Table of Contents

Overview

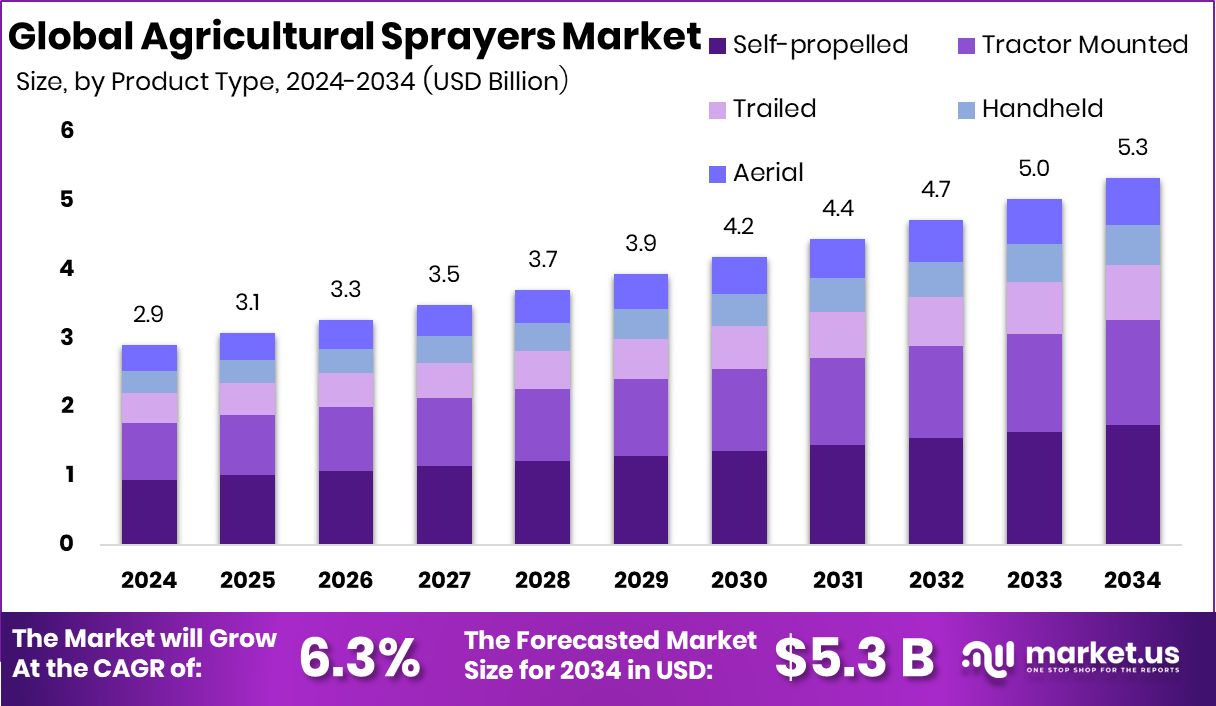

New York, NY – September 23, 2025 – The Global Agricultural Sprayers Market is projected to reach approximately USD 5.3 billion by 2034, up from USD 2.9 billion in 2024, growing at a CAGR of 6.3% from 2025 to 2034. Asia-Pacific leads the market with a 42.8% share valued at USD 1.2 billion, reflecting the region’s strong adoption of modern spraying technologies.

Agricultural sprayers play a crucial role in modern farming. They allow farmers to apply water, fertilizers, pesticides, and herbicides uniformly across crops, ensuring better resource efficiency and crop protection. Available in various types, including handheld, tractor-mounted, and drone-based sprayers, these tools save labor, reduce operational time, and enhance overall farm productivity, supporting sustainable agricultural practices.

The agricultural sprayers market reflects the global demand for advanced spraying equipment and technologies. Its growth is driven by rising food demand, evolving farming practices, and the adoption of precision agriculture, which encourages farmers to invest in mechanized and automated solutions.

One of the key growth drivers is the expanding global population, which increases the need for higher crop yields. To meet this demand, farmers are increasingly turning to mechanized spraying solutions that improve efficiency and promote healthier crops. For example, Marut Drones raised USD 6.2 million in Series A funding amid India’s push for local drone manufacturing.

The market is also boosted by the need for effective pest and disease management. Changing weather patterns and the emergence of new pests make timely crop protection essential. Supporting this trend, U.S.-based agricultural drone company Hylio secured USD 2 million to expand production, emphasizing its focus on ‘Made in America’ solutions.

Key Takeaways

- The Global Agricultural Sprayers Market is expected to be worth around USD 5.3 billion by 2034, up from USD 2.9 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034.

- In 2024, self-propelled agricultural sprayers captured 32.7%, showing a strong preference for advanced mechanized solutions.

- Large farm owners dominated the agricultural sprayers market with 43.1%, highlighting demand for efficiency across expansive fields.

- Hydraulic nozzles held the lead at 49.4%, proving their reliability and effectiveness in precise crop protection applications.

- Fuel-based sprayers accounted for 56.8%, reflecting farmers’ continued reliance on powerful, high-capacity equipment for large-scale spraying.

- Low-volume sprayers secured 51.2%, driven by cost-effectiveness and reduced chemical usage in modern agricultural practices.

- The Asia-Pacific region, holding a 42.8% share and USD 1.2 Bn, shows strong agricultural mechanization growth.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-agricultural-sprayers-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.9 Billion |

| Forecast Revenue (2034) | USD 5.3 Billion |

| CAGR (2025-2034) | 6.3% |

| Segments Covered | By Product Type (Self-propelled, Tractor Mounted, Trailed, Handheld, Aerial), By Farm Size (Large, Medium, Small), By Nozzle Type (Hydraulic Nozzle, Gaseous Nozzle, Centrifugal Nozzle, Thermal Nozzle), By Power Source (Fuel-Based, Electric and Battery-Driven, Solar, Manual), By Capacity (Ultra-Low Volume, Low Volume, High Volume) |

| Competitive Landscape | AG Spray Equipment Inc., Amazone H. Dreyer GmbH & Co. KG, Bucher Industries AG, CNH Industrial N.V., Deere & Company, Exel Industries SA, H&H Farm Machine Co., KisanKraft Limited, Kubota Corporation, STIHL |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157153

Key Market Segments

By Product Type

Self-propelled sprayers led the Agricultural Sprayers Market in 2024, holding a 32.7% share. Their dominance stems from high efficiency and advanced technology, reducing manual labor while enhancing coverage. Equipped with adjustable booms, precise controls, and improved fuel efficiency, these sprayers are ideal for large-scale farms. Their adaptability to various terrains and crops, combined with GPS and automation for precision farming, minimizes chemical waste and supports sustainability, solidifying their market leadership.

By Farm Size

Large farms commanded a 43.1% share of the market in 2024, driven by the need for mechanized, efficient spraying solutions. Spanning vast areas, these farms rely on sprayers with high-capacity tanks, wide booms, and automated systems to ensure rapid, uniform application of pesticides and fertilizers. With global demand for food rising, large farms adopt GPS-guided and variable-rate technology sprayers to optimize resources and support sustainable practices, maintaining their dominant position.

By Nozzle Type

Hydraulic nozzles captured a 49.4% share in 2024, leading due to their versatility, affordability, and uniform droplet delivery. Widely used for their durability and adaptability across crops and conditions, these nozzles support precise application, enhancing crop quality and yields. Compatible with both traditional and advanced systems, hydraulic nozzles integrate with pressure regulators and GPS, ensuring their continued dominance in the market.

By Power Source

Fuel-based sprayers held a 56.8% share in 2024, preferred for their mobility and reliability in large and medium-sized farms. Their ability to operate without electricity makes them ideal for remote areas, while high spraying pressure and long run times ensure efficient coverage. As global food demand grows, fuel-based sprayers’ durability and efficiency in tough conditions reinforce their market leadership.

By Capacity

Low-volume sprayers dominated with a 51.2% share in 2024, driven by their efficiency and reduced chemical usage. These sprayers deliver concentrated sprays, cutting costs and environmental impact while maintaining crop health. Lightweight and versatile, low-volume sprayers align with sustainable farming trends, making them the top choice for precision and resource-efficient crop protection.

Regional Analysis

Asia-Pacific led the market in 2024 with a 42.8% share, valued at USD 1.2 billion. This dominance is fueled by the region’s vast agricultural landscape, mechanization efforts, and rising food demand in countries like India, China, and Japan.

Government subsidies and precision farming adoption drive sprayer use, while diverse crops and climates demand advanced solutions. Labor shortages push reliance on automated and fuel-based sprayers, and the focus on sustainability boosts low-volume sprayer demand. Asia-Pacific’s technological and agricultural advancements ensure its continued market leadership.

Top Use Cases

- Pest Control in Field Crops: Farmers use portable backpack sprayers to target insects and bugs on grains like wheat or corn. These tools mix pesticides with water for even spread, keeping plants healthy without harming nearby areas. This method saves time on big fields, cuts down on chemical waste, and boosts crop yields by stopping pests early in the growth stage.

- Weed Management in Row Crops: Handheld or tractor-mounted sprayers apply herbicides precisely between rows of vegetables or soy. They spray just where weeds grow, avoiding damage to the main plants. This approach helps clear fields quickly, reduces manual labor, and supports cleaner harvests with less effort for small to medium farms.

- Fertilizer Application in Orchards: Air-assisted sprayers mounted on tractors reach tree branches in fruit groves like apples or citrus. They deliver liquid nutrients directly to leaves and roots for better absorption. This even coverage promotes stronger growth, improves fruit quality, and makes upkeep easier for orchard owners.

- Disease Prevention in Vineyards: Boom sprayers with fans push fungicides deep into grapevine canopies to fight molds and blights. The tech ensures full leaf contact, guarding against rainy weather risks. It streamlines treatment for vine rows, lowers disease spread, and aids in producing healthier grapes with steady care.

- Spot Treatment in Gardens: Compressed air hand sprayers handle small-scale jobs like treating flower beds or greenhouses for fungi. They allow quick, focused sprays on affected spots, using minimal liquids. This is ideal for home or small plot farmers, offering easy control and eco-friendly results without over-application.

Recent Developments

1. Deere & Company

Deere’s recent development focuses on integrating its See & Spray technology across more platforms. The premium ExactApply nozzle control system is now available on the new 410R sprayer model, enhancing application accuracy. Their major push is on data connectivity, using the JDLink network to provide real-time sprayer analytics and machine health monitoring to farmers’ mobile devices, aiming to maximize uptime and input efficiency during critical application windows.

2. CNH Industrial N.V. (Case IH & New Holland)

CNH brands have advanced their precision spraying systems. Case IH introduced the new Patriot 4450 sprayer with updated AIM Command FLEX nozzles for superior droplet size control and a refined cab for operator comfort. New Holland’s recent focus is on the IntelliSpray system for its T4 Electric Power tractor, which uses cameras to spot-spray weeds in specialty crops, reducing herbicide use in targeted applications.

3. Bucher Industries AG (Kuhn)

Through its Kuhn brand, Bucher has recently launched the new Delphi self-propelled sprayer for the European market, emphasizing a low-weight design to minimize soil compaction. A key innovation is the new CropCARE advanced nozzle control system, which provides individual PWM (Pulse Width Modulation) control for each nozzle. This allows for unprecedented application accuracy and reduced overlap, contributing to significant chemical savings and environmental protection.

4. Amazon H. Dreyer GmbH & Co. KG

Amazon’s recent developments are centered on the Pantera self-propelled sprayer series. They have introduced the new Pantera 4504 model and enhanced their UX operating system with the “Amacontrol” smartphone app for remote process monitoring. A major innovation is the “SpotSpray” kit, an AI-powered camera system that enables real-time, site-specific weed control, allowing the sprayer to switch individual nozzles on/off automatically within milliseconds.

5. AG Spray Equipment Inc.

AG Spray Equipment has recently expanded its product line with the new 1600-gallon Trailed Sprayer, designed for large-scale operations. Their development focus is on robust, practical solutions, featuring improved hydraulic agitation and a high-flow rate centrifugal pump for consistent chemical mixing and application. They also emphasize customizable boom options, catering to North American farmers seeking reliable, high-capacity spraying equipment with local service support.

Conclusion

Agricultural sprayers as a cornerstone of modern farming, blending tradition with smart tech to meet rising food needs. These tools help farmers apply essentials like nutrients and protectors more evenly and kindly to the earth, cutting waste and aiding green practices. With a push toward exact farming and steady crop care, sprayers are set to grow in appeal, especially in busy regions. Their role in building tougher, more fruitful fields points to a bright path ahead, where efficiency meets sustainability for better harvests overall.