Table of Contents

Overview

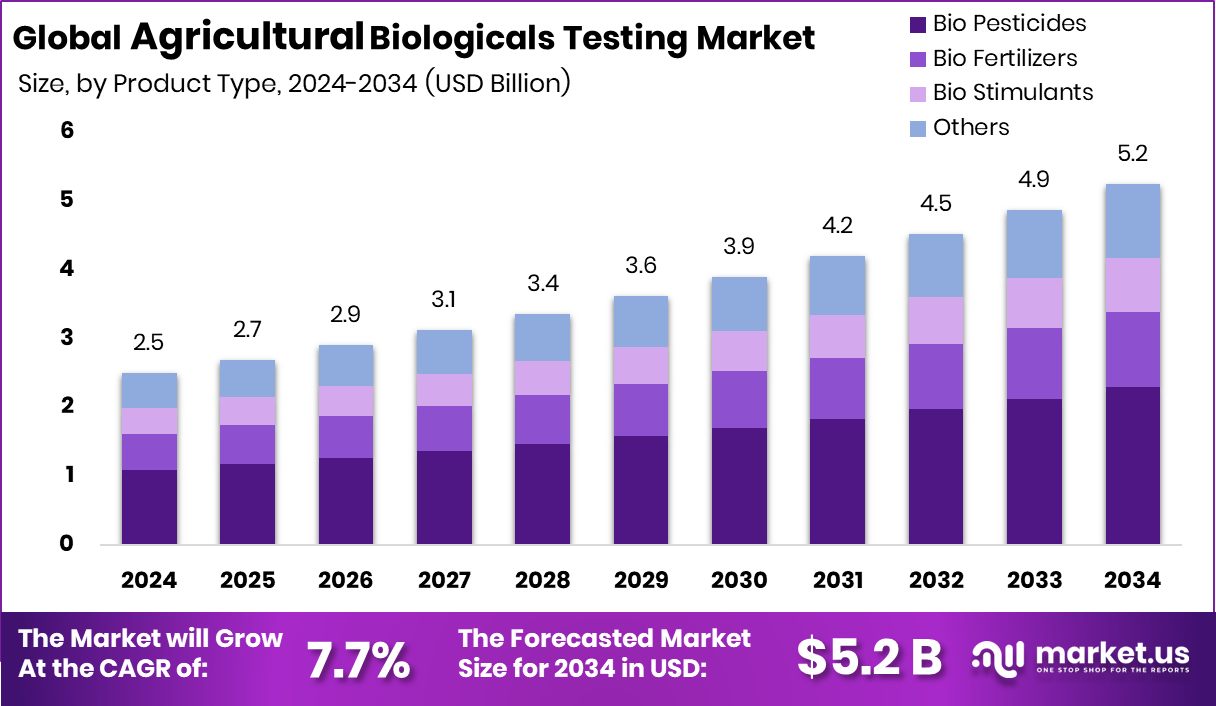

New York, NY – October 01, 2025 – The Global Agricultural Biologicals Testing Market is projected to reach USD 5.2 billion by 2034, rising from USD 2.5 billion in 2024, with a steady CAGR of 7.7% between 2025 and 2034. North America leads this industry, holding a 45.8% share and generating USD 1.1 billion in market value in 2024.

Agricultural biologicals testing involves evaluating bio-based products such as biopesticides, biofertilizers, and biostimulants. These tests ensure products are safe, effective, and compliant with agricultural regulations. They assess the effects on crops, soil health, and the environment, confirming that biological solutions can support sustainable farming while maintaining productivity and quality.

This market is expanding as farmers, regulators, and consumers increasingly favor natural alternatives over synthetic chemicals. Testing services include laboratory analyses, field trials, and regulatory compliance, all of which help introduce reliable and safe biological products into agriculture. A key driver is the global shift toward sustainable farming, as concerns over chemical residues and environmental impacts rise.

Recent developments highlight this momentum. For instance, BiocSol raised €5.2 million in seed funding to advance microbial pesticide solutions. Similarly, India’s Agrim secured $17.3 million to improve farmer access to seeds and pesticides, reflecting growing investments in biological inputs.

Stricter government regulations requiring enhanced safety testing are pushing manufacturers to adopt professional testing services. At the same time, technological innovations—such as advanced genomics, bioassays, and digital field trials—are improving speed and accuracy in testing processes. This creates fresh opportunities for service providers to scale operations and support the rapidly evolving agricultural biologicals sector.

Key Takeaways

- The Global Agricultural Biologicals Testing Market is expected to be worth around USD 5.2 billion by 2034, up from USD 2.5 billion in 2024, and is projected to grow at a CAGR of 7.7% from 2025 to 2034.

- In the Agricultural Biologicals Testing Market, Bio Pesticides lead with 43.6%, reflecting growing sustainable farming needs.

- Field Support accounts for 36.2% in the Agricultural Biologicals Testing Market, highlighting rising demand for on-ground validation.

- The North America market, at 45.8% share, worth USD 1.1 Bn, shows strong growth.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-agricultural-biologicals-testing-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.5 Billion |

| Forecast Revenue (2034) | USD 5.2 Billion |

| CAGR (2025-2034) | 7.7% |

| Segments Covered | By Product Type (Bio Pesticides, Bio Fertilizers, Bio Stimulants, Others), By End-User (Field Support, Regulatory, Analytical, Others) |

| Competitive Landscape | RJ Hill Laboratories Limited, Bionema Limited, Staphyt SA, Anadiag Group, SGS SA |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157733

Key Market Segments

By Product Type Analysis

Bio Pesticides led the Agricultural Biologicals Testing Market in 2024, commanding a 43.6% share. This dominance underscores the global shift toward eco-friendly crop protection alternatives, driven by growing concerns over chemical pesticide residues. Derived from natural sources like bacteria, fungi, and plants, Bio Pesticides offer effective pest control with minimal environmental impact.

Stricter regulations on chemical pesticides have boosted demand for Bio Pesticides, necessitating robust testing to verify safety, efficacy, and stability across diverse agricultural conditions. Testing ensures target-specific performance, environmental compatibility, and resistance management, providing critical data for farmers and regulators.

By End-User Analysis

In 2024, Field Support accounted for 36.2% of the Agricultural Biologicals Testing Market, solidifying its critical role in validating biological products under real-world conditions. Field Support testing evaluates biopesticides, biostimulants, and biofertilizers across varied soils, climates, and crops, offering practical insights that lab tests cannot replicate.

This segment’s prominence reflects the growing demand for reliable, farmer-focused data to ensure product effectiveness and safety amid the push for sustainable agriculture. By identifying issues like pest resistance or environmental stress, Field Support enhances product reliability before widespread use.

Regional Analysis

North America dominated the Agricultural Biologicals Testing Market in 2024, holding a 45.8% share valued at USD 1.1 billion. This leadership stems from stringent regulations, advanced farming technologies, and strong demand for sustainable crop solutions. Europe trails closely, propelled by strict environmental policies and a shift away from chemical inputs.

Asia Pacific is witnessing rapid growth due to population-driven food demand and government support for sustainable practices. Latin America shows steady progress, fueled by large-scale crop production, while the Middle East & Africa are emerging markets driven by improving agricultural infrastructure. North America’s regulatory rigor and testing advancements cement its position as the global leader, shaping the industry’s move toward sustainable agricultural practices.

Top Use Cases

- Efficacy Verification for Biopesticides: Farmers and manufacturers test natural pest-control agents, like microbes or plant extracts, on crops to check if they effectively reduce insects and diseases without harming plants. This helps ensure reliable protection in fields, supporting healthier harvests and cutting down on chemical use for safer food production.

- Biofertilizer Nutrient Boost Assessment: Testing evaluates how soil bacteria or fungi in biofertilizers improve nutrient uptake in plants, such as better root growth and stronger yields. It confirms these natural helpers enhance soil health over time, making farming more sustainable and reducing reliance on synthetic options for eco-friendly growth.

- Biostimulant Crop Resilience Evaluation: Labs and field trials measure how seaweed or hormone-based biostimulants help plants withstand stress from drought or poor soil. This testing verifies improved vigor and recovery, aiding farmers in tougher climates to grow resilient crops with minimal environmental impact.

- Regulatory Safety and Compliance Checks: Government agencies require tests to prove biological products are safe for humans, animals, and ecosystems before market approval. This involves checking toxicity and stability, ensuring standards are met to build trust in organic farming practices and avoid health risks.

- Field Performance and Stability Trials: Real-world testing on diverse farms assesses how biologicals hold up under varying weather and soil conditions, tracking long-term effects on crop quality. It guides practical application tweaks, helping growers optimize use for consistent results and broader adoption of green techniques.

Recent Developments

1. RJ Hill Laboratories Limited

Hill Laboratories has significantly expanded its agricultural biologicals testing capacity with a new, purpose-built facility in Hamilton, New Zealand. This investment focuses on advanced methods for biostimulant and biofertilizer efficacy and quality control, including plant bioassays and molecular techniques. The expansion strengthens their support for the rapidly growing biologics sector, providing local manufacturers and exporters with critical data for product development and regulatory submission.

2. Bionema Limited

Bionema is advancing microbial biocontrol testing through the development of proprietary encapsulation technologies to enhance formulation efficacy and shelf-life. Their recent work focuses on high-throughput screening methods for microbial strains and optimizing synergistic combinations of biopesticides. They also provide comprehensive in vitro and in vivo testing services to validate product performance against target pests, helping clients accelerate the commercialization of more robust and reliable biological control agents.

3. Staphyt SA

Staphyt has expanded its global biologics testing network, enhancing its field trial capabilities across Europe, North America, and South America. Their recent developments include specialized GEP (Good Experimental Practice) field protocols for biostimulants and biocontrol agents under diverse agro-climatic conditions. They are also investing in new data management systems to handle complex biological trial data, ensuring robust statistical analysis and reporting for regulatory approval and product positioning.

4. Anadiag Group

Anadiag is leveraging its expertise in molecular diagnostics to offer innovative testing services for agricultural biologics. Their recent developments include using DNA-based tools for the precise identification and quantification of microorganisms in complex biopesticide and biofertilizer formulations. This ensures product quality, verifies label claims, and detects contaminants, providing a high level of specificity that traditional culture-based methods cannot achieve for quality control and patent protection.

5. SGS SA

SGS has launched new, harmonized testing strategies for agricultural biologicals to meet evolving global regulatory standards. Their recent initiatives include developing standardized protocols for evaluating the environmental fate of biopesticides and the mode of action of biostimulants. They offer a complete “one-stop” package from lab and greenhouse studies to extensive field trials, helping clients navigate the complex registration process in key markets worldwide efficiently.

Conclusion

Agricultural Biologicals testing is a cornerstone of modern farming’s shift toward sustainability. With rising interest in organic produce and eco-safe methods, this field is evolving to meet demands for reliable, nature-based solutions that protect crops while nurturing the planet. Challenges like varying regulations persist, but opportunities in precision tech and global partnerships promise wider access and innovation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)