Table of Contents

Overview

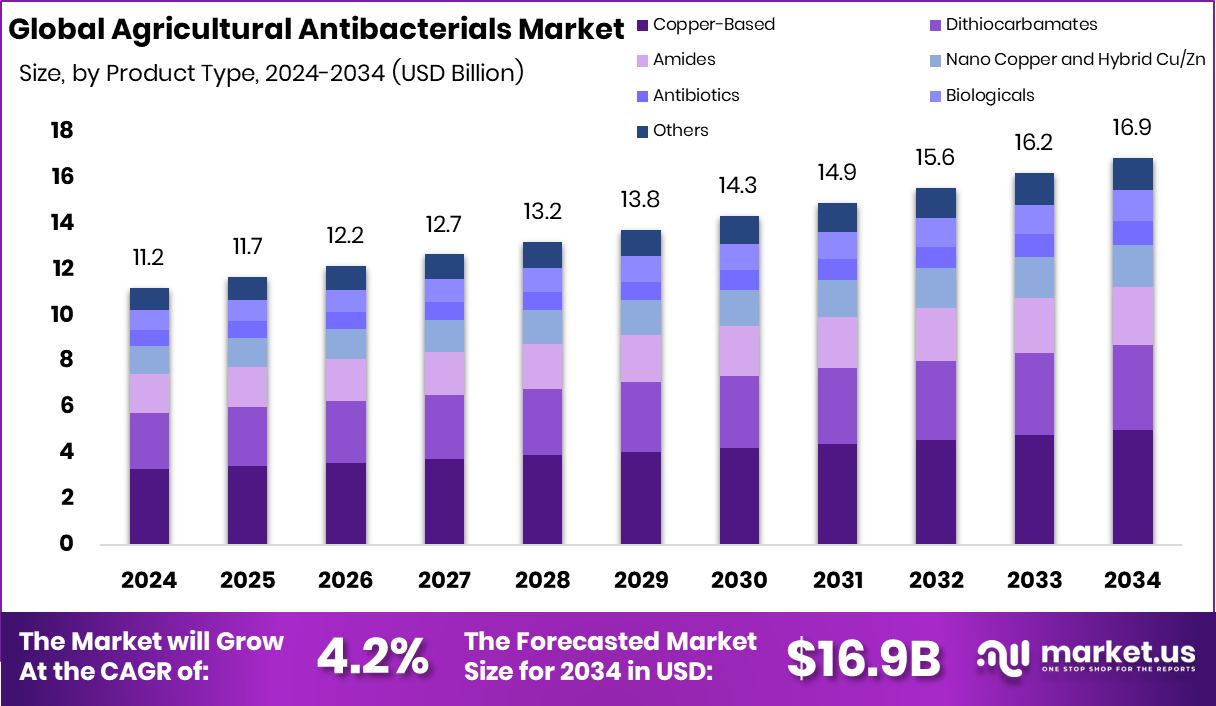

New York, NY – September 26, 2025 – The Global Agricultural Antibacterials Market is projected to reach USD 16.9 billion by 2034, rising from USD 11.2 billion in 2024, at a CAGR of 4.2% between 2025 and 2034. The Asia Pacific region, holding 45.9% market share valued at USD 5.1 billion in 2024, continues to lead global growth.

Agricultural antibacterials are products used to prevent or control bacterial infections in crops and livestock. By suppressing harmful bacteria in plants, soil, or animals, these solutions protect yields, improve animal health, and reduce the risks of foodborne diseases. The market encompasses a wide range of products from crop protection agents to livestock treatments designed to ensure food safety and farm productivity.

The need for effective antibacterial solutions is growing as farmers face challenges such as bacterial outbreaks, climate variability, and pressure to adopt sustainable practices. According to the Food and Agriculture Organization (FAO), global food production must increase by nearly 60% to feed the expanding population. This demand underscores the importance of antibacterial use to minimize crop and livestock losses, ensuring a stable food supply.

Investment and innovation are also shaping the market. In 2024, Peptobiotics raised USD 6.2 million in Series A funding to advance antimicrobial peptide technology aimed at replacing antibiotics in aquaculture. Similarly, Sound Agriculture secured USD 75 million in Series D funding to accelerate climate-smart agriculture and crop breeding solutions. These developments highlight the sector’s shift toward next-generation antibacterial products.

Consumer expectations around food safety and quality are another strong driver. With stricter regulations and higher awareness of contamination risks, farmers are turning to advanced antibacterial practices to ensure safe produce from farm to table. The sector is moving toward bio-based and eco-friendly antibacterials. The global push for sustainable agriculture and reduced chemical use is opening opportunities for natural formulations that balance effectiveness with environmental safety. This shift positions agricultural antibacterials not only as a safeguard for productivity but also as a cornerstone of future sustainable farming.

Key Takeaways

- The Global Agricultural Antibacterials Market is expected to be worth around USD 16.9 billion by 2034, up from USD 11.2 billion in 2024, and is projected to grow at a CAGR of 4.2% from 2025 to 2034.

- Copper-based products hold a 29.5% share, showing strong adoption in the agricultural antibacterials market.

- Liquid suspensions dominate with 57.8%, highlighting farmers’ preference for easy-to-apply antibacterial formulations.

- Foliar sprays account for 59.1%, making them the most effective application method in this market.

- Fruits and vegetables lead usage at 45.9%, reflecting antibacterial solutions’ importance in protecting perishable crops.

- Strong agricultural activity and rising food safety needs boosted Asia Pacific’s 45.9% share, USD 5.1 Bn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/agricultural-antibacterials-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 11.2 Billion |

| Forecast Revenue (2034) | USD 16.9 Billion |

| CAGR (2025-2034) | 4.2% |

| Segments Covered | By Product Type (Copper-Based, Dithiocarbamates, Amides, Nano Copper and Hybrid Cu/Zn, Antibiotics, Biologicals, Others), By Formulation Form (Liquid Suspensions, Liquid-Dispersible Granules (WDG), Wettable Powders, Nano-dispersions and Encapsulates), By Application Method (Foliar Spray, Seed/Transplant Treatment, Soil Injection, Water-System and Drip-Irrigation Injection), By Crop (Fruits and Vegetables, Cereals and Grains, Oilseeds and Pulses, Commercial Crops, Turf and Ornamentals) |

| Competitive Landscape | Bayer AG, Syngenta AG, Corteva Agriscience, Sumitomo Chemical Co., Ltd., Albaugh LLC, Certis Biologicals, Koppert, BioWorks Inc., BioSafe Systems, LLC, Phagelux AgriHealth, Inc., Parijat Industries (India) Pvt. Ltd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157300

Key Market Segments

By Product Type Analysis

Copper-based products lead the Agricultural Antibacterials Market, holding a 29.5% global share in 2024. Renowned for their broad-spectrum antibacterial efficacy, copper compounds are a trusted choice for farmers due to their proven effectiveness in protecting crops and soil from bacterial diseases. Their dual role as preventive and curative solutions makes them particularly valuable in regions prone to bacterial outbreaks, which threaten crop yield and quality.

Regulatory approval and compatibility with integrated pest management further bolster their dominance, especially in fruit and vegetable production, where bacterial diseases can lead to significant economic losses. The cost-effectiveness of copper formulations compared to newer alternatives ensures their widespread use across small and large-scale farms. With rising global food demand and a focus on food safety, copper-based antibacterials are poised to maintain their strong market position.

By Formulation Form Analysis

Liquid suspensions command the Agricultural Antibacterials Market, capturing a 57.8% share in 2024. Their dominance stems from ease of application, superior field performance, and enhanced absorption compared to other formulations. Liquid suspensions deliver uniform coverage on crops and soil, minimizing untreated areas that could harbor bacterial growth. Their versatility—suitable for spraying, irrigation, or mixing with other inputs—makes them highly popular among farmers.

The stability and effectiveness of liquid suspensions across diverse crops, coupled with their compatibility with advanced spraying technologies, drive their preference in large-scale farming. As global food demand grows and bacterial crop losses become a pressing concern, liquid suspensions are expected to retain their leading 57.8% share, supporting efficient disease management.

By Application Method Analysis

Foliar spray dominates the Agricultural Antibacterials Market with a 59.1% adoption rate in 2024. Its leadership is driven by the method’s ability to deliver antibacterial agents directly to plant leaves, where infections often originate, ensuring rapid absorption and action against pathogens. Foliar spraying provides uniform coverage across large fields, making it ideal for both small-scale and commercial farming.

Its compatibility with conventional and advanced sprayers reduces labor and enhances cost-effectiveness by minimizing product wastage. The method’s efficiency in protecting crops at critical growth stages meets the rising demand for high-quality yields and reduced bacterial losses. These advantages solidify foliar spray’s position as the preferred application method, maintaining its 59.1% market share.

By Crop Analysis

Fruits and vegetables lead the Agricultural Antibacterials Market, accounting for 45.9% of demand in 2024. Their dominance reflects the high susceptibility of these crops to bacterial infections, which can rapidly compromise yield and quality, particularly in warm, humid conditions. The higher per-acre economic value of fruits and vegetables drives farmers to prioritize antibacterial protection to maximize returns.

Increasing global demand for fresh produce, fueled by dietary shifts toward healthier foods, further amplifies the need for effective antibacterial solutions. Additionally, stringent international food safety and export standards push growers to adopt reliable treatments to ensure blemish-free, safe produce. This dynamic sustains strong antibacterial use in horticulture, reinforcing the segment’s leading 45.9% market share.

Regional Analysis

In 2024, the Asia Pacific region led the Agricultural Antibacterials Market, capturing a 45.9% share valued at USD 5.1 billion. The region’s dominance is driven by its vast agricultural sector, particularly in countries like China, India, and Southeast Asia, where agriculture supports both domestic needs and export markets.

Rising population and increasing demand for fresh fruits and vegetables have heightened the need for antibacterial solutions to combat crop infections. Government initiatives to modernize farming practices and enhance food safety further boost adoption across small and large-scale farms.

North America and Europe follow, with growth fueled by stringent food safety regulations and advanced agricultural technologies, promoting the use of effective antibacterials. Latin America’s robust horticulture and export-driven agriculture create significant opportunities for antibacterial applications.

The Middle East & Africa, while smaller in market size, are seeing gradual growth due to the adoption of modern farming techniques. The Asia Pacific’s commanding 45.9% share solidifies its position as the global leader in the Agricultural Antibacterials Market in 2024.

Top Use Cases

- Protecting Fruit Orchards from Bacterial Blight: Farmers spray copper-based antibacterials on apple and pear trees to stop fire blight, a nasty bacterial disease that kills blossoms and branches. This quick action keeps fruits healthy and boosts harvest quality, helping growers meet market needs without losing entire crops to infection spread in wet weather.

- Treating Bacterial Spot in Tomato Fields: In vegetable patches, liquid suspensions of antibiotics like streptomycin are applied via foliar spray to fight bacterial spot, which causes ugly lesions on leaves and fruits. This simple method saves yields, cuts waste, and ensures fresh produce reaches stores looking perfect, supporting steady income for small-scale veggie farmers.

- Controlling Citrus Canker in Grove Management: Antibacterial treatments target canker bacteria on orange and lemon trees, preventing pimple-like sores that ruin fruit skin and invite more pests. By mixing these into irrigation systems, orchard owners maintain tree vigor, improve export-ready quality, and avoid costly tree removal, keeping groves productive year after year.

- Managing Bacterial Wilt in Potato Crops: Soil treatments with amide antibacterials help potatoes battle wilt, a soil-borne bug that clogs plant vessels and wilts leaves fast. This preventive step protects root health, raises tuber sizes, and reduces replanting needs, making it a go-to for large farms aiming for reliable spud supplies amid changing climates.

- Safeguarding Rice Paddies from Sheath Blight: Farmers use dithiocarbamate sprays on rice plants to curb sheath blight, where bacteria rot stems and cut grain output. Easy to apply during growth stages, this keeps paddies lush, fights rapid spread in humid areas, and supports food security by ensuring bountiful harvests for rice-dependent communities.

Recent Developments

1. Bayer AG

Bayer is advancing integrated solutions to combat antimicrobial resistance (AMR) in agriculture. Their focus is on preventive animal health through vaccines, diagnostics, and improved hygiene protocols to reduce the need for antibiotics. The company also promotes responsible use principles in its livestock products. Recent initiatives include partnerships to develop alternatives and educational campaigns for farmers on antibiotic stewardship, aligning with their “One Health” approach.

2. Syngenta AG

While Syngenta’s core crop protection business focuses on fungicides and insecticides, its animal health unit, Syngenta Group’s ADAMA, is involved in the sector. Recent developments are not prominently publicized in antibacterials. Their contribution lies more broadly in animal health management, including hygiene and nutrition products that support overall livestock wellness, indirectly helping to reduce the reliance on antibiotics through better herd management practices.

3. Corteva Agriscience

Corteva is heavily invested in biological solutions as alternatives to traditional chemicals. Their recent developments include expanding their portfolio of biocontrol products, which can include beneficial microorganisms that outcompete or inhibit bacterial pathogens. By focusing on these sustainable tools for managing bacterial diseases in crops, Corteva aims to provide farmers with effective options that reduce environmental impact and potentially slow the development of resistance.

4. Sumitomo Chemical Co., Ltd.

Sumitomo Chemical is actively developing new modes of action for crop protection. A key recent development is the introduction of antibiotics-like bactericides with novel molecular targets to combat resistant bacterial pathogens in crops like rice and vegetables. Their research focuses on compounds that are effective at low doses and have a favorable environmental profile, addressing the critical need for new solutions against devastating plant diseases.

5. Albaugh LLC

As a major supplier of generic agrochemicals, Albaugh’s recent developments in antibacterials involve expanding market access for established copper-based bactericides and streptomycin formulations. Their strategy focuses on providing cost-effective solutions to farmers for controlling bacterial diseases like fire blight and bacterial spot. They ensure regulatory compliance and emphasize proper application guidelines to promote effective and responsible use of these important disease management tools.

Conclusion

Agricultural Antibacterials as a vital tool in modern farming, striking a balance between boosting crop health and tackling stubborn bacterial threats that threaten yields. With farmers facing warmer weather and tougher pests, these solutions offer reliable defense while paving the way for greener practices like natural blends and smart spraying tech. Looking ahead, the shift toward sustainable options will drive innovation, helping growers thrive without harming the land or food chain.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)