Table of Contents

Overview

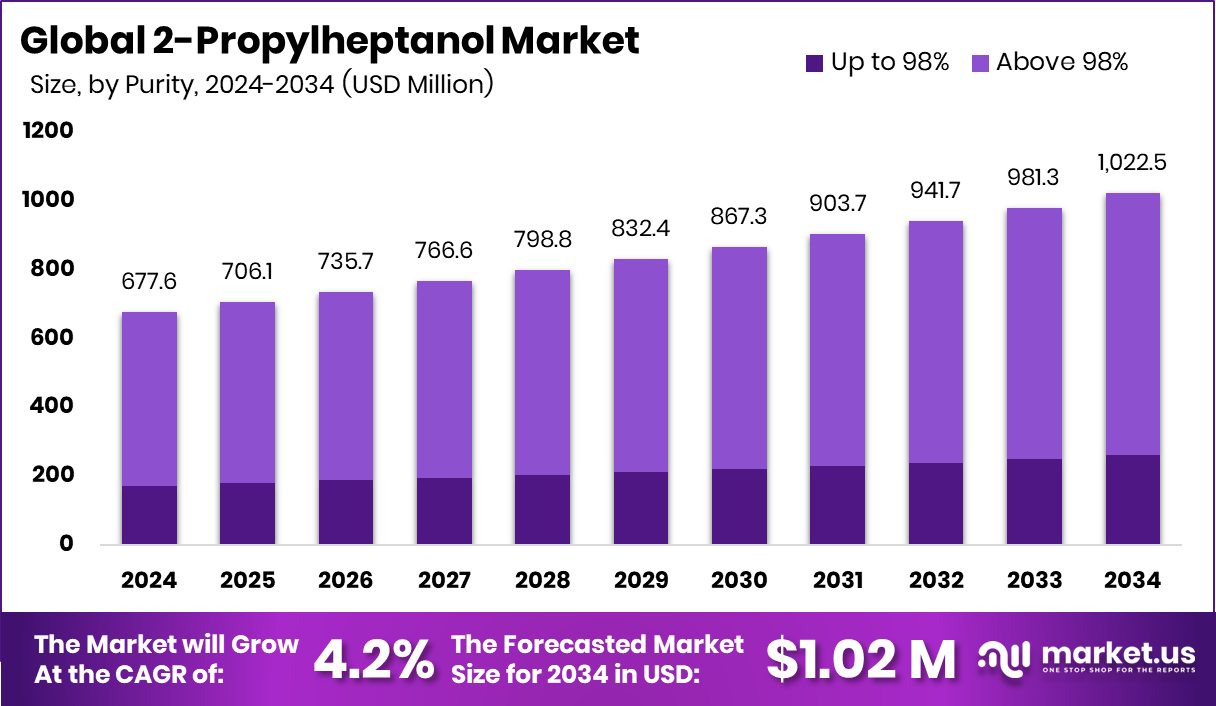

New York, NY – October 06, 2025 – The Global 2-Propylheptanol Market was valued at USD 677.6 million. Between 2025 and 2034, the market is projected to expand at a CAGR of 4.2%, reaching approximately USD 1022.5 million by 2034.

2-Propylheptanol, a C10 branched-chain oxo alcohol, is produced through the hydroformylation of C4 alkenes followed by hydrogenation. Known for its low volatility, favorable low-temperature performance, and versatile industrial applications, it plays a crucial role in various downstream industries.

The primary growth driver of this market is its extensive use in plasticizer production, particularly di-(2-propylheptyl) phthalate, which enhances flexibility in PVC-based products such as cable insulation, flooring, and coverings. Beyond plasticizers, 2-propylheptanol is increasingly applied in the lubricants sector as an additive, in acrylates for adhesives, and in the fragrance and aroma industry.

Additionally, its relatively low volatility supports its use in surfactants and detergents, making it safer and more effective in cleaning applications. Despite these advantages, the market faces potential headwinds from tightening environmental and chemical regulations, which could impact production and application scope in the coming years.

Key Takeaways

- The Global 2-Propylheptanol Market was valued at USD 677.6 million in 2024, at a CAGR of 4.2% and is estimated to reach USD 1022.5 million by 2034.

- Based on the purity, in 2024, 2-propylheptanol, which is more than 98% pure, led the market, encompassing about 74.6% share of the total global market.

- Among the applications of 2-propylheptanol, the plasticizers manufacturing industry dominated the market in 2024, accounting for around 44% of the market share.

- Asia Pacific was the largest market for 2-propylheptanol in 2024, with approximately 46.3% of the total market share.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-2-propylheptanol-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 677.6 Million |

| Forecast Revenue (2034) | USD 1022.5 Million |

| CAGR (2025-2034) | 4.2% |

| Segments Covered | By Purity (Up to 98%, Above 98%), By Applications (Plasticizers, Surfactants, Lubricants, Acrylates, Others) |

| Competitive Landscape | Evonik Industries AG, BASF SE, Ningbo Inno Pharmchem Co., Ltd., PETRONAS Chemicals Group Berhad, Shandong Hanshen Chemical Technology Co., Ltd., Zhengzhou Alpha Chemical Co., Ltd., Shandong Bonroy Chemical Co., Ltd., Ningbo Inno Pharmchem Co., Ltd, Kenya Chemical, Zhengzhou Alfa Chemical Co., Ltd., Chemical Bull Pvt. Ltd. & Other Key Players. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158180

Key Market Segments

Purity Analysis

In 2024, 2-propylheptanol with over 98% purity led the market, capturing a 74.6% share due to its superior chemical properties. The market is segmented into up to 98% and above 98% purity grades. High-purity 2-propylheptanol offers enhanced chemical stability and consistent reactivity, making it essential for producing plasticizers where even minor impurities can compromise product quality, processing, and performance.

Lower purity grades risk unwanted side reactions during synthesis, reducing efficiency and yield. High-purity grades mitigate these issues, making them ideal for large-scale industrial applications. Industries like automotive, construction, and consumer goods favor high-purity 2-propylheptanol to meet stringent quality and regulatory standards.

Application Analysis

The plasticizer industry dominated the 2-propylheptanol market in 2024, accounting for 44.1% of the market share. Segmented by applications into plasticizers, surfactants, lubricants, acrylates, and others, 2-propylheptanol, a C10 alcohol, is vital for producing high-molecular-weight plasticizers used in high-performance PVC applications.

These plasticizers enhance flexibility, thermal stability, and low volatility, critical for softening polymers in durable plastic products. Compared to other applications, 2-propylheptanol provides superior plasticizing efficiency, migration resistance, and low-temperature flexibility. The plasticizer market, with a global consumption of approximately 12 million tons annually, drives higher allocation of 2-propylheptanol due to its large scale and steady demand.

Regional Analysis

The Asia Pacific region led the global 2-propylheptanol market, valued at USD 313.7 million and holding a 46.3% revenue share. Rapid industrialization and urbanization in countries like China, India, Vietnam, and Indonesia fuel demand for plastics, construction materials, and automotive products, all reliant on 2-propylheptanol-derived plasticizers.

The region’s growing population drives infrastructure and residential construction, increasing the need for flexible PVC in pipes, window frames, and insulation. Additionally, Asia Pacific, a major automotive hub producing around 54 million vehicles annually, boosts demand for 2-propylheptanol in applications like dashboards, door panels, and seat coverings, with growth expected to continue.

Top Use Cases

- Plasticizers Production: 2-Propylheptanol acts as a key raw material in making plasticizers that soften hard PVC materials, turning them into flexible products like cables and flooring. This makes it vital for the construction and automotive industries, where durable, bendy plastics are needed for everyday use and building projects. Its low volatility ensures long-lasting performance without easy evaporation.

- Surfactants for Cleaning: As a base for surfactants, 2-Propylheptanol helps create effective detergents and hard-surface cleaners used in homes and factories. These agents break down dirt and grease easily, making cleaning more efficient. Its branched structure boosts foaming and wetting properties, ideal for industrial hygiene products that tackle tough stains safely.

- Lubricants Formulation: In lubricants, 2-Propylheptanol serves as a building block for esters that reduce friction in machines and engines. This extends equipment life in automotive and manufacturing sectors by providing smooth operation under high pressure and heat. Its stability prevents breakdown, ensuring reliable performance in demanding environments.

- Adhesives via Acrylates: 2-Propylheptanol contributes to acrylates used in strong adhesives for packaging, cars, and buildings. These bonds hold materials tightly while staying flexible, resisting migration over time. This application supports industries needing durable joints that withstand weather and stress without failing.

- Cosmetics Ingredients: Derived into oleate and palmitate esters, 2-Propylheptanol finds use in cosmetics for smooth textures in creams and lotions. Its low water mixability aids in stable formulations that feel light on skin. This makes it suitable for personal care items focused on hydration and protection.

Recent Developments

1. Evonik Industries AG

Evonik has been focusing on the sustainability profile of its 2-Propylheptanol and derivative plasticizers. Recent developments are integrated into their broader “Next Generation Plasticizers” initiative, which emphasizes low-volatility, phthalate-free products like DINP. Their strategic focus is on providing high-performance, sustainable solutions for the plastics industry, particularly in flexible PVC applications, by leveraging their integrated production capabilities for 2-Propylheptanol.

2. Johnson Matthey

Johnson Matthey’s recent developments are centered on licensing its leading LP Oxo SM process technology, which is used to produce alcohols like 2-Propylheptanol. Their R&D focuses on catalyst and process improvements for this technology, aiming to enhance efficiency, yield, and sustainability for their global licensing clients. This indirectly advances 2-Propylheptanol production by enabling licensees to operate more competitively and with a potentially reduced environmental footprint.

3. BASF SE

As a major producer, BASF’s recent developments for 2-Propylheptanol are linked to its Palatinol 10-P DINP plasticizer. The company emphasizes product stewardship and the safe use of this high-molecular-weight phthalate. Key activities include supporting regulatory compliance, particularly under REACH, and ensuring a reliable supply for the wire and cable, flooring, and coated fabrics industries through its robust, integrated production network in Europe.

4. Ningbo Inno Pharmchem Co., Ltd.

Ningbo Inno Pharmchem has positioned itself as a key global supplier of 2-Propylheptanol. Its recent developments focus on scaling production capacity and maintaining a competitive cost structure to serve the international market for plasticizers. The company emphasizes its role as a reliable merchant supplier, particularly for producers of DINP in Asia, and works to ensure consistent product quality to meet the technical specifications required by downstream customers.

5. PETRONAS Chemicals Group Berhad

PETRONAS Chemicals has entered the 2-Propylheptanol market through its Oxo Malaysia Sdn. Bhd. joint venture. The primary recent development was the successful commissioning and ramp-up of its new 2-Propylheptanol plant in Pahang. This strategic investment diversifies their oxo-alcohols product portfolio, captures more value from their integrated feedstock chain, and strengthens their position in the Southeast Asian market for plasticizers and other derivative applications.

Conclusion

2-Propylheptanol stands out as a versatile chemical essential for modern industries, driving flexibility in plastics, effective cleaning solutions, and reliable lubricants. As markets shift toward sustainable and high-performance materials, its role in adhesives and cosmetics grows, promising steady demand amid global manufacturing expansions and regulatory pushes for safer alternatives.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)