Table of Contents

Overview

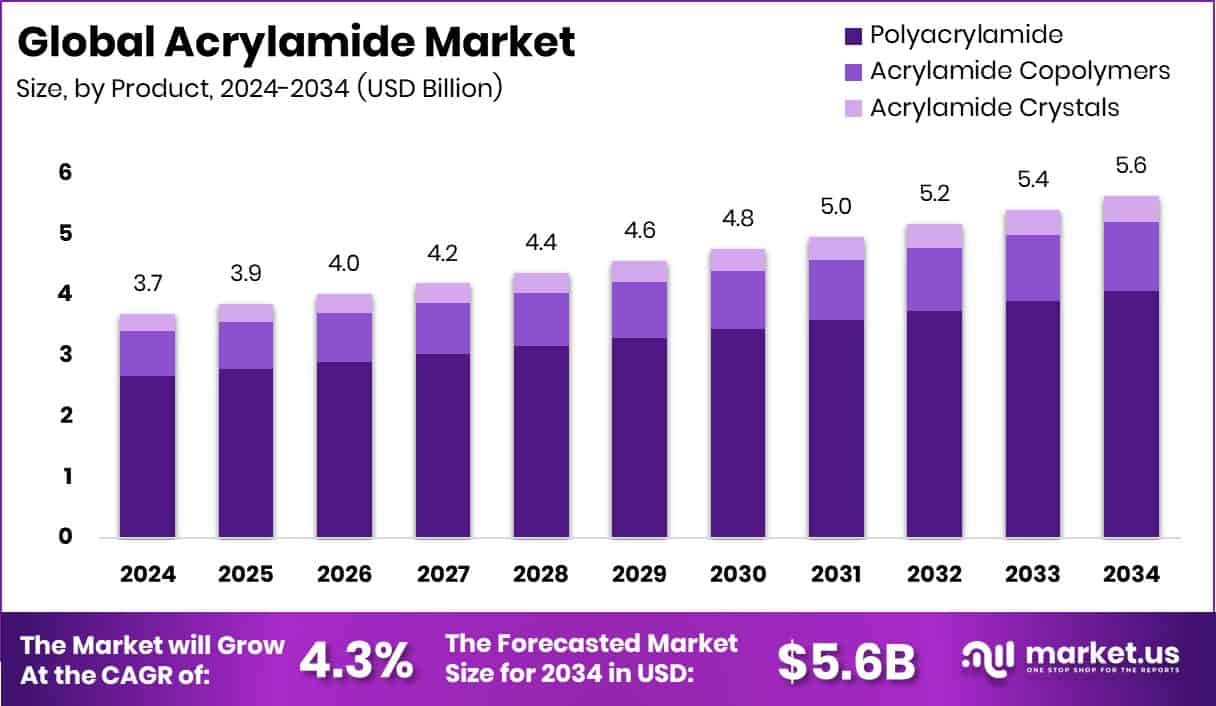

New York, NY – October 17, 2025 – The global acrylamide market is projected to reach USD 5.6 billion by 2034, rising from USD 3.7 billion in 2024 at a CAGR of 4.3%.

Acrylamide, a colorless crystalline compound (CH₂=CH–C(O)NH₂), serves mainly as a monomer for polyacrylamide used in water treatment, paper production, and mining. Market expansion is driven by stringent environmental and water-quality regulations urging industries to enhance wastewater management.

Global infrastructure funding supports this momentum—Alma’s $20 million treatment upgrade, Washington’s $309 million clean-water fund, Iraq’s €130 million sanitation program, and Canada’s CAD 369.5 million commitment all strengthen demand. Growth also comes from urbanization and industrialization, which increase wastewater volumes requiring treatment.

In addition to its role in enhanced oil recovery and pulp & paper, acrylamide is gaining importance through innovation in low-residual monomers, biodegradable formulations, and integration with sustainable recycling systems.

New sustainability-focused investments such as the £2 million recycling project and Oxyle’s €15.3 million pollutant-removal funding are opening new, high-value applications, aligning the market with global clean-technology initiatives and circular-economy goals.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-acrylamide-market/request-sample/

Key Takeaways

- The Global Acrylamide Market is expected to be worth around USD 5.6 billion by 2034, up from USD 3.7 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034.

- In 2024, the acrylamide market was dominated by polyacrylamide, capturing around 72.3% share globally.

- Anionic acrylamide held the largest ionic segment, accounting for approximately 47.2% market share in 2024.

- In 2024, solid form dominated the acrylamide market, capturing about 67.9% of total revenue.

- Wastewater treatment applications led the acrylamide market, accounting for 46.6% of global consumption in 2024.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161352

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 3.7 Billion |

| Forecast Revenue (2034) | USD 5.6 Billion |

| CAGR (2025-2034) | 4.3% |

| Segments Covered | By Product (Polyacrylamide, Acrylamide Copolymers, Acrylamide Crystals), By Ionic Type (Cationic, Anionic, Non-ionic), By Form (Solid, Liquid), By Application (Waste Water Treatment, Dispersing Agent, Oil Recovery Agent, Stabilizer and Thickener, Water Repellent, Others) |

| Competitive Landscape | DOW Chemical Company, Ashland, Mitsui Chemical Inc., Yongsan Chemicals Inc., Zhejiang Xinyong Biochemical Co., Ltd, Beijing Hengju Chemical Group Corporation, SNF Floerger, Others |

Key Market Segments

By Product Analysis

In 2024, polyacrylamide accounted for a dominant 72.3% share in the By Product segment of the Acrylamide Market, underscoring its crucial role in municipal and industrial wastewater treatment. Its superior performance in solid–liquid separation and sludge dewatering makes it indispensable in large-scale water management systems. The product’s adaptability also supports key industries such as enhanced oil recovery, paper manufacturing, and mineral processing, reinforcing its broad industrial importance.

Ongoing innovations in polymer chemistry, particularly the use of high-molecular-weight formulations for improved efficiency and reduced environmental impact, further boost its demand.

With global industries emphasizing sustainability and stricter water-quality standards, polyacrylamide’s established performance profile ensures its continued dominance in the coming years, consolidating its position as the preferred polymer solution in diverse treatment and processing applications.

By Lonic Type Analysis

In 2024, the anionic segment accounted for a dominant 47.2% share of the Acrylamide Market by Ionic Type, reflecting its extensive use in wastewater treatment. Anionic acrylamide polymers are highly effective in removing suspended solids and organic impurities, making them essential for both municipal and industrial water purification systems. Their superior flocculation and clarification capabilities ensure efficient treatment performance under diverse operational conditions.

Beyond water management, the anionic form is widely applied in mineral processing, paper production, and soil stabilization due to its strong binding and stabilizing properties. Its cost-effectiveness, adaptability across varying pH levels, and high operational efficiency have made it a preferred choice for large-scale environmental and industrial processes.

As the global focus on sustainable water management intensifies, the anionic type is expected to retain its leading position due to its proven reliability and functional versatility across various end-use industries.

By Form Analysis

In 2024, the solid form accounted for a dominant 67.9% share of the Acrylamide Market by Form, highlighting its strong preference across industrial sectors. The solid variant is valued for its stability, easy storage, and extended shelf life compared to liquid forms, making it ideal for long-term industrial use.

It plays a key role in water treatment, mining, and paper manufacturing, where dry polymers are rehydrated before application to ensure efficient performance and reduced material waste. Additionally, solid acrylamide’s ease of handling and transportability make it highly suitable for bulk operations.

Continuous demand from large-scale industrial facilities and the global emphasis on improving operational efficiency further bolster its market strength. These advantages ensure that the solid form remains the preferred choice for manufacturers and end-users, sustaining its leadership across major end-use applications in 2024.

By Application Analysis

In 2024, wastewater treatment accounted for a leading 46.6% share of the Acrylamide Market by Application, emphasizing its vital role in global water management. Acrylamide-based polymers, particularly polyacrylamide, are extensively used in municipal and industrial treatment systems for effective flocculation and sludge dewatering, significantly improving water clarity and recycling efficiency.

The segment’s dominance is reinforced by the rising global demand for clean water and the enforcement of stricter environmental and discharge regulations across regions. These polymers’ ability to remove suspended solids and contaminants with high precision has positioned them as indispensable in wastewater operations.

As nations invest heavily in modernizing treatment infrastructure to ensure sustainability, the wastewater treatment segment remains the largest and most influential application area in the acrylamide industry, reflecting its essential contribution to environmental protection and resource-efficient industrial processes.

Regional Analysis

In 2024, Asia-Pacific led the global Acrylamide Market with a 37.2% share, valued at approximately USD 1.3 billion, reflecting its dominance across industries such as wastewater treatment, mining, and paper manufacturing. Strong industrialization and rapid urban growth in China, India, and Japan continue to drive regional consumption of acrylamide-based polymers. The region’s growing investments in clean water infrastructure and sustainable chemical applications further strengthen its leadership.

North America followed, supported by technological advancements in water management and industrial efficiency, while Europe maintained steady progress under strict wastewater discharge regulations and a shift toward eco-friendly processing methods.

Meanwhile, Latin America and the Middle East & Africa are steadily emerging, driven by infrastructure expansion and increasing industrial wastewater treatment projects, contributing to a balanced global market landscape and setting the foundation for broader growth opportunities across developing economies.

Top Use Cases

- Wastewater treatment/sludge dewatering: Acrylamide is polymerized into polyacrylamide that acts as a flocculant—helping tiny particles in water clump together so they can settle. This improves the separation of solids from water in municipal and industrial wastewater systems.

- Enhanced oil recovery (EOR) in oil fields: Partially hydrolyzed polyacrylamide (HPAM) is injected into oil reservoirs to increase the viscosity of water floods, helping push trapped oil toward production wells.

- Paper strength and retention aid: Acrylamide copolymers are used in papermaking to increase the dry strength of paper and help retain fine fibres and fillers during sheet formation.

- Electrophoresis in laboratories (PAGE gels): Acrylamide is used to form polyacrylamide gels for protein and DNA separation in labs (PAGE technique). The gel matrix acts like a sieve, sorting molecules by size under an electric field.

- Adhesives and bonding applications: Acrylamide-based adhesives are employed in composites or bonding systems to enhance bond stability, reduce stress in materials, and improve the lifetime of bonded interfaces.

- Soil conditioning and erosion control: Polyacrylamide derived from acrylamide is used in soil to improve structure, reduce erosion, and enhance infiltration by binding soil particles together.

Recent Developments

- In September 2025, Dow confirmed a one- to two-year delay to its Path2Zero project in Alberta, Canada, which is a blue-hydrogen-based chemicals complex that would expand ethylene, polyethylene, and lower carbon chemical capacity.

- In September 2025, Ashland launched a new agrimer® eco-coat polymer for seed coatings, emphasizing sustainability in agriculture. While not strictly acrylamide, it shows their work in specialty polymer chemistry.

- In May 2025, Hengju Chemical was reported to obtain a patent for a temperature-controllable constant-temperature reaction device. This apparatus helps maintain uniform, stable temperature in reaction vessels. Such technology could improve consistency or yields in their acrylamide/polyacrylamide production processes.

- In November 2024 Q&A, Mitsui’s management said they are exploring combining their biocatalyst technology for producing acrylamide with cell culture / genetic analysis technologies (via partner companies like DNA Chip Research) to expand into diagnostic / testing businesses.

Conclusion

The Acrylamide Market is steadily growing due to its crucial role in environmental and industrial applications. Its wide use in wastewater treatment, mining, oil recovery, and paper manufacturing highlights its importance in sustainability and efficiency. Ongoing innovations in biodegradable polymers and low-residual formulations are making production more eco-friendly.

With governments and industries investing heavily in clean-water infrastructure and green technologies, acrylamide continues to be a key material supporting global water management and resource optimization. The market’s future lies in balancing industrial demand with sustainability goals, ensuring cleaner production and improved environmental performance across multiple applications.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)