Table of Contents

Overview

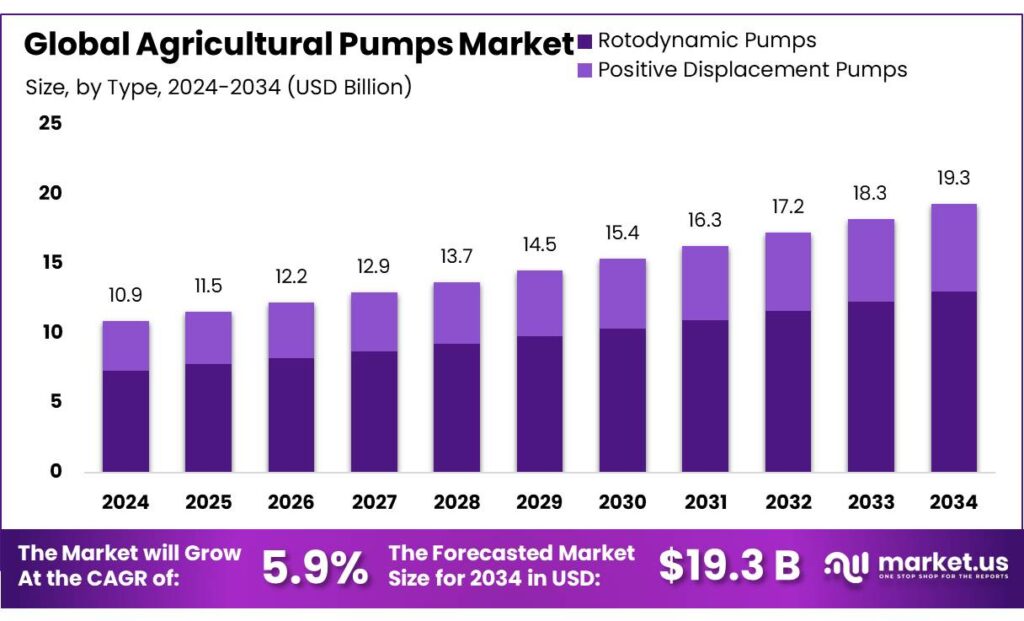

New York, NY – October 08, 2025 – The Global Agricultural Pumps Market is projected to reach USD 19.3 billion by 2034, rising from USD 10.9 billion in 2024, at a CAGR of 5.9% from 2025 to 2034. In 2024, Asia Pacific dominated the market with a 42.6% share, accounting for USD 4.6 billion in revenue.

Agricultural pumps are vital in modern farming, ensuring reliable water delivery for irrigation, livestock, and aquaculture. These include surface, submersible, centrifugal, and mono-block pumps designed for various farming scales. In India, where agriculture remains a core economic activity, pumps are essential to sustain productivity, especially in rain-fed regions.

The Ministry of Agriculture & Farmers Welfare reports that irrigation covers about 64.3 million hectares, or 48% of the net sown area, underscoring pumps’ critical role in crop management. India hosts over 26 million agricultural pumps, irrigating around 35% of cropped areas. Rural electrification under the Saubhagya scheme and the National Electric Mobility Mission has improved access to electric pumps, enhancing irrigation reliability.

Government programs further boost growth. The Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) aims to cover 70 million hectares with micro-irrigation systems, which requires over 2 million new pumps. Meanwhile, the KUSUM scheme has already enabled the installation of 400,000 solar pumps, promoting sustainable irrigation and reducing diesel dependence. Growing food demand, water scarcity, and the need for yield efficiency drive market expansion. According to the FAO, efficient irrigation can raise crop yields by 20–30%, solidifying pumps as indispensable tools in modern agriculture.

Key Takeaways

- The Global Agricultural Pumps Market size is expected to be worth around USD 19.3 billion by 2034, from USD 10.9 billion in 2024, growing at a CAGR of 5.9%.

- Rotodynamic Pumps held a dominant market position in the Agricultural Pumps Market, capturing more than a 67.4% share.

- Electricity Grid-Connection held a dominant market position in the Agricultural Pumps Market, capturing more than a 48.2% share.

- 6–10 Meter held a dominant market position in the Agricultural Pumps Market, capturing more than a 44.9% share.

- 4 HP to 30 HP held a dominant market position in the Agricultural Pumps Market, capturing more than a 56.3% share.

- Irrigation held a dominant market position in the Agricultural Pumps Market, capturing more than a 59.8% share.

- Asia Pacific emerged as the leading region in the global Agricultural Pumps Market, capturing 42.6% of the total share and reaching a value of USD 4.6 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-agricultural-pumps-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 10.9 Billion |

| Forecast Revenue (2034) | USD 19.3 Billion |

| CAGR (2025-2034) | 5.9% |

| Segments Covered | By Type (Rotodynamic Pumps, Centrifugal Pumps, Axial Flow, Mixed Flow, Positive Displacement Pumps, Rotary Pumps, Reciprocating Pumps), By Power Source (Electricity Grid-Connection, Diesel/Petrol, Solar), By Head Size (Up to 6 Meter, 6-10 Meter, Above 10 Meter), By Power Output (Upto 4 HP, 4 HP to 30 HP, Above 30), By Application (Irrigation, Drainage, Water Transfer, Fertigation, Others) |

| Competitive Landscape | Grundfos Holding A/S, Ingersoll-Rand, Flowserve Corporation, Sulzer Ltd., Pentair, ITT, INC., Schlumberger Limited, EBARA International Corporation, The Weir Group PLC |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158003

Key Market Segments

By Type

In 2024, rotodynamic pumps commanded a 67.4% share of the Agricultural Pumps Market, driven by their high efficiency and versatility across diverse irrigation applications. These pumps are favored for their ability to manage large water volumes with low maintenance costs, making them ideal for both small and large-scale farming.

Advances in pump design have further boosted their energy efficiency, reducing operational expenses. Rising water stress and the need for optimized crop production continue to fuel demand, with rotodynamic pumps expected to maintain their dominance in 2025, supported by government subsidies for efficient irrigation and agricultural mechanization.

By Power Source

Electricity grid-connected pumps led the market in 2024 with a 48.2% share, benefiting from reliable power access in agricultural regions. These pumps offer long-term cost savings by reducing fuel dependency and operational costs compared to diesel alternatives. Government initiatives promoting rural electrification and subsidies for energy-efficient equipment have driven their adoption. Their consistent performance and ability to meet high-capacity water needs make them a top choice for large-scale farming.

By Head Size

In 2024, pumps with a 6–10 meter head size dominated with a 44.9% share, favored for their suitability in medium-depth irrigation. These pumps strike a balance between efficiency and performance, delivering adequate water flow without excessive energy use, making them ideal for small to mid-sized farms. Their compatibility with various irrigation methods, such as flood and sprinkler systems, and ease of installation, enhances their appeal.

By Power Output

Pumps in the 4 HP to 30 HP range held a 56.3% share in 2024, valued for their flexibility and efficiency across diverse irrigation needs. Suitable for both small and large farms, these pumps efficiently lift water from wells, rivers, and reservoirs for various irrigation setups, including flood, drip, and sprinkler systems. Their durability, availability, and cost-effectiveness make them a preferred choice globally.

By Application

Irrigation remained the dominant application in 2024, accounting for 59.8% of the Agricultural Pumps Market. Pumps for irrigation are critical for ensuring a consistent water supply across varying climatic and soil conditions, supporting crop yields in regions with limited rainfall. The growing global demand for food production and efficient water management drives their widespread use, making irrigation pumps essential for both small and large-scale farming operations.

Regional Analysis

In 2024, the Asia Pacific region led the global Agricultural Pumps Market, holding a 42.6% share and a market value of USD 4.6 billion. This dominance is fueled by the region’s extensive agricultural sector, rapid adoption of mechanized farming, and robust government-supported irrigation initiatives. Key contributors include India, China, and Indonesia, where agriculture remains a cornerstone of the economy and supports a significant portion of the workforce.

Government policies, such as subsidies for pump purchases, rural electrification efforts, and programs like India’s PM-KUSUM promoting solar-powered pumps, have accelerated adoption. China’s heavy investment in advanced irrigation technologies for crops like rice and wheat further drives market growth, reinforcing the Asia Pacific’s leading position.

Top Use Cases

- Irrigation Systems: Farmers use these pumps to pull water from rivers, wells, or ponds and spread it evenly across fields through sprinklers or drip lines. This keeps crops healthy even in dry spells, boosts yields, and saves water by targeting roots directly. It’s a game-changer for big farms needing a steady flow without waste, making every drop count for better harvests.

- Livestock Watering: Pumps deliver fresh water to animals from deep sources, ensuring they have a clean drinking supply all day. This supports healthy herds by preventing shortages that could slow growth or cause stress. Easy setup with tanks or troughs helps remote ranches stay productive, cutting labor and keeping operations smooth.

- Drainage and Flood Control: During heavy rains, pumps quickly remove excess water from low fields to stop root rot and crop loss. Placed in ditches or flooded spots, they protect soil health and let planting resume fast. This simple fix turns potential disasters into minor hiccups for resilient farming.

- Fertigation and Chemical Application: These pumps mix fertilizers or pesticides into water streams for precise delivery to plants. It cuts chemical use while ensuring even coverage, leading to stronger growth and fewer pests. Ideal for modern setups, it simplifies tasks and promotes eco-friendly practices on any farm size.

- Frost Protection: On cold nights, pumps circulate water over young crops to form a thin ice shield that traps warmth and guards against freezes. This low-cost trick saves delicate fruits and veggies from damage, extending growing seasons and securing income for chilly regions.

Recent Developments

1. Grundfos Holding A/S

Grundfos is advancing agricultural pumps with a strong focus on solar-powered solutions and smart control. Their recent iSOLUTIONS range integrates pumps with sensors and cloud-based data analytics, enabling precise irrigation, reducing water waste, and optimizing energy use. This supports sustainable agriculture by allowing farmers to monitor and control water usage remotely, even in off-grid areas using solar energy.

2. Ingersoll Rand

Through its brands like ARO and Milton Roy, Ingersoll Rand is enhancing its diaphragm pump technology for agriculture, particularly for precise chemical injection and transfer. Recent developments focus on improving pump durability for harsh agrochemicals and providing reliable, leak-free performance. Their pumps are engineered for easy maintenance and to handle a wide range of viscosities, supporting efficient and safe application of fertilizers and pesticides.

3. Flowserve Corporation

Flowserve’s recent focus on agriculture involves providing robust, large-capacity pumps for critical water management infrastructure. This includes high-efficiency vertical turbine pumps and axial flow pumps for large-scale irrigation, drainage, and water transfer projects. Their developments emphasize engineering custom solutions that offer reliability and long service life, helping to move vast quantities of water for agricultural districts and food processing facilities.

4. Sulzer Ltd.

Sulzer has introduced new high-efficiency submersible and end-suction pumps designed for the agricultural market. Recent models focus on reducing the total cost of ownership through improved hydraulic designs that lower energy consumption. They are also expanding their offerings for solar-powered irrigation systems, providing a reliable water supply for crop irrigation while leveraging renewable energy sources to minimize operational costs and environmental impact.

5. Pentair

Pentair is integrating smart technology into its agricultural water solutions. Their recent developments include the Pentair EcoTouch system, which combines efficient pumps with advanced controllers for precise irrigation management. This allows for automated scheduling and monitoring based on weather data, significantly improving water efficiency. Their focus remains on providing energy-saving pumps that help farmers conserve water and reduce operating costs.

Conclusion

Agricultural Pumps as the unsung heroes powering sustainable farming worldwide. They tackle water shortages head-on by enabling smart irrigation and efficient resource use, helping farmers grow more with less effort and impact. With rising focus on green tech like solar options and automation, these tools are evolving to fit smarter, climate-resilient operations. Their role in feeding a growing world will only deepen, blending reliability with innovation for thriving rural economies.