Table of Contents

Overview

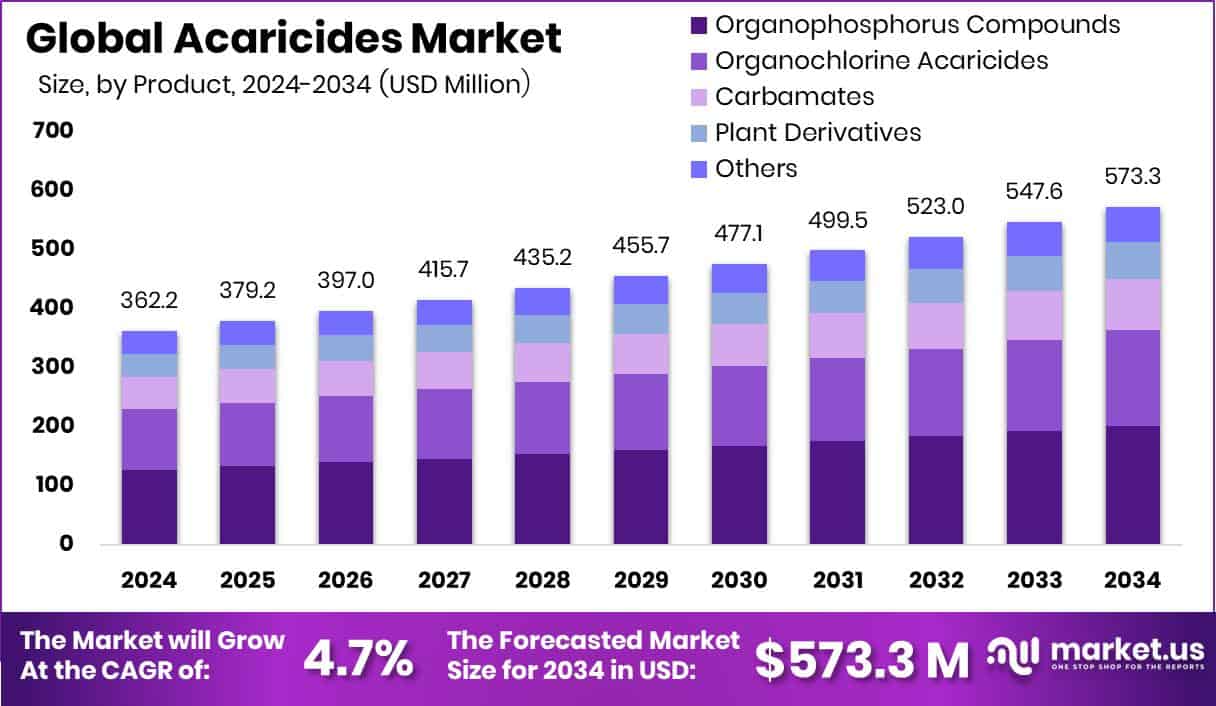

New York, NY – September 03, 2025 – The Global Acaricides Market is projected to reach USD 573.3 million by 2034, rising from USD 362.2 million in 2024, with a steady CAGR of 4.7% from 2025 to 2034. Growth is strongly supported by agricultural demand, with the Asia Pacific region accounting for 48.3% of the market.

Acaricides—chemical or biological agents—are vital in protecting crops from mites and in animal husbandry for preventing tick-borne diseases in cattle, sheep, and pets. Their role in securing crop yields, improving livestock health, and reducing pest-related losses makes them indispensable across farming and veterinary practices.

Key growth comes from rising food production needs. As populations expand, farmers increasingly use acaricides to protect yields from mite damage, ensuring food security. Livestock management is another driver: ticks can lower milk, meat, and wool output, so farmers rely on acaricides to maintain herd productivity and profitability.

Government initiatives are also boosting adoption. A recent example is the launch of the 21st livestock census combined with a USD 25 million Pandemic Fund aimed at strengthening animal health systems and curbing zoonotic diseases. This underscores acaricides’ importance in both food safety and animal welfare.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-acaricides-market/request-sample/

Key Takeaways

- The Global Acaricides Market is expected to be worth around USD 573.3 million by 2034, up from USD 362.2 million in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034.

- In the acaricides market, organophosphorus compounds dominate with a 34.7% share, ensuring effective pest management.

- Spray-based applications hold the lead with a 47.9% share, highlighting farmers’ preference for easy pest control methods.

- Agriculture applications capture a 62.5% share, showing acaricides’ essential role in protecting crops from mite damage.

- The Asia Pacific acaricides market reached USD 174.9 million.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155773

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 362.2 Million |

| Forecast Revenue (2034) | USD 573.3 Million |

| CAGR (2025-2034) | 4.7% |

| Segments Covered | By Product (Organophosphorus Compounds, Organochlorine Acaricides, Carbamates, Plant Derivatives, Others), By Mode Of Action (Dipping Vat, Spray, Hand Dressing, Others), By Application (Agriculture, Animal Husbandry, Others) |

| Competitive Landscape | Bayer AG, BASF SE, FMC Corporation, Nissan Chemical Industries, Ltd., STAR BIO SCIENCE, NIPPON SODA CO., LTD., Nufarm, Sumitomo Chemical Ltd. |

Key Market Segments

By Product Analysis

In 2024, Organophosphorus Compounds led the By Product segment of the Acaricides Market with a 34.7% share. Their dominance comes from broad-spectrum efficiency against mites and ticks, making them vital for both crop protection and livestock health. Farmers favor these compounds for their quick action, reliable performance, and ability to secure productivity.

Their strong role is further tied to rising pest resistance against older options, as organophosphorus effectively targets pest nervous systems, even under heavy infestations. Widespread use in fruits, vegetables, and plantation crops, along with cost-effectiveness and easy formulation, boosts adoption across emerging markets.

By 2025, demand is expected to stay high, particularly in developing regions where agricultural and livestock growth continues to drive usage. Despite increasing regulatory focus on residues, this segment is projected to maintain its leading position in the near future.

By Mode Of Action Analysis

In 2024, the Spray segment led the By Mode of Action category in the Acaricides Market with a 47.9% share. Its dominance stems from easy application, wide coverage, and fast contact action against mites and ticks. Farmers favor sprays for protecting crops like fruits, vegetables, and plantations, where pest damage can cause major economic losses.

Sprays are also versatile, working with common equipment and suitable for both small and large farms. Their ability to treat large areas quickly adds to their appeal. In livestock care, spray acaricides are widely used to control ticks and safeguard herd health.

By 2025, sprays are expected to retain their leadership, driven by growing adoption in regions with expanding farming and livestock activities where practical pest control is essential.

By Application Analysis

In 2024, Agriculture led the By Application segment of the Acaricides Market with a 62.5% share. This dominance reflects the vital role of acaricides in shielding crops such as fruits, vegetables, cereals, and plantations from destructive mite infestations.

Farmers rely heavily on these solutions to secure yields and maintain quality, particularly in regions where pest pressure is severe and agriculture underpins economic stability. Rising global food demand has further strengthened their adoption in farming systems.

The segment’s strength is also linked to the growth of commercial farming, where large-scale production requires dependable pest control. By improving productivity and supporting export standards, acaricides remain crucial. Additionally, changing climates and warmer conditions have widened mite prevalence, deepening agriculture’s reliance on their use.

Regional Analysis

The acaricides market reflects clear regional differences shaped by farming systems, pest intensity, and regulations. In 2024, Asia Pacific led with a 48.3% share worth USD 174.9 million, driven by its vast agricultural base and the urgent need to secure food supplies for its large population. Countries such as China, India, and those in Southeast Asia face growing mite infestations in fruits, vegetables, and tea, fueling strong demand for acaricide solutions.

North America and Europe show steady growth, supported by advanced farming methods and strict regulatory policies that encourage integrated pest management. Meanwhile, the Middle East & Africa are expanding acaricide use in arid farming regions, and Latin America is adopting them across large-scale, export-oriented crops.

Still, Asia Pacific remains the standout leader, propelled by agricultural expansion, climate-related pest surges, and rising farmer awareness. Growing food demand and increased investments in pest control ensure the region’s continued dominance in the global acaricides market.

Top Use Cases

- Protecting Crops from Mites: Acaricides are widely used in farming to protect crops like grapes, citrus fruits, vegetables, and tea. Tiny pests such as spider mites can damage leaves and lower yields. Farmers spray acaricides on fields as part of pest management to keep plants healthy and harvests strong.

- Controlling Ticks and Mites on Livestock: In animal farming, acaricides are applied directly to cattle, sheep, and goats to remove ticks and mites. Farmers often use dip tanks, where animals are bathed in the medicine, or they apply pour-on liquids and sprays along the back of the animals. This prevents diseases that ticks and mites spread in herds.

- Tick Control Around Homes and Yards: Acaricides are also used in residential areas to lower tick numbers near houses, gardens, or wooded yards. Spraying the ground or using special bait boxes that treat mice carrying ticks can reduce infestations. One study showed that applying acaricide in spring reduced tick numbers by up to 100%, although it didn’t always reduce tick-borne diseases in people.

- Natural and Biological Acaricides: There is growing interest in eco-friendly options called bioacaricides. These are made from plants, microbes, or natural compounds. Examples include neem oil, essential oils, and fungi like Beauveria bassiana. They are often used in organic farming because they are safer for the environment and reduce chemical load on soil and food.

Recent Developments

- In July 2025, Bayer expanded its alliance with M2i Group to distribute pheromone-based pest control gels across Asia-Pacific, Latin America, and the United States. These eco-friendly solutions target crop pests with minimal residue, reinforcing Bayer’s focus on biological pest management.

- In June 2024, FMC Canada became the exclusive distributor of Novonesis’ biosolutions like TagTeam®, Optimize®, JumpStart®, BioniQ®, Cell‑Tech®, and Nitragin®, for the 2025 growing season. They will also work together on new biological technology to help Canadian farmers.

- In March 2024, BASF received expanded approval for its Velifer® bioinsecticide/miticide. Greenhouse growers can now use it in soil-directed sprays, as well as dip and drench applications. The updated label also covers new crops such as fruit and nut trees, vines, brambles, and bushberries. Velifer uses a strain of Beauveria bassiana to control mites and other pests safely, with no residue and without harming beneficial insects.

Conclusion

The acaricides market continues to play a vital role in protecting crops, livestock, pets, and even human environments from harmful mites and ticks. With rising concerns over food security, animal health, and vector-borne diseases, demand for effective solutions remains strong. At the same time, there is a growing shift toward safer, eco-friendly, and biological acaricides, reflecting stricter regulations and sustainability goals worldwide.

Innovations such as microbial products, plant-based extracts, and integrated pest management approaches are reshaping the industry. Overall, acaricides will remain essential for agriculture and public health while moving toward greener and more sustainable pest control methods.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)