Table of Contents

Overview

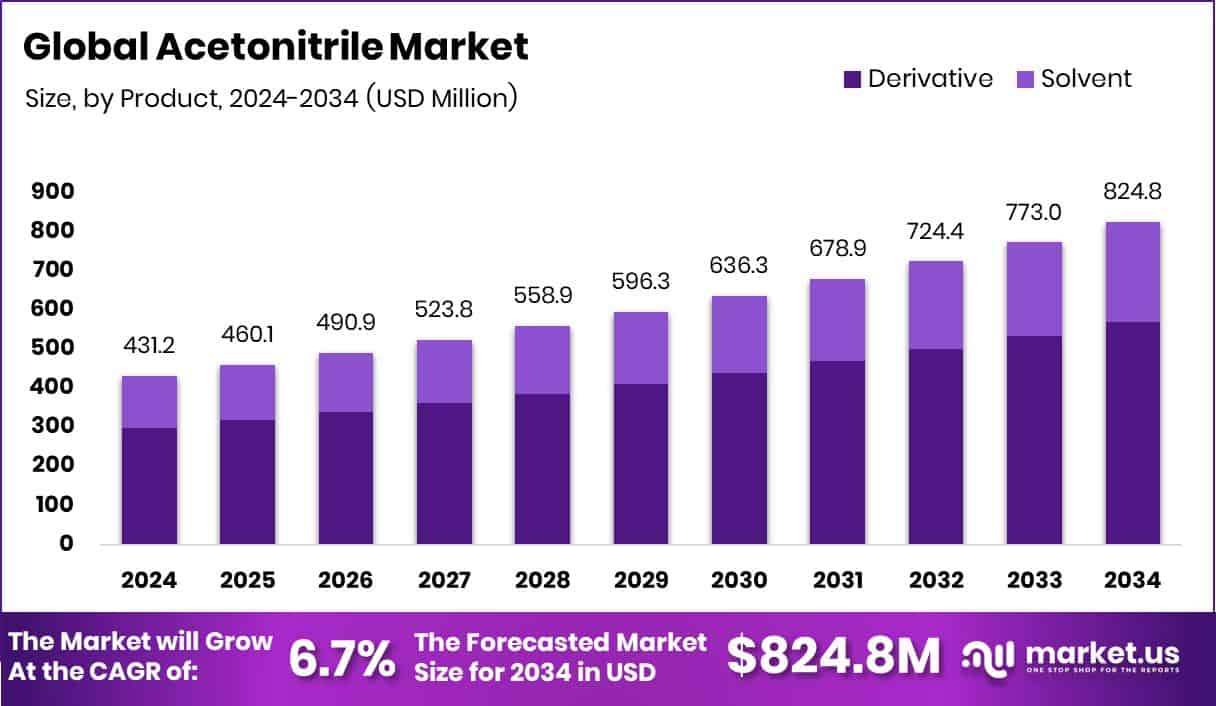

New York, NY – Nov 25, 2025 – The Global Acetonitrile Market is set to reach USD 824.8 million by 2034, rising from USD 431.2 million in 2024 at a 6.7% CAGR from 2025-2034. Growth remains strong in the Asia Pacific, which holds a 38.20% share valued at USD 164.7 million, backed by expanding pharmaceutical and agrochemical production.

Acetonitrile continues to play a critical role as a high-purity solvent in pharmaceuticals, analytical testing, and agrochemical formulation. Its fast evaporation, strong polarity, and compatibility with complex chemical reactions make it essential for HPLC systems, drug synthesis, and advanced chemical workflows. Since most production depends on acrylonitrile manufacturing, supply strength is closely tied to larger industrial cycles.

Funding momentum is reinforcing downstream demand. Investments such as Kotak’s $45 million backing for Cropnosys, Scimplify’s $9.5 million raise, and India’s Agrim securing $17.3 million signal accelerating innovation in agri-inputs and chemical research—areas that rely heavily on high-purity acetonitrile. Further, VitalFluid’s €5 million investment toward sustainable AgTech development highlights a shift toward cleaner and more efficient agricultural chemistry, supporting continued solvent use in testing, formulation, and R&D pipelines.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-acetonitrile-market/request-sample/

Key Takeaways

- The Global Acetonitrile Market is expected to be worth around USD 824.8 million by 2034, up from USD 431.2 million in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034.

- Derivative products dominate the acetonitrile market with a strong 69.1% share globally.

- Organic synthesis holds a 44.2% share in the acetonitrile market due to its versatile solvent performance.

- Pharmaceutical applications lead the acetonitrile market with a strong 46.9% share worldwide.

- The Asia Pacific Acetonitrile Market value stands firmly at USD 164.7 Mn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=165587

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 431.2 Million |

| Forecast Revenue (2034) | USD 824.8 Million |

| CAGR (2025-2034) | 6.7% |

| Segments Covered | By Product (Derivative, Solvent), By Application (Organic Synthesis, Analytical Applications, Extraction, Others), By End Use (Pharmaceutical, Agrochemicals, Electronics, Chemical, Others) |

| Competitive Landscape | Alkyl Amines Chemicals Limited, Asahi Kasei Corporation, Avantor Performance Materials LLC, Formosa Plastic Corporation, Henan GP Chemicals Co., Ltd, Honeywell International Inc., Imperial Chemical Corporation, INEOS, Jindal Speciality Chemicals, Nantong Acetic Acid Chemical Co., Ltd. |

Key Market Segments

By Product Analysis

In 2024, the Derivative segment dominated the Acetonitrile Market under the By-Product category with a 69.1% share, highlighting its essential role in processing and formulation workflows. This large share demonstrates how derivative-based forms are widely preferred for stable performance, reliable solubility, and compatibility across diverse chemical environments.

Its strong position reflects how industries increasingly depend on controlled, consistent solvent characteristics to support efficiency, process repeatability, and large-scale production demands. With its 69.1% share, the Derivative segment continues to guide broader market behaviour, shaping usage patterns, purity requirements, and future product development priorities.

By Application Analysis

In 2024, Organic Synthesis led the By Application segment of the Acetonitrile Market with a 44.2% share, reinforcing its position as the most critical end-use area. This strong share reflects how widely acetonitrile is used in reactions that require stable polarity, reliable dissolution behaviour, and controlled evaporation during synthesis steps.

Its dominance also shows the ongoing reliance of pharmaceutical and chemical manufacturers on acetonitrile for improving product yield, selectivity, and consistency in downstream processing. With a 44.2% contribution, Organic Synthesis continues to influence overall demand trends, guiding production focus and purity expectations across the market.

By End Use Analysis

In 2024, the Pharmaceutical segment led the Acetonitrile Market under the By End Use category with a 46.9% share, emphasising its critical reliance on the solvent for high-precision manufacturing. This 46.9% portion reflects continued use of acetonitrile in purification, active ingredient processing, and controlled synthesis steps where accuracy and consistency are essential.

Its leading position also demonstrates how pharmaceutical environments depend on solvent stability, purity, and repeatable performance across analytical testing and production workflows. With such a notable share, the Pharmaceutical segment remains a primary demand driver and continues shaping overall application patterns and future usage priorities in the market.

Regional Analysis

Asia Pacific leads the Acetonitrile Market with a 38.20% share valued at USD 164.7 Mn, reinforcing its role as the largest consumer and processing hub. This dominance reflects a strong presence in pharmaceuticals, agrochemicals, and analytical systems that depend on reliable solvent performance.

North America continues to contribute steadily through established industrial operations, although its scale remains below Asia Pacific. Europe maintains consistent participation supported by structured regulations, chemical manufacturing, and advanced research environments.

Meanwhile, the Middle East & Africa show emerging yet selective demand tied to growing industrialisation, and Latin America holds a moderate role as solvent use expands gradually. With its 38.20% share and USD 164.7 Mn value, Asia Pacific continues to set market direction, influencing global demand patterns and supply alignment.

Top Use Cases

- Solvent for organic synthesis: Acetonitrile is often used in chemical labs and factories as the liquid medium in which reactions happen. Because it dissolves lots of compounds and doesn’t interfere much with many reaction steps, chemists use it to build, modify, or purify molecules.

- Electrolyte or solvent in battery/electrochemical applications: Because acetonitrile has a relatively high dielectric constant and dissolves salts well, it finds use in battery research and certain electrochemical cells.

- Extraction and distillation support in petrochemical & refining processes: In petrochemical industries, acetonitrile serves as a helper liquid to pull out specific components (for example, in extractive distillation) or to refine hydrocarbon mixtures.

- Intermediate or auxiliary in agrochemical/pharmaceutical manufacturing: Acetonitrile is used as a building block or supporting medium when making agrochemical actives, pharmaceuticals, dyes, or resins. For instance, it may help in producing thiamine or other nitrile-based chemicals.

Recent Developments

- In October 2025, Honeywell announced its updated business segment structure ahead of its planned Aerospace spin-off and the completion of the Solstice Advanced Materials separation.

- In June 2024, AKC announced a technological breakthrough – a proof-of-concept for a lithium-ion battery using its proprietary high-ionic-conductivity electrolyte that uses acetonitrile (AcN) as a key ingredient. The innovation aims to deliver higher power output even at low temperatures and better durability at high temperatures.

- In April 2024, INEOS Nitriles began sales of a new bio-based acetonitrile for pharmaceutical production, offering a ~90 % reduction in carbon footprint compared to conventional acetonitrile.

Conclusion

The Acetonitrile Market continues to evolve as industries demand high-purity and reliable solvent performance for advanced manufacturing, research, and chemical processing. Its role remains essential in pharmaceuticals, laboratory testing, agrochemicals, batteries, and speciality synthesis, making it a strategic chemical across modern supply chains.

Growth is supported by advancements in synthesis technology, cleaner production pathways, and increasing investment in analytical and precision chemistry. Innovation trends such as sustainable solvents, bio-based inputs, and improved process efficiencies are shaping future direction.

As global manufacturing expands and regulated industries strengthen quality requirements, acetonitrile remains a critical material influencing research, production, and formulation standards worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)