Table of Contents

Overview

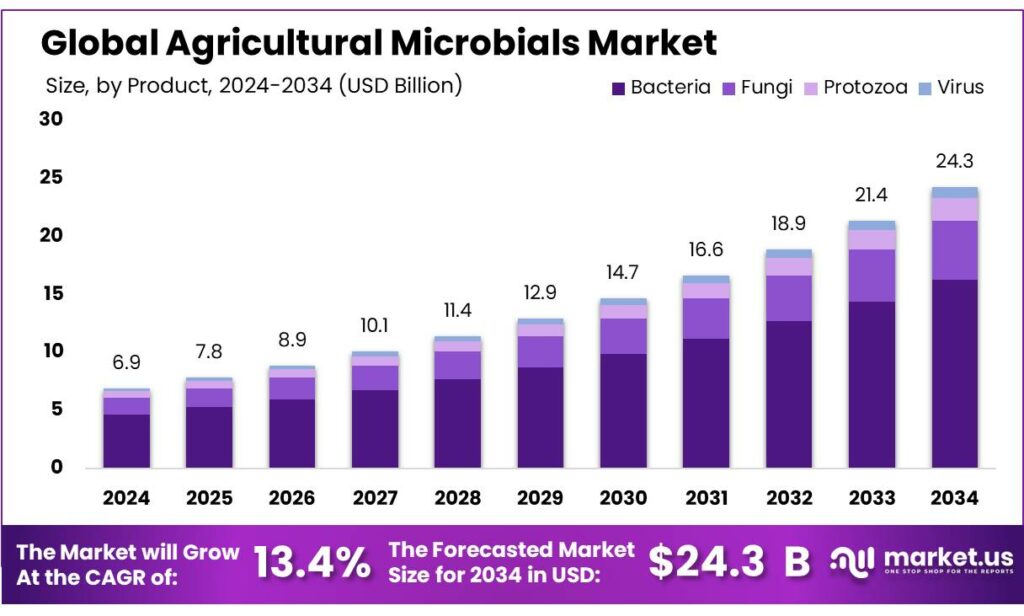

New York, NY – September 25, 2025 – The Global Agricultural Microbials Market is projected to reach approximately USD 24.3 billion by 2034, increasing from USD 6.9 billion in 2024, at a compound annual growth rate (CAGR) of 13.4% during 2025–2034. In 2024, North America emerged as the leading region, accounting for more than 45.8% of the global market and generating USD 3.1 billion in revenue.

Agricultural microbials comprising beneficial bacteria, fungi, biofertilizers, and biopesticides are increasingly recognized as sustainable alternatives to synthetic agrochemicals. These products improve soil health, support crop protection, and enhance long-term agricultural sustainability. The segment is a core component of the broader bio-agriculture movement, which is gaining momentum due to increasing policy support, investment interest, and the growing global emphasis on food security and environmental stewardship.

Government initiatives are a key driver of this expansion. For instance, the Ministry of Agriculture and Farmers Welfare in India allocated INR 122,528.77 crore toward farmer welfare programs in FY 2024–2025. Furthermore, the Fertilizer (Inorganic, Organic, or Mixed) (Control) Fourth Amendment Order, 2025, introduced a comprehensive regulatory framework for biostimulants, microbial formulations, and biochemical fertilizers. This initiative is aimed at enhancing crop productivity and promoting sustainable input adoption.

Market growth is further reinforced by factors such as environmental concerns, pesticide resistance, regulatory pressures, and the rising demand for organic food products. In India, multiple government-led programs underpin this trend. The Soil Health Card Scheme, initiated in 2015, targets 14 crore farmers by providing soil-specific nutrient advisories, thereby encouraging balanced and biologically integrated fertilizer use.

Additionally, the Prime Minister Dhan-Dhaanya Krishi Yojana, announced in mid-2025 with an annual allocation of INR 24,000 crore, aims to benefit 1.7 crore farmers by promoting integrated sustainable farming systems, including organic and microbial-based practices. Complementing this, ICAR-NIBSM’s outreach campaign in Chhattisgarh engaged more than 4,100 farmers to promote biofertilizers, biopesticides, and integrated pest management techniques, thereby strengthening grassroots adoption of microbial solutions.

Key Takeaways

- The Agricultural Microbials Market size is expected to be worth around USD 24.3 billion by 2034, from USD 6.9 billion in 2024, growing at a CAGR of 13.4%.

- Bacteria held a dominant market position, capturing more than a 67.2% share of the global agricultural microbials market.

- Liquid held a dominant market position, capturing more than a 59.3% share in the agricultural microbials market.

- Soil held a dominant market position, capturing more than a 42.8% share in the agricultural microbials market.

- Cereals & Grains held a dominant market position, capturing more than a 39.5% share in the agricultural microbials market.

- North America dominates the Agricultural Microbials market, holding 45.8% of global revenue valued at USD 3.1 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-agricultural-microbials-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 6.9 Billion |

| Forecast Revenue (2034) | USD 24.3 Billion |

| CAGR (2025-2034) | 13.4% |

| Segments Covered | By Product (Bacteria, Fungi, Protozoa, Virus), By Formulation (Liquid, Dry), By Application(Foliar, Soil, Seed, Others), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others) |

| Competitive Landscape | Certis, Marrone Bio Innovations, Inc., BASF SE, Novozymes, Sumitomo Chemical Co., Ltd., Koppert Biological Systems, Andermatt Biocontrol AG, Corteva Agriscience |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156952

Key Market Segments

By Product Type

Bacteria Lead with 67.2% Share

In 2024, bacteria commanded a 67.2% share of the global agricultural microbials market, driven by their versatility in biofertilizers and biopesticides. Strains like Bacillus, Pseudomonas, and Rhizobium are widely used for their ability to enhance plant growth, improve nutrient uptake, and protect against pests and diseases.

Their compatibility with various crops and soil types, coupled with eco-friendly benefits, makes them a top choice for farmers shifting toward sustainable practices. Government and institutional support for alternatives to chemical inputs, alongside growing awareness of soil health, has boosted adoption, particularly among small- and medium-scale farmers embracing organic farming.

By Formulation

Liquid Formulations Hold 59.3% Share

Liquid formulations led the market in 2024 with a 59.3% share, favored for their ease of use, rapid absorption, and compatibility with modern irrigation and spraying systems. Their high microbial viability during storage and application enhances field effectiveness, especially for crops like vegetables, cereals, and pulses. Liquid microbials’ longer shelf life and ability to integrate with other crop inputs make them popular among both small and large farms, particularly in mechanized agriculture regions.

By Application

Soil Application Dominates with 42.8% Share

Soil application accounted for 42.8% of the market in 2024, as it directly improves plant nutrition, root health, and crop productivity. Microbial soil treatments, such as biofertilizers and biostimulants, enhance soil structure, nutrient availability, and microbial balance in degraded farmlands. With increasing focus on sustainable farming and soil conservation, farmers are adopting these solutions to counter the effects of chemical fertilizer overuse, achieving benefits like improved nitrogen fixation, phosphorus solubilization, and root development.

By Crop Type

Cereals & Grains Lead with 39.5% Share

Cereals and grains, including wheat, rice, maize, and barley, held a 39.5% market share in 2024 due to their extensive cultivation and need for high soil fertility and pest protection. Microbial products like biofertilizers and biopesticides help farmers reduce input costs while maintaining yields, especially in regions with declining soil health. These solutions are critical in large rural economies reliant on grain production, supporting both productivity and sustainability.

Regional Analysis

North America Leads with 45.8% Share (USD 3.1 Billion)

North America dominated the agricultural microbials market in 2024, capturing a 45.8% share valued at USD 3.1 billion. This leadership stems from advanced row-crop systems, high-value horticulture, and a robust regulatory and distribution framework. The U.S. drives adoption through seed-applied inoculants and precision farming, while Canada’s cereal, pulse, and canola sectors benefit from nitrogen-fixing and phosphorus-solubilizing microbes.

Strong distribution networks, partnerships between multinationals and biotech startups, and clear regulations for biopesticides and biofertility products accelerate growth. University extension networks and on-farm trials further support adoption, while microbial solutions align with integrated pest management (IPM) in greenhouse and controlled-environment agriculture, reducing chemical use.

Top Use Cases

- Nitrogen Fixation in Legumes: Farmers add helpful bacteria like Rhizobium to legume seeds, turning air nitrogen into a form plants can use. This cuts down on chemical fertilizers, boosts crop growth naturally, and keeps soil fertile for future seasons. It’s a simple way to grow beans or peas healthier without extra costs, making farming easier and more reliable year after year.

- Phosphorus Solubilization for Root Crops: Tiny soil fungi break down locked-up phosphorus in the ground, freeing it for plant roots to grab. Applied as seed coatings, these microbes help carrots or potatoes develop stronger roots and bigger yields. This natural trick improves nutrient flow in tough soils, cuts waste, and supports steady harvests even in dry or poor areas.

- Biopesticide Control Against Soil Pests: Beneficial bacteria like Bacillus target root-eating insects without harming helpful bugs or the earth. Sprayed or mixed into soil, they stop pests from spreading and protect young plants. This green shield reduces crop losses, keeps fields clean from chemicals, and lets farmers grow safe veggies with less worry about bugs ruining their work.

- Drought Stress Relief in Cereals: Special microbes coat seeds to help wheat or corn plants hold water better during dry spells. They build stronger roots and keep leaves green longer, easing the hit from less rain. Farmers see tougher crops that bounce back fast, saving time and effort while ensuring food keeps coming even when the weather turns harsh.

- Soil Remediation in Polluted Fields: Fungi and bacteria clean up heavy metals or toxins in old farm dirt by trapping or breaking them down. Added through sprays, they restore balance so plants grow without picking up poisons. This revives worn-out land for safe farming, cuts cleanup bills, and turns bad spots into productive patches for better long-term yields.

Recent Developments

1. Certis

Certis is expanding its biologicals portfolio through strategic partnerships and product launches. A key development is the collaboration with Bi-PA to distribute novel bio-fungicides and bio-insecticides across Europe. This move strengthens Certis’s integrated crop solutions, offering growers sustainable alternatives to conventional chemicals. The company is focusing on high-efficacy microbial products to meet increasing regulatory and consumer demands for residue-free produce.

2. Marrone Bio Innovations, Inc.

Marrone Bio Innovations continues to launch and register new microbial-based solutions. A significant recent development is the EPA registration of Stargus Biofungicide, based on a novel strain of Bacillus amyloliquefaciens. The company is also expanding the global reach of its flagship bioinsecticide, Venerate XC. Their focus remains on discovering and developing unique microorganisms to address complex pest and disease challenges while promoting resistance management.

3. BASF SE

BASF is aggressively advancing its agricultural microbials pipeline. A major recent milestone is the launch of its latest biological fungicide, Poncho/VOTiVO 2.0, which provides enhanced nematode and disease control for corn and soybeans. BASF is leveraging its global R&D capabilities to create synergistic combinations of chemical and biological solutions, integrating them into digital farming platforms for precision application.

4. Novozymes

Following its merger with Chr. Hansen, the new Novozymes, is a global leader in biological solutions. A key recent focus is the expansion of its BioAg Alliance with Corteva Agriscience, launching new microbial products like JumpStart LS. The company is leveraging its unparalleled microbial library to develop next-generation inoculants and biostimulants that improve nutrient uptake and crop resilience, solidifying its position at the forefront of microbial innovation.

5. Sumitomo Chemical Co. Ltd.

Sumitomo Chemical is strengthening its biologicals business through acquisitions and internal development. A pivotal recent move was the acquisition of a significant stake in BioConsortia, Inc., a company specializing in advanced microbial discovery and development. This partnership aims to accelerate the creation of microbial products for seed treatment and soil health. Sumitomo is integrating these solutions into its portfolio to offer comprehensive, sustainable crop protection strategies worldwide.

Conclusion

Agricultural Microbials as a game-changer for greener fields worldwide. These tiny helpers swap out harsh chemicals for natural boosts, making soils richer and crops tougher against dry spells or bugs. Farmers gain steady output with less hassle, while buyers get cleaner food that tastes better and lasts longer. With more folks choosing earth-friendly ways, this smart switch promises thriving farms, happier communities, and a healthier planet for years to come.