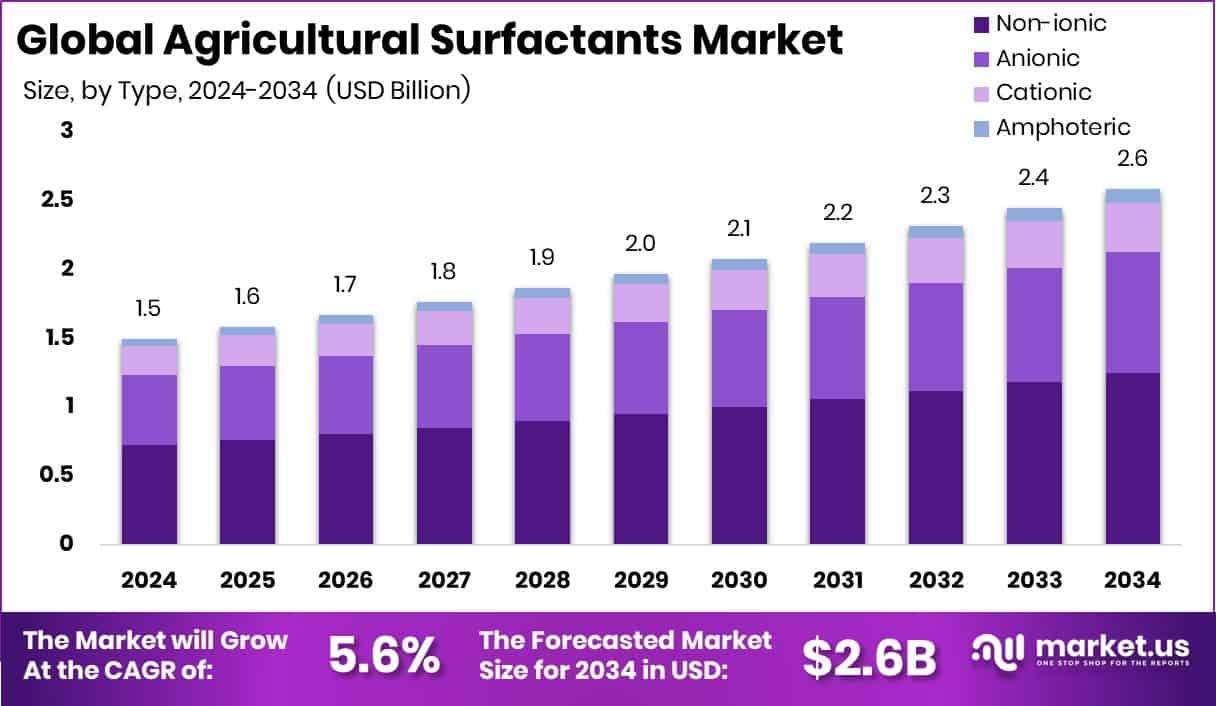

The Global Agricultural Surfactants Market is projected to reach USD 2.6 billion by 2034, rising from USD 1.5 billion in 2024, at a CAGR of 5.6% from 2025 to 2034. Within this, Asia Pacific holds 42.80%, equivalent to USD 0.6 billion, highlighting strong regional adoption.

Agricultural surfactants are vital in farming as they lower liquid surface tension, enabling pesticides, herbicides, fungicides, and fertilizers to spread more evenly, penetrate leaves, and improve absorption. These additives are widely used in cereals, oilseeds, fruits, vegetables, and other crops, supporting both productivity and sustainability by reducing chemical wastage.

Market growth is fueled by rising global food demand, the need for higher yields, and the adoption of efficient crop protection practices. Expansion of high-value crop cultivation and innovations in spray technology further push demand. Climate change and pest resistance also underline the importance of precision in chemical delivery.

The shift toward precision agriculture and large-scale commercial farming is boosting demand, with farmers aiming for maximum coverage and minimal waste. Supporting developments include Locus Fermentation Solutions securing $30 million after restructuring its carbon farming program, and Unilever, AXA, and Tikehau pledging €300 million toward an agriculture-focused impact fund.

➤ Click the sample report link for complete industry insights: https://market.us/report/agricultural-surfactants-market/request-sample/

Key Takeaways

- The Global Agricultural Surfactants Market is expected to be worth around USD 2.6 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034.

- Non-ionic surfactants hold a 48.2% share in the agricultural surfactants market, driven by versatile application benefits.

- Synthetic substrates dominate the agricultural surfactants market with a 79.1% share, reflecting their efficiency and cost-effective production advantages.

- The cereals and grains segment leads the agricultural surfactants market at 49.4%, supported by large-scale crop cultivation needs.

- Herbicide application accounts for 49.8% of the agricultural surfactants market, fueled by rising weed control product usage globally.

- Strong crop production drives Asia Pacific 42.80%, USD 0.6 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155550

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.5 Billion |

| Forecast Revenue (2034) | USD 2.6 Billion |

| CAGR (2025-2034) | 5.6% |

| Segments Covered | By Type (Non-ionic, Anionic, Cationic, Amphoteric), By Substrate (Synthetic, Bio-based), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others), By Application (Herbicides, Insecticides, Fungicides, Others) |

| Competitive Landscape | Clariant, Evonik Industries AG, Dow, Solvay, Bayer AG, Nufarm, Huntsman International LLC, Croda International Plc, Helena Agri-Enterprises, LLC, Stepan Company, Wilbur-Ellis Holding, Inc. |

Key Market Segments

By Type Analysis

In 2024, Non-ionic surfactants led the Agricultural Surfactants Market By Type segment with a 48.2% share. Their dominance stems from versatility, broad compatibility with pesticides and fertilizers, and reliable performance across different water qualities and pH levels. These surfactants lower surface tension without altering active ingredients, enabling better spray coverage and deeper plant penetration.

Their effectiveness in both systemic and contact agrochemical applications makes them suitable for cereals, oilseeds, fruits, and vegetables, while adaptability to diverse climates supports global use. Growing adoption of precision farming and the focus on input efficiency have further driven their uptake.

Farmers increasingly rely on non-ionic surfactants to counter pest resistance and uneven distribution issues. With sustainability becoming central, newer biodegradable formulations are strengthening their acceptance. This strong positioning is expected to hold as agriculture continues shifting toward efficient and sustainable crop practices.

By Substrate Analysis

In 2024, Synthetic surfactants held a leading position in the Agricultural Surfactants Market By Substrate segment, capturing a 79.1% share. Their dominance comes from wide availability, affordability, and consistent performance across varied agricultural applications. Derived from petrochemical sources, they provide strong stability, long shelf life, and compatibility with herbicides, fungicides, and insecticides.

Their effectiveness in ensuring uniform spray coverage, deeper chemical penetration, and higher active ingredient efficiency has made them a preferred option for large-scale farming. Designed to perform reliably under different water qualities and environmental conditions, they are suited to diverse crops and geographies. Established production systems also support mass manufacturing at competitive prices, ensuring accessibility across developed and emerging markets.

With ongoing innovations improving formulation efficiency and lowering application costs, synthetic surfactants maintain their leading role. Despite sustainability considerations, their proven adaptability and contribution to intensive farming keep them central to achieving productivity and crop protection goals.

By Crop Type Analysis

In 2024, Cereals and Grains led the Agricultural Surfactants Market By Crop Type segment, accounting for a 49.4% share. This dominance is tied to the large-scale cultivation of staple crops such as wheat, rice, corn, and barley, which are essential to global food security. Managing pests, weeds, and diseases in these crops requires efficient use of agrochemicals, where surfactants significantly enhance the performance of herbicides, fungicides, and insecticides.

Non-ionic and other compatible surfactants are widely applied to improve spray coverage, ensure uniform distribution, and increase absorption into plant surfaces, resulting in stronger protection and higher yields. With rising population and food demand, farmers are turning to advanced crop protection techniques to maximize productivity per hectare.

The segment also benefits from growing adoption of mechanized and precision farming, particularly where accurate and consistent chemical application is critical. Since cereals and grains are cultivated across diverse climates, surfactants play a vital role in maintaining crop health and yield stability. Given their importance in the global food supply chain, cereals and grains are expected to retain their leading position in the market.

By Application Analysis

In 2024, Herbicides dominated the Agricultural Surfactants Market By Application segment with a 49.8% share. This strong position is driven by the growing need for effective weed control to safeguard crop yields and maximize nutrient utilization. In both large-scale and precision farming, surfactants play a vital role in enhancing herbicide efficiency by improving spray coverage, penetration, and adhesion to weed surfaces.

By breaking down the waxy leaf layers, surfactants enable herbicides to enter plant tissues more effectively, ensuring faster action. This is especially critical in addressing herbicide-resistant weed species, an escalating issue across many farming regions. Their widespread use in cereals, grains, and oilseeds further strengthens the segment’s dominance.

Rising demand for higher productivity per hectare, particularly in areas with limited arable land, has reinforced the reliance on herbicide-surfactant combinations. With growing emphasis on precision application and reducing chemical waste, these formulations continue to gain importance. Their proven ability to improve field performance while supporting sustainable farming practices ensures herbicides remain the leading application segment in the agricultural surfactants market.

Regional Analysis

In 2024, the Asia Pacific region led the Agricultural Surfactants Market with a 42.80% share, valued at USD 0.6 billion. This dominance is supported by its extensive agricultural base, diverse climates, and strong demand for crop protection across major producers such as China, India, and Australia.

Rising population levels and the resulting pressure on food demand are prompting farmers to adopt advanced inputs like surfactants to boost yields and enhance agrochemical effectiveness. Government-backed initiatives that encourage modern farming and the growth of precision agriculture are further accelerating usage across the region.

The adoption of surfactants is also expanding due to the need for efficient chemical application to manage pest resistance and reduce wastage in large-scale production of cereals, grains, fruits, and vegetables. Moreover, the growing emphasis on sustainability is creating opportunities for bio-based surfactants, which align with stricter environmental regulations in key markets.

Asia Pacific’s varied climatic conditions allow year-round farming, increasing the importance of reliable agrochemical performance throughout different crop cycles. Combined with technological improvements in spray systems and formulations, the region is expected to sustain its leadership, driven by high agricultural productivity, supportive policies, and rising demand for efficient and eco-friendly solutions.

Top Use Cases

- Enhancing Spray Coverage and Adhesion: Surfactants lower surface tension, helping agrochemical sprays—like herbicides, insecticides, and fungicides—spread evenly and stick well to plant surfaces, improving coverage and effectiveness. This ensures better absorption and less runoff.

- Improving Penetration of Active Ingredients: By breaking down the waxy cuticle on leaves, surfactants help active ingredients enter plant tissues more effectively. This speeds up the action of pest control chemicals, especially beneficial for tougher, resistant weeds.

- Wetting Water-Repellent (Hydrophobic) Soils: Surfactants help water soak into hard-to-wet sandy soils instead of just running off. This improves water and nutrient distribution, reducing waste and boosting plant growth in dry, hydrophobic soil types.

- Emulsifying Low-Solubility Pesticides: Some agrochemicals don’t dissolve well in water. Surfactants enable stable emulsions, allowing these chemicals to mix evenly in sprays and work properly, enhancing their activity in the field.

- Combining Fertilizer and Surfactant Benefits: Certain products, like nitrogen-surfactant blends, mix nitrogen fertilizer with surfactants to reduce chemical “tie-up” in hard water and promote better spray spreading and penetration—especially useful for glyphosate and similar herbicides.

Recent Developments

- In March 2025, Clariant launched two new adjuvants: Synergen Soil, a glucamide‑based soil adjuvant that boosts water movement and retains moisture in soil; and Synergen Guard 100, a nano‑emulsion rainfastness booster that enhances biological spray coverage and performance.

- In October 2024, the company inaugurated a new regenerative thermal oxidation (RTO) process at its Green River, Wyoming, plant. This emissions control upgrade cuts greenhouse gas output by up to 20% annually (a 4% reduction at the Group level) and supports a major soda ash capacity expansion.

- In January 2024, Evonik opened the world’s first industrial‑scale plant in Slovakia for producing rhamnolipid biosurfactants—natural, biodegradable surfactants made via fermentation. These eco‑friendly surfactants offer high performance and give the company a unique edge in green surfactants.

- In January 2024, Dow’s EcoSense™ 2470 Surfactant, a sustainable surfactant made using recycled carbon materials, won a BIG Innovation Award. It stands out for combining strong cleaning power with eco‑friendly production—showing Dow’s commitment to green surfactant innovation.

Conclusion

The Agricultural Surfactants Market is steadily evolving as farmers worldwide seek efficient, sustainable, and cost-effective solutions to boost crop yields. Surfactants have become essential in improving the performance of herbicides, fungicides, insecticides, and fertilizers by enhancing spray coverage, penetration, and absorption. Their role is increasingly vital in addressing challenges such as pest resistance, limited arable land, and the demand for higher productivity.

With growing adoption of precision farming, biodegradable formulations, and eco-friendly solutions, agricultural surfactants are positioned to remain central to modern farming. Their contribution ensures better resource utilization, healthier crops, and a stronger push toward sustainable global food security.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)