Table of Contents

Overview

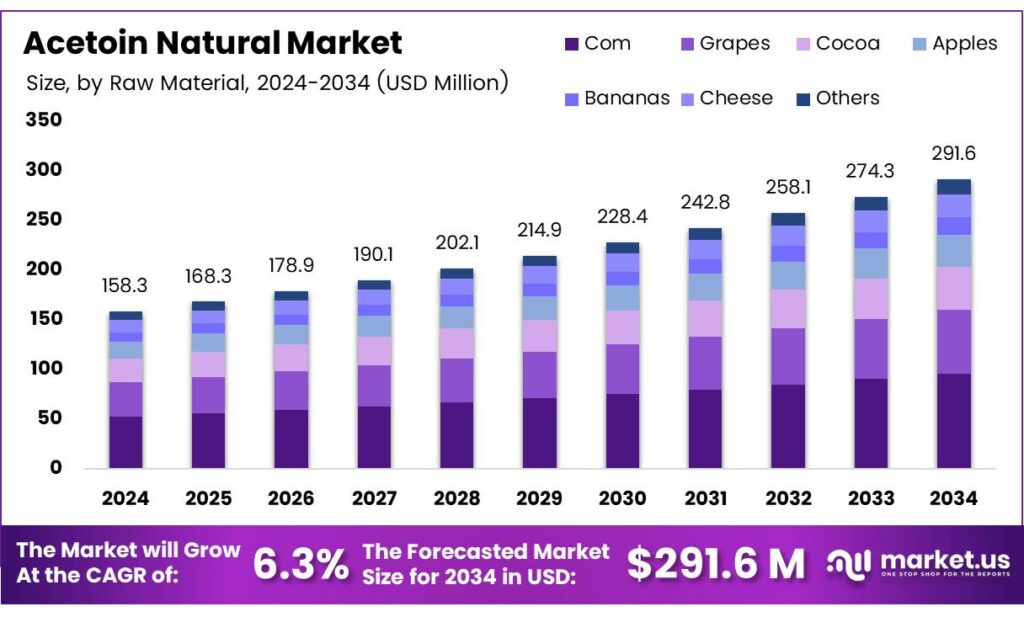

New York, NY – September 18, 2025 – The Global Natural Acetoin Market is projected to grow significantly, reaching USD 291.6 million by 2034, up from USD 158.3 million in 2024, at a CAGR of 6.3% between 2025 and 2034. Acetoin is a versatile platform chemical with widespread applications across the food, pharmaceutical, and chemical industries. Growing environmental concerns and the need to reduce reliance on fossil resources are driving a shift toward sustainable production methods.

Recent advances in biotechnology have enabled the engineering of Bacillus subtilis strains to improve fermentation efficiency. By regulating genes linked to spore formation and autolysis, researchers enhanced cell stability. Additionally, blocking competing pathways allowed more carbon flux to be redirected toward acetoin production. A cell-density–induced promoter further boosted synthesis efficiency. In trials using bagasse lignocellulosic hydrolysate in a 5-L bioreactor, the engineered strain achieved a remarkable acetoin titer of 64.3 g/L, equivalent to 89.5% of the theoretical yield.

Comparative studies highlighted the performance differences among engineered strains. For example, strain BSM-1 produced 23.7 g/L, which was 13.8% lower than the control strain BS-1 (27.5 g/L), while strain BSM-2 reached 30.8 g/L, outperforming the control with similar biomass levels. Naturally, many bacteria—including Klebsiella, Bacillus, Enterobacter, Lactococcus, and Serratia—are known to produce acetoin.

However, in most cases, acetoin is formed as a by-product of 2,3-butanediol and diacetyl pathways, resulting in low yields. Moreover, some strains raise safety concerns due to pathogenicity. To overcome these limitations, scientists are employing mutagenesis screening and fermentation optimization to develop high-yielding, safe, and non-pathogenic strains. These advancements are making industrial-scale production of natural acetoin increasingly feasible, aligning with the market’s shift toward sustainable and eco-friendly chemical processes.

Key Takeaways

- The Global Acetoin Natural Market is projected to grow from USD 158.3 Million in 2024 to USD 291.6 Million by 2034 at a CAGR of 6.3%.

- Corn dominates the raw material segment with a 32.9% market share in 2024 due to high starch content and availability.

- Liquid form holds 72.6% market share in 2024, favored for easy blending and high solubility in the food and fragrance industries.

- Natural form captures 68.3% market share in 2024, driven by demand for clean-label, bio-based flavor ingredients.

- The Food and beverage segment leads with 49.4% market share in 2024, fueled by acetoin’s use as a natural flavor enhancer.

- North America leads with 41.8% of global market value (USD 66.1 Mn) in 2024, driven by clean-label trends in food and beverages.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-acetoin-natural-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 158.3 Million |

| Forecast Revenue (2034) | USD 291.6 Million |

| CAGR (2025-2034) | 6.3% |

| Segments Covered | By Raw Material (Com, Grapes, Cocoa, Apples, Bananas, Cheese, Others), By Form (Liquid Form, Powder Form), By Source (Natural, Synthetic), By End Use (Food and Beverage, Paints and Coatings, Cosmetics and Personal Care, Pharmaceutical, Others) |

| Competitive Landscape | Vigon International, Sunaux, The Good Scents Company, Jiangxi Global Natural Spice Co., Ltd., Axxence Aromatic GmbH, Penta Manufacturing Company, Elan Chemical Company, Inc., Yancheng Hongtai Bioengineering Co., Ltd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156514

Key Market Segments

By Raw Material

Corn Commands 32.9% of Raw Material Use in 2024

In 2024, corn led the global acetoin natural market with a 32.9% share, driven by its high starch content and widespread availability, making it a cost-effective and efficient feedstock for microbial fermentation. Corn ensures a reliable supply chain and consistent yields, cementing its role among acetoin producers.

Corn’s dominance is expected to grow as demand for renewable, sustainable raw materials rises in food and beverage production. Its accessibility in major agricultural hubs like the United States, China, and Brazil keeps costs competitive, while bioprocessing advancements improve conversion efficiency, boosting output and reducing environmental impact.

By Form

Liquid Form Holds 72.6% Market Share in 2024

Liquid acetoin dominated the global market in 2024 with a 72.6% share, favored for its ease of blending, high solubility, and consistent flavor delivery in food, beverage, and fragrance applications. Its use in bakery, dairy, and confectionery enhances buttery and creamy notes, driving widespread adoption.

In 2025, liquid acetoin’s lead is expected to persist due to growing demand for natural flavors and clean-label products. Its advantages in precise dosing and uniform mixing make it ideal for pharmaceutical and chemical applications, while cost-effective storage and transportation further solidify its market edge.

By Source

Natural Form Captures 68.3% Share in 2024

In 2024, natural acetoin held a 68.3% share of the global market, fueled by consumer preference for clean-label, natural ingredients in food, beverages, and cosmetics. Produced through bio-based fermentation, natural acetoin is prized for its safety, sustainability, and authentic buttery flavors, free of synthetic additives.

Its strong presence in the bakery, dairy, and flavor industries supports its dominance, with growth expected in 2025 as regulations tighten on artificial additives. Health and wellness trends in North America and Europe, along with eco-friendly production investments, further bolster natural acetoin’s lead over synthetic alternatives.

By End Use

Food and Beverage Leads with 49.4% Share in 2024

The food and beverage sector accounted for 49.4% of the global acetoin natural market in 2024, driven by its role as a natural flavor enhancer in bakery, dairy, confectionery, and beverages. Acetoin’s rich, buttery, and creamy notes make it ideal for creating authentic taste profiles, especially in clean-label and organic products. Demand is set to grow as the food industry prioritizes natural ingredients, with bakery and dairy leading the charge in products like bread, cakes, yogurts, and flavored milk. The beverage sector is also exploring acetoin for cream-based and specialty drinks, expanding its application scope.

Regional Analysis

North America Holds 41.8% Share, USD 66.1 Million in 2024

North America led the global acetoin natural market in 2024 with a 41.8% share, valued at USD 66.1 million, driven by a strong shift toward clean-label packaged foods and beverages. The region’s robust bakery, dairy, and beverage industries rely on acetoin’s buttery and creamy notes to replace artificial flavors while maintaining familiar tastes. U.S. brands use acetoin in snacks, coffees, creamers, and ready-to-drink beverages, supported by clear food-safety and labeling regulations.

Advanced fermentation expertise, access to carbohydrate feedstocks, and established flavor houses streamline production. Canada’s demand for premium bakery and better-for-you dairy alternatives further drives growth. Innovations in high-protein snacks, plant-based dairy, and low-sugar treats leverage acetoin to enhance flavor and aroma, with efficient distribution supporting rapid market expansion.

Top Use Cases

- Bakery Flavor Booster: Acetoin natural enhances breads, cakes, and pastries with a rich, buttery flavor. It blends easily, giving baked goods a warm, homemade taste that shoppers love. Perfect for clean-label brands, it avoids synthetic additives, meeting the demand for natural, tasty treats that feel indulgent yet wholesome.

- Dairy Product Enhancer: In yogurts, cheeses, and ice creams, natural acetoin adds creamy, smooth notes that elevate taste. It helps dairy brands craft natural products that stand out on shelves. Consumers enjoy the authentic flavor, making it a go-to for companies aiming to deliver healthy, delicious dairy without artificial ingredients.

- Beverage Flavoring: Acetoin natural brings a velvety, creamy touch to drinks like flavored milk, smoothies, or craft sodas. It mixes well, enhancing taste and texture for a satisfying sip. Its natural profile suits brands targeting health-conscious drinkers who want refreshing beverages with real, eco-friendly ingredients that don’t compromise on flavor.

- Cosmetic Scent Additive: Used in creams, lip balms, and perfumes, acetoin naturally offers a soft, buttery scent that feels comforting. It’s gentle on the skin and aligns with the push for green beauty products. Brands use it to create luxurious, natural cosmetics that appeal to eco-savvy consumers seeking safe, pleasant fragrances.

- Pharmaceutical Flavor Masking: Acetoin natural improves the taste of liquid medicines or chewables by masking bitterness with a mild, creamy flavor. It ensures smooth mixing and better patient acceptance, especially for kids. Pharma brands use it to craft natural, user-friendly formulations that make taking medicine easier and more enjoyable.

Recent Developments

1. Vigon International

Vigon continues to advance its natural portfolio through strategic partnerships and NSF certification for its Natural Acetoin. Recent developments focus on enhancing supply chain transparency and technical support for customers developing clean-label products. Their “Vigon Cares” initiative underscores a commitment to sustainable and responsible sourcing of natural ingredients, ensuring reliable access for the flavor and fragrance industry.

2. Sunaux

Sunaux has recently expanded its production capabilities for natural aroma chemicals, including Acetoin Natural, to meet growing global demand. The company emphasizes cost-effective manufacturing without compromising quality. Their development focus is on optimizing fermentation processes to achieve high-purity, certified natural Acetoin that complies with international regulatory standards for use in flavors, fragrances, and personal care products.

3. The Good Scents Company

The Good Scents Company has recently updated its comprehensive information database to include detailed listings and regulatory information for natural Acetoin from various global suppliers. Their development is digital, providing a crucial resource for manufacturers to find technical data, usage levels, and compliance information, facilitating easier sourcing and formulation of products requiring natural ingredients.

4. Jiangxi Global Natural Spice Co., Ltd.

This key manufacturer has recently invested in scaling up its biotechnological production of Natural Acetoin via fermentation. Their developments focus on achieving larger volumes and consistent quality to serve the international market competitively. They are actively pursuing certifications to strengthen their position as a major global supplier of natural aroma chemicals directly from the source.

5. Axxence Aromatic GmbH

Axxence has recently emphasized its fully integrated biotech production of Natural Acetoin, derived from sustainable raw materials. Their development highlights advancements in proprietary fermentation and purification processes, ensuring a product of exceptional sensory quality and purity. They focus on providing a stable, traceable supply chain for high-end natural flavor applications in the food and beverage industry.

Conclusion

Acetoin Natural as a natural rising star in the ingredient world. Its natural, buttery charm fits perfectly with the growing demand for clean, sustainable products across food, drinks, cosmetics, and medicines. It delivers authentic flavors and scents that consumers crave, helping brands innovate while keeping things simple and eco-friendly. This versatile ingredient is poised to shape the future of natural formulations.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)