Table of Contents

Overview

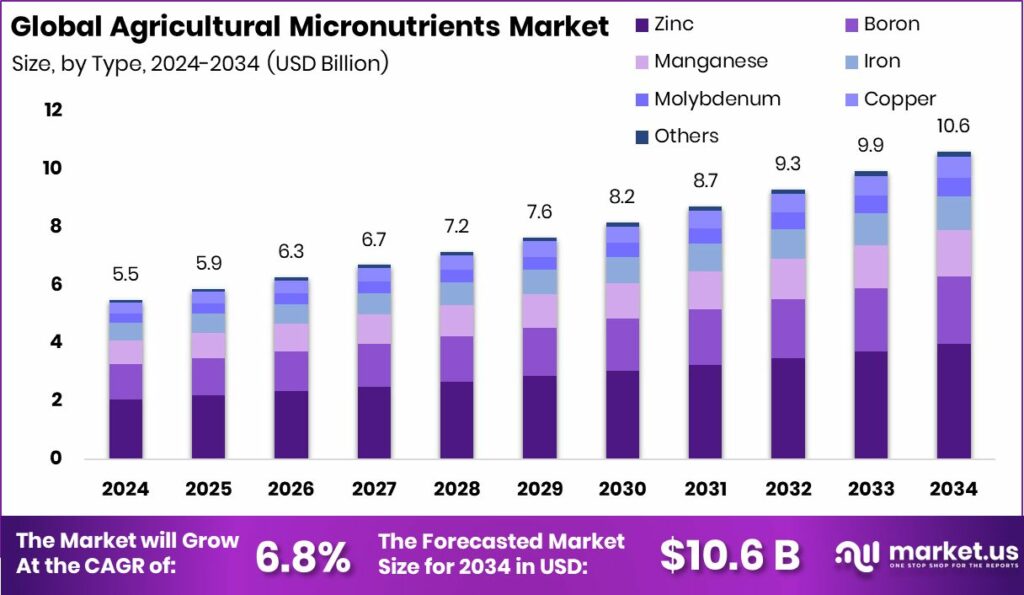

New York, NY – September 22, 2025 – The Global Agricultural Micronutrients Market is projected to reach USD 10.6 billion by 2034, rising from USD 5.5 billion in 2024, at a steady CAGR of 6.8% from 2025 to 2034. The Asia-Pacific region continues to dominate the market, holding a 42.8% share, with its market value recorded at USD 2.3 billion in 2024.

Agricultural micronutrients are vital trace elements, including zinc, iron, manganese, copper, boron, and molybdenum, required in very small amounts for plant growth and development. Despite their minimal quantity, these nutrients are indispensable for critical processes such as enzyme activation, chlorophyll synthesis, and overall plant metabolism. Even slight deficiencies can lead to lower crop yields, compromised quality, and greater susceptibility to pests and diseases.

The market encompasses a wide range of micronutrient products, available in chelated and non-chelated forms, used through soil applications, foliar sprays, and seed treatments. With intensively cultivated soils showing rising nutrient deficiencies, the importance of micronutrients in restoring soil balance and supporting sustainable farming has grown significantly. For instance, Sound Agriculture recently secured USD 25 million to advance bioinspired nutrient solutions, highlighting the growing investment focus on innovation in this space.

One of the strongest growth drivers is the global demand for food security. According to the United Nations, the world population is expected to reach 9.7 billion, making higher agricultural productivity a necessity. Farmers are increasingly recognizing that macronutrients alone cannot ensure yield stability—micronutrients have become equally essential to modern farming systems. Additionally, soil degradation caused by the overuse of chemical fertilizers and intensive farming practices is fueling demand for micronutrient-enriched fertilizers.

Widespread deficiencies in zinc, iron, and boron are directly affecting crop performance. The adoption of micronutrient-based fertilizers not only enhances crop resilience and productivity but also ensures better-quality harvests. At the same time, food industry players are aligning investments with agricultural sustainability. Recently, WK Kellogg allocated USD 200 million to improve supply chain efficiency in 2025, reinforcing the link between farming inputs and food production security.

Key Takeaways

- The Global Agricultural Micronutrients Market is expected to be worth around USD 10.6 billion by 2034, up from USD 5.5 billion in 2024, and is projected to grow at a CAGR of 6.8% from 2025 to 2034.

- In 2024, zinc dominated the Agricultural Micronutrients Market, holding a 37.4% share due to crop nutrition.

- Solid form products captured 61.9% share, highlighting farmers’ preference for easy application and longer stability.

- Soil application led the market with 46.8% share, ensuring direct nutrient supply for healthy crops.

- Cereals accounted for a 41.1% share, reflecting their global demand and essential reliance on micronutrient supplementation.

- Asia-Pacific’s 42.8% strong dominance reflects growing crop demand and rising soil deficiency concerns in 2024.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/agricultural-micronutrients-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 5.5 Billion |

| Forecast Revenue (2034) | USD 10.6 Billion |

| CAGR (2025-2034) | 6.8% |

| Segments Covered | By Type (Zinc, Boron, Manganese, Iron, Molybdenum, Copper, Others), By Form (Solid, Liquid), By Application Mode (Soil, Foliar, Fertigation, Seed Treatment, Others), By Crop Type (Cereals, Pulses and Oilseeds, Fruits and Vegetables, Others) |

| Competitive Landscape | BASF SE, Coromandel International, Grupa Azoty, Haifa Group, Helena AgriEnterprises, LLC, Indian Farmers Fertiliser Cooperative Limited (IFFCO), Israel Chemicals Ltd., Koch Agronomic Services, LLC, Nouryon Chemicals Holdings B.V., Nufarm |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156868

Key Market Segments

By Type Analysis

In 2024, zinc commanded a 37.4% share of the agricultural micronutrients market, solidifying its position as the leading micronutrient. Essential for enzyme activation, protein synthesis, and growth regulation, zinc is critical for crop health, particularly in major crops like cereals, rice, wheat, and maize.

Its dominance stems from widespread soil zinc deficiencies, exacerbated by intensive farming and over-reliance on macronutrient fertilizers. Studies highlight zinc deficiency as a global issue, especially in calcareous and alkaline soils, making zinc-based fertilizers vital for boosting crop yield and nutritional quality to meet rising food demand.

By Form Analysis

Solid formulations led the market in 2024, capturing a 61.9% share. Favored for their cost-effectiveness, ease of use, and compatibility with large-scale farming, solid micronutrients like powders and granules integrate seamlessly with traditional fertilizers. Their long shelf life and stability make them a preferred choice over liquid alternatives.

The rise in soil application methods, addressing deficiencies in zinc, boron, and iron, further drives their adoption. Solid formulations are particularly effective for bulk crops like cereals and pulses, supported by growing awareness of balanced nutrient management and government-backed soil health initiatives.

By Application Mode Analysis

Soil application dominated in 2024 with a 46.8% market share, valued for its ability to enrich the root zone and provide long-term nutrient availability. This method corrects widespread deficiencies in zinc, boron, and iron, especially in intensively farmed soils. Its compatibility with traditional fertilizers and sustained impact on soil fertility make it ideal for staple crops like rice, wheat, and maize. Government programs promoting soil health have further popularized this method, reinforcing its role in sustainable agriculture and enhanced crop productivity.

By Crop Type Analysis

Cereals held a 41.1% share of the market in 2024, reflecting their critical role in global food security. Crops like wheat, rice, maize, and barley require micronutrients such as zinc, iron, and manganese to support grain development and plant health. Even minor deficiencies can significantly reduce yields and grain quality, driving demand for micronutrient applications. With global population growth increasing pressure on cereal production, micronutrient-enriched soils are essential for meeting food demands, supported by government initiatives addressing soil nutrient gaps.

Regional Analysis

In 2024, Asia-Pacific led the agricultural micronutrients market with a 42.8% share, valued at USD 2.3 billion. The region’s dominance is driven by its vast agricultural sector, growing population, and urgent need for enhanced crop productivity.

Countries like India and China, major producers of cereals and pulses, face significant zinc and boron deficiencies, spurring the adoption of micronutrient fertilizers. Government-backed soil health programs and awareness campaigns further fuel market growth. As intensive farming continues, Asia-Pacific’s reliance on micronutrients to ensure food security and sustainable practices will sustain its market leadership.

Top Use Cases

- Correcting Zinc Deficiency in Cereal Crops: Farmers often face zinc shortages in soils, leading to stunted growth in wheat and rice. By applying zinc-rich fertilizers through soil banding, crops absorb this key nutrient better, sparking enzyme activity and protein building. This simple fix boosts plant vigor, lifts grain yields, and sharpens crop quality, helping growers meet food needs without wasting other inputs like water or nitrogen.

- Enhancing Iron Uptake in Horticultural Plants: Iron gaps cause yellow leaves in fruits and veggies, hurting their market appeal. Foliar sprays of chelated iron deliver quick fixes, aiding chlorophyll production for lush green growth. Gardeners and pros use this for tomatoes and leafy greens, ensuring tastier harvests and stronger sales while cutting waste from poor-quality produce.

- Boosting Boron for Root Health in Pulses: Pulses like beans struggle with weak roots from boron lack, slowing water uptake and pod formation. Mixing boron granules into planting furrows strengthens cell walls and flower set, leading to fuller crops. This easy soil tweak supports sustainable farming, improves drought resistance, and raises output for protein-rich foods in dry areas.

- Manganese Support for Turf and Ornamentals: Lawns and flowers turn spotty from manganese shortages, especially in sandy soils. Liquid foliar applications green up foliage fast, fueling photosynthesis and disease. Homeowners and landscapers rely on this for vibrant yards, saving on replacements and promoting eco-friendly care that fits busy routines without heavy equipment

- Molybdenum Aid in Legume Nitrogen Fixation: Legumes like soybeans falter in fixing nitrogen without molybdenum, cutting natural soil fertility. Seed coatings with this nutrient kickstart bacteria partnerships, enriching fields organically. Farmers gain healthier plants, lower synthetic fertilizer needs, and better soil for rotations, fostering long-term farm health and cost savings in eco-focused operations.

Recent Developments

1. BASF SE

BASF is advancing sustainable micronutrient delivery with its Nova brand of chelates. A key recent development is the expansion of its IDHA chelating agent production in Ludwigshafen, Germany, significantly increasing capacity. This investment supports the growing global demand for high-efficacy, biodegradable micronutrient chelates that improve nutrient use efficiency and crop resilience in the face of climate stress, aligning with their focus on sustainable solutions.

2. Coromandel International

Coromandel International is strengthening its micronutrient portfolio through product innovation and partnerships. A recent development is the launch of ‘Gromor Sure’, a zinc-enriched fertilizer, and ‘NutriK’, a potash-based liquid fertilizer with micronutrients. They are also focusing on customised, soil health-centric solutions, integrating micronutrients into their wider offerings to address specific regional deficiencies and improve overall nutrient management for Indian farmers.

3. Grupa Azoty

Facing financial headwinds in its core fertilizer business, Grupa Azoty’s recent developments in micronutrients are part of a strategic shift towards higher-value, specialized products. The company is focusing on producing and promoting its line of liquid and crystalline micronutrient fertilizers. This move aims to diversify its portfolio, improve margins, and provide farmers with advanced solutions for precision nutrition.

4. Haifa Group

Haifa Group continues to lead in precision nutrition with its controlled-release and water-soluble fertilizers. A significant recent development is the increased integration of micronutrients into its innovative Multicote and NutriNet technologies. This allows for the synchronized release of macro and micronutrients, preventing deficiencies and enhancing crop quality. Their R&D focuses on tailored recipes for specific crops and conditions, maximizing bioavailability and efficiency.

5. Helena Agri-Enterprises, LLC

Helena’s key development in micronutrients is the promotion and distribution of its proprietary Aspire fertilizer. This biostimulant-based product is enriched with boron and potassium, designed to enhance bloom, fruit set, and overall crop vigor at critical growth stages. Their strategy focuses on integrating micronutrients into holistic crop management programs, often bundled with herbicides and fungicides, providing a one-stop-shop solution for growers.

Conclusion

Agricultural Micronutrients as a quiet powerhouse in modern farming, quietly tackling soil woes from years of heavy use and climate shifts. They unlock healthier plants, richer harvests, and smarter resource use, paving the way for farming that feeds more people without draining the earth. With growers waking up to balanced nutrition’s perks and tech making delivery spot-on, these tiny helpers promise a greener, more reliable food chain ahead, one where every seed thrives and sustainability isn’t just a buzzword, but an everyday practice.