Table of Contents

- Introduction

- Editor’s Choice

- Dropshipping Market Overview

- Number of Digital Buyers Worldwide

- Main Dropshipping Product Categories

- Global Dropshipping Sales

- Global Dropshipping Statistics – By Store Niche

- eCommerce Usage Distribution in Sites

- Demographics of Dropshipping Consumers

- Retailer vs. Dropshipping Statistics

- Social Media Usage for Dropshipping

- Dropshipping Revenue & Profit Statistics

- Top Challenges Faced by Dropshipping Businesses

Introduction

According to Dropshipping Statistics, Dropshipping is a retail fulfillment method where sellers partner with suppliers to offer products without keeping inventory.

Sellers set up online stores, forwarding customer orders to suppliers who handle order processing and shipping directly to customers.

This model enables flexibility in product selection and eliminates the need for inventory management. Sellers earn profit by marking up product prices.

While dropshipping simplifies inventory logistics, it presents challenges such as maintaining supplier relationships and ensuring customer satisfaction.

Despite this, it offers a low-cost entry into e-commerce, requiring strategic marketing and efficient operations for success.

Editor’s Choice

- The global dropshipping market has grown significantly at a CAGR of 25.10%.

- By 2023, total market revenue increased to $286.4 billion, with corresponding growth in each category: product reselling rose to $119.43 billion, print on demand to $75.61 billion, creation of the product to $56.13 billion, and business extensions to $35.23 billion.

- Electronics and Media dominate the market with a substantial 34% share. Reflecting the high demand for consumer electronics, gadgets, and media products through online platforms.

- In 2023, the number of digital buyers surged to 2.64 billion, indicating a robust expansion in global e-commerce activity.

- Projections for the coming years suggest a continued upward trajectory, with dropshipping sales expected to reach $7,385 billion by 2025.

- Apparel leads as the most prominent niche, accounting for 26.00% of the top-performing dropshipping stores. Reflecting the high consumer interest in fashion and clothing items.

- Gen Z leads with a significant 38% share, highlighting their strong presence and active involvement in digital activities.

Dropshipping Market Overview

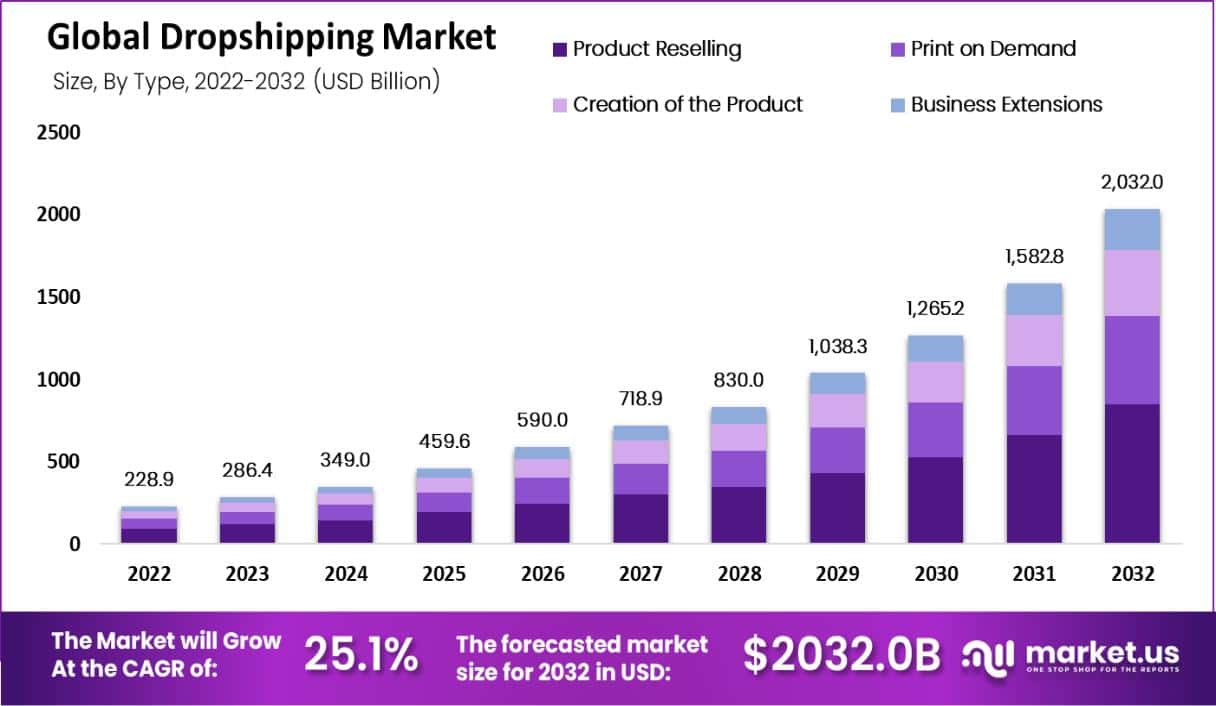

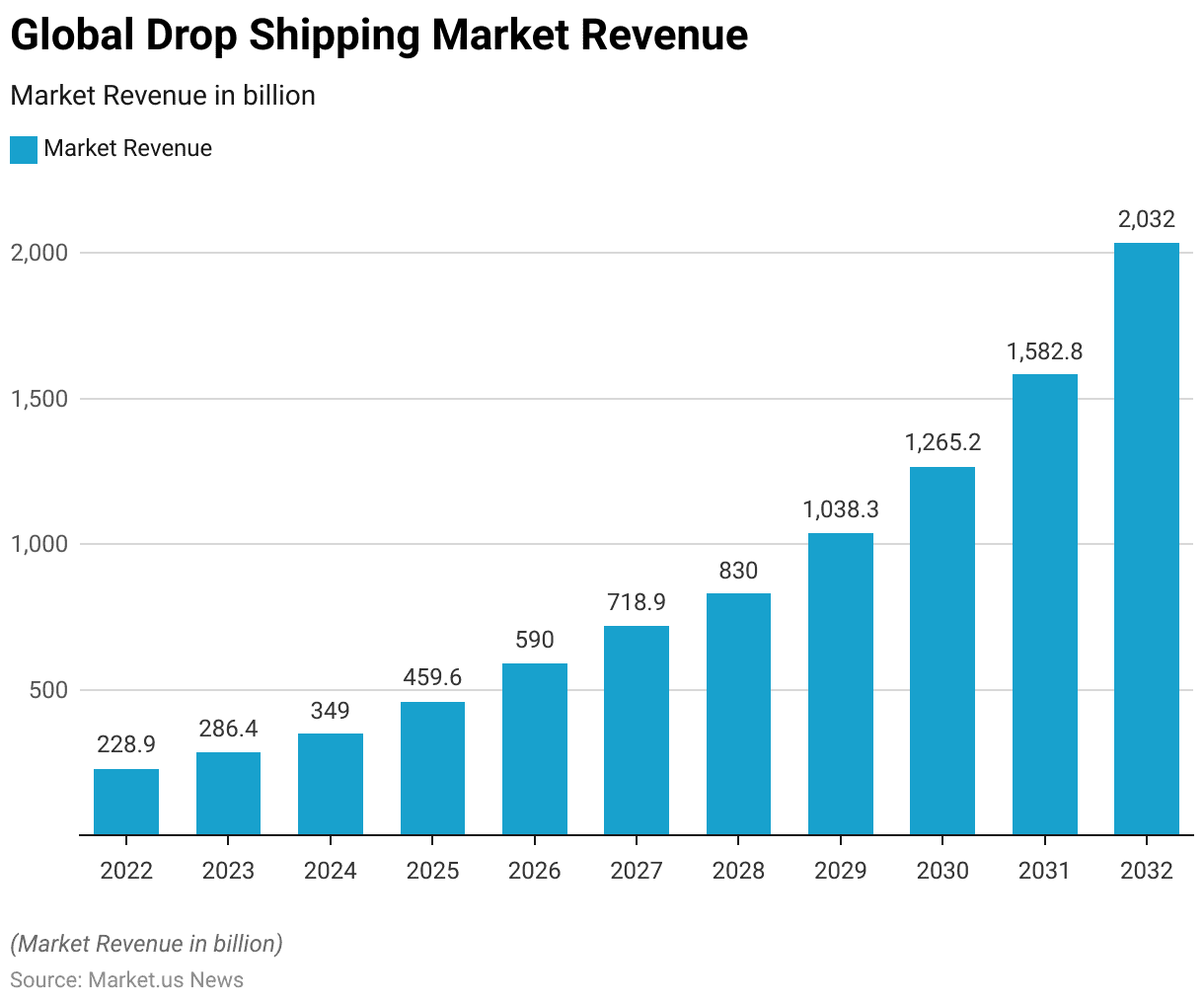

Global Dropshipping Market Size

- The global dropshipping market has demonstrated significant growth over the past decade and is projected to continue this trajectory well into the next decade at a CAGR of 25.10%.

- In 2022, the market revenue was recorded at $228.9 billion. This figure rose to $286.4 billion in 2023, indicating a robust growth pattern.

- The market is expected to continue expanding, with revenue projected to reach $349.0 billion.

- The projections for 2031 and 2032 are even more optimistic. With revenues expected to reach $1,582.8 billion and $2,032.0 billion, respectively.

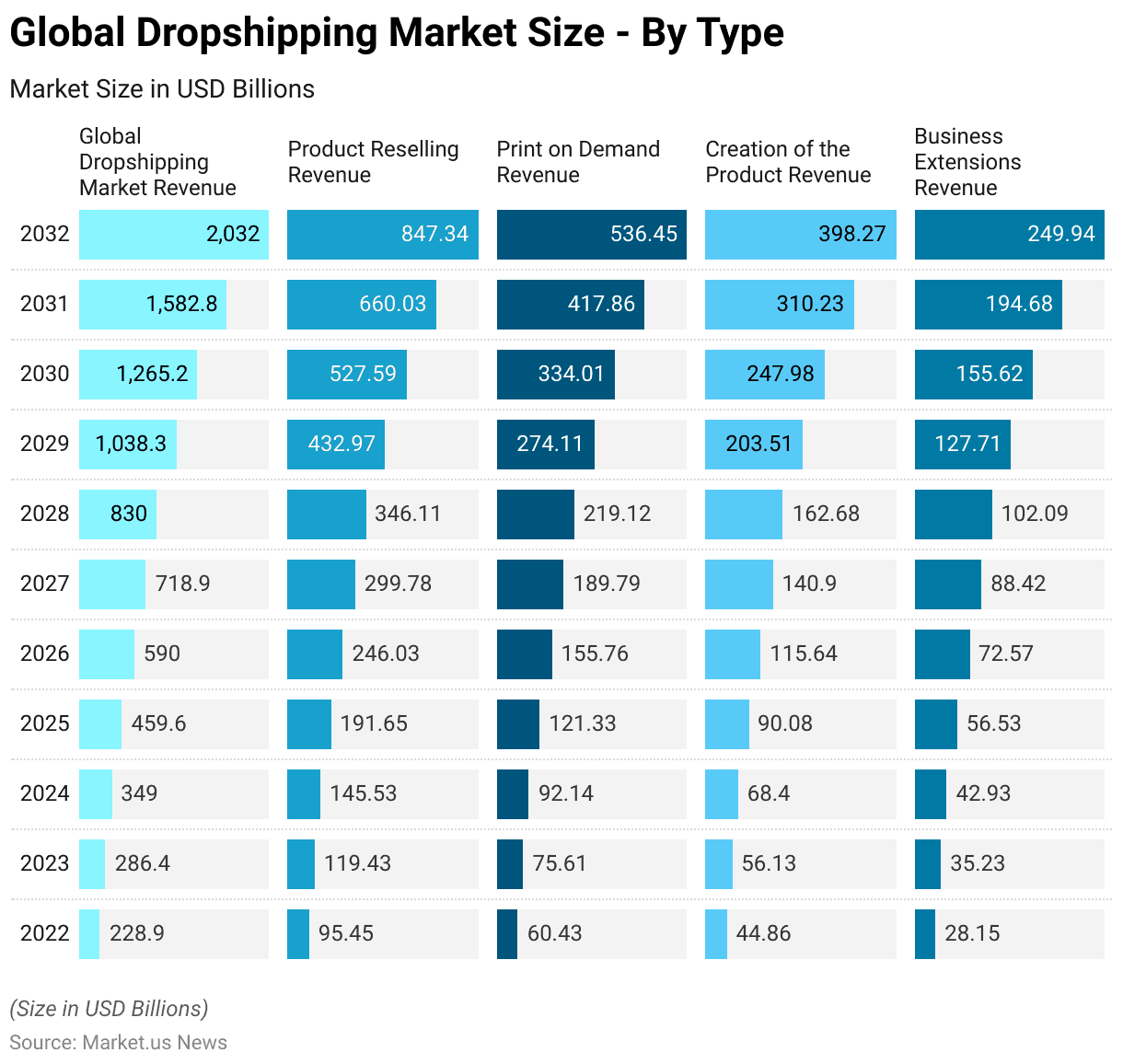

Global Dropshipping Market Size – By Type

- The global dropshipping market has exhibited substantial growth across various segments over the past decade, which is expected to continue.

- In 2022, the total market revenue was $228.9 billion, distributed among different types of dropshipping: product reselling accounted for $95.45 billion, print on demand generated $60.43 billion, creation of the product contributed $44.86 billion, and business extensions brought in $28.15 billion.

- By 2023, total market revenue increased to $286.4 billion, with corresponding growth in each category: product reselling rose to $119.43 billion, print on demand to $75.61 billion, creation of the product to $56.13 billion, and business extensions to $35.23 billion.

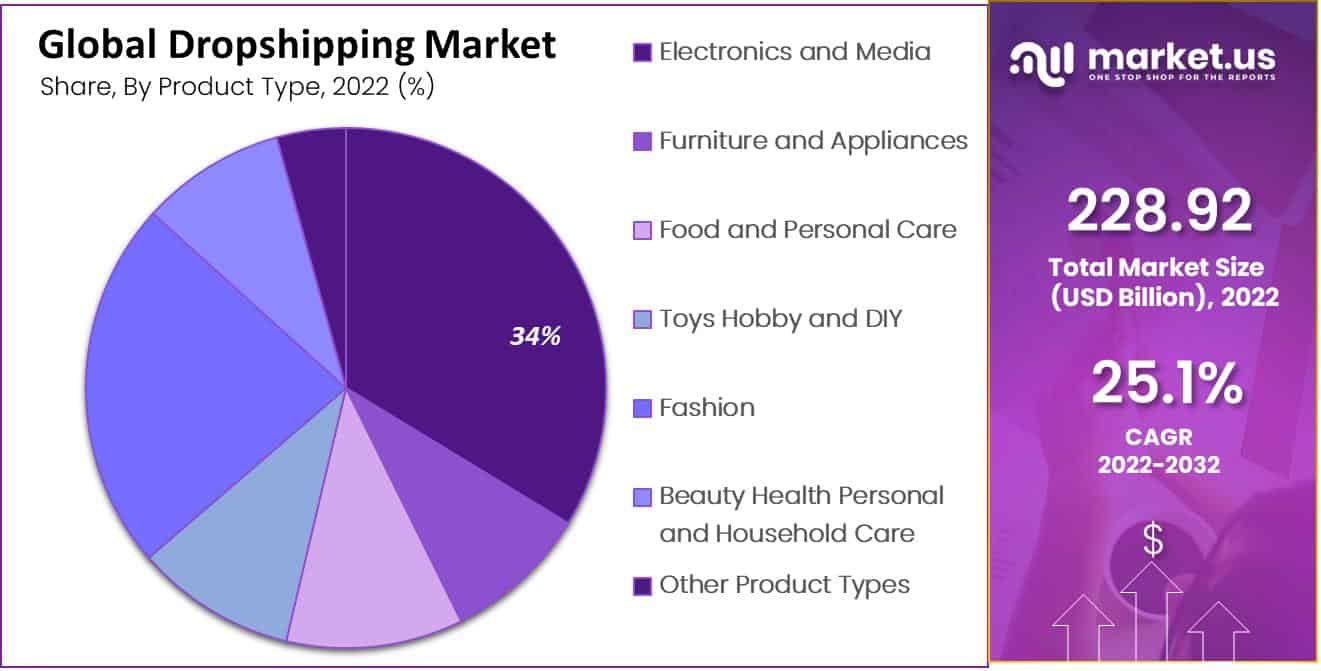

Dropshipping Market Share – By Product Type

- Electronics and Media dominate the market with a 34% share, reflecting the high demand for consumer electronics, gadgets, and media products through online platforms.

- Fashion is another major segment, capturing 23% of the market, driven by consumers’ increasing preference for online apparel and accessory shopping.

- Food and Personal Care products account for 11% of the market, indicating a robust interest in groceries and personal care items.

- Toys, Hobby, and DIY products also hold a notable share at 10%, showing consumer engagement in hobbies and home projects.

- Furniture and Appliances, as well as Beauty, Health, Personal, and Household Care, each make up 9% of the market, pointing to steady demand in these categories.

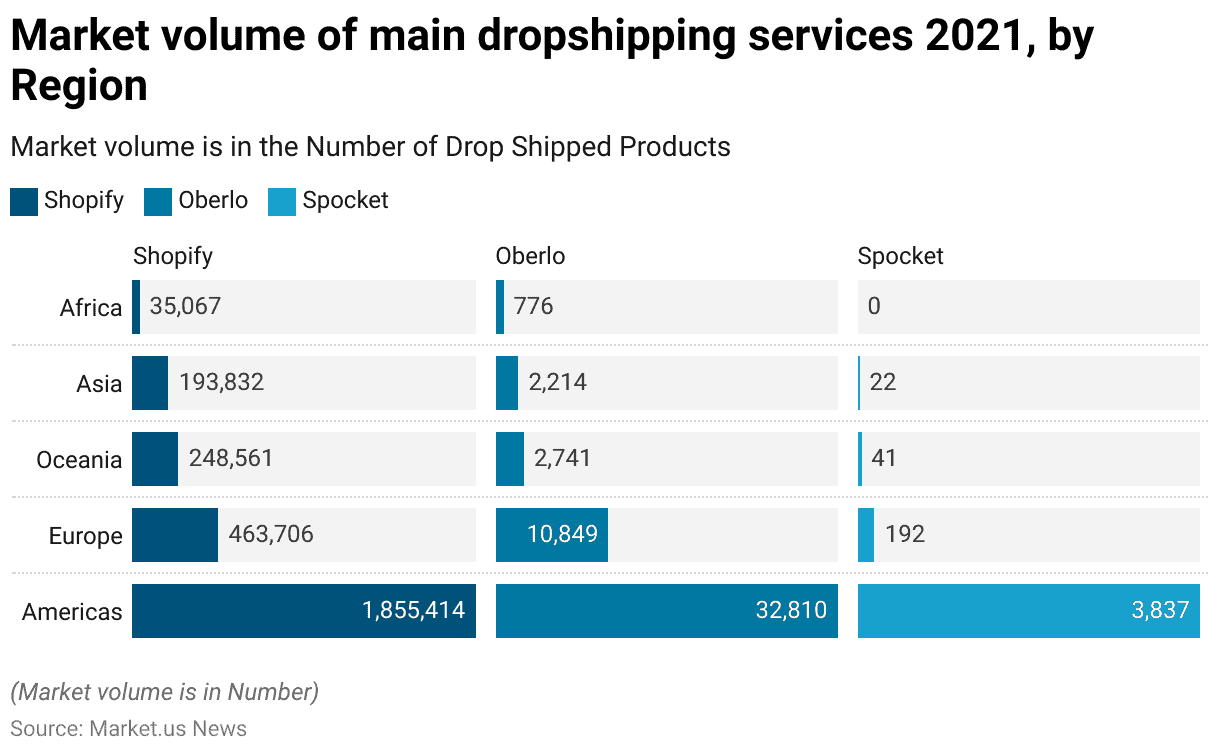

Market Volume of Main Dropshipping Services – By Region

- The Americas led with a substantial volume, where Shopify facilitated the shipment of 1,855,414 products, followed by Oberlo with 32,810 products and Spocket with 3,837 products.

- Europe also showed a strong presence in the dropshipping market, with Shopify shipping 463,706 products, Oberlo managing 10,849, and Spocket contributing a modest 192 products.

- Oceania’s market was smaller yet significant, with Shopify handling 248,561 products, Oberlo 2,741, and Spocket just 41 products.

- In Asia, the numbers were lower, with Shopify at 193,832 products, Oberlo at 2,214, and Spocket at 22 products.

- Africa had the least volume, where Shopify shipped 35,067 products, Oberlo handled 776, and Spocket had no activity.

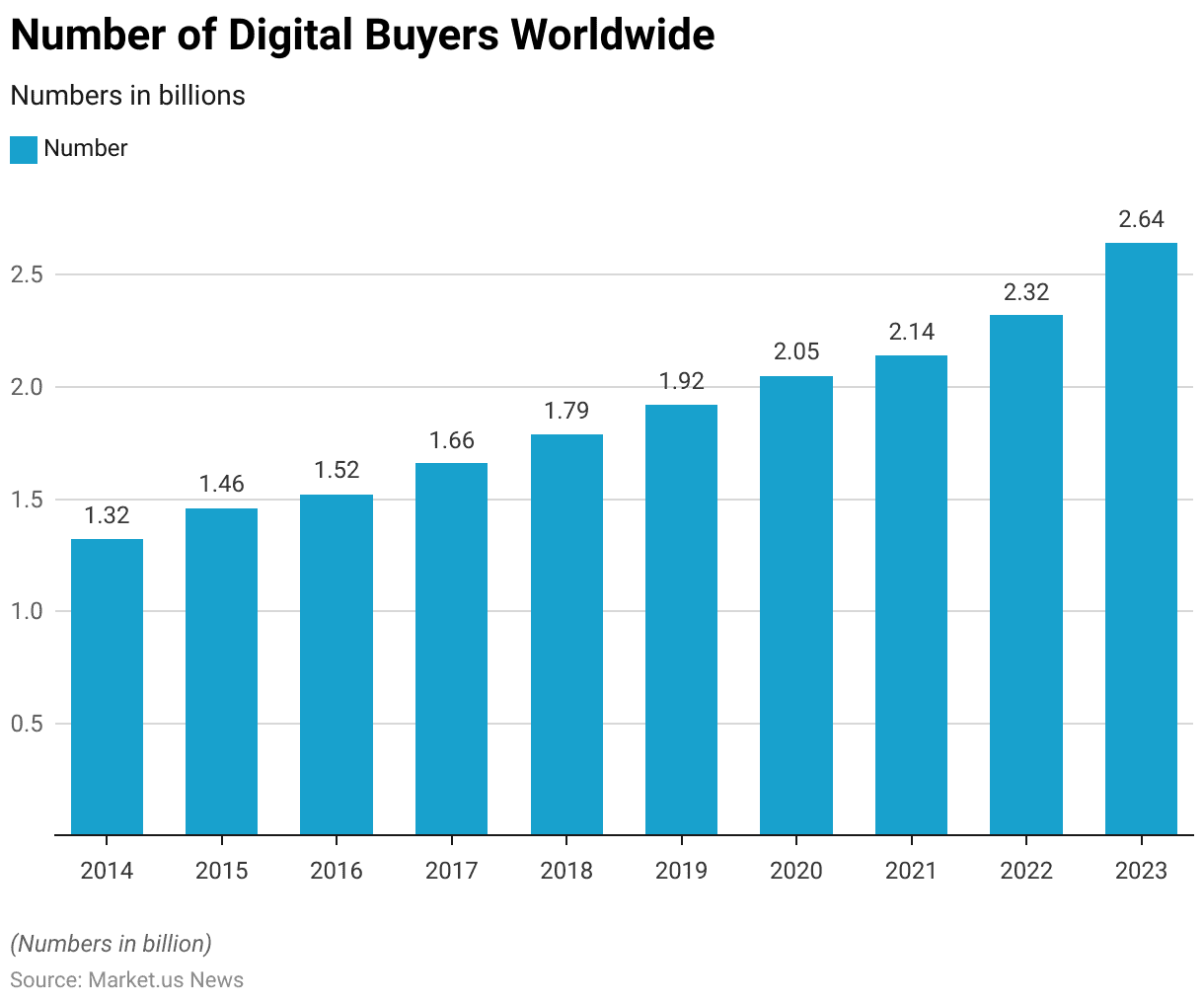

Number of Digital Buyers Worldwide

- Starting in 2014, the global digital buyer count was approximately 1.32 billion.

- This figure gradually increased to 1.46 billion in 2015, followed by a slight rise to 1.52 billion in 2016.

- The growth continued more robustly through the subsequent years, reaching 1.66 billion in

- The most dramatic increase occurred in 2023, when the number of digital buyers surged to 2.64 billion, indicating a robust expansion in global e-commerce activity.

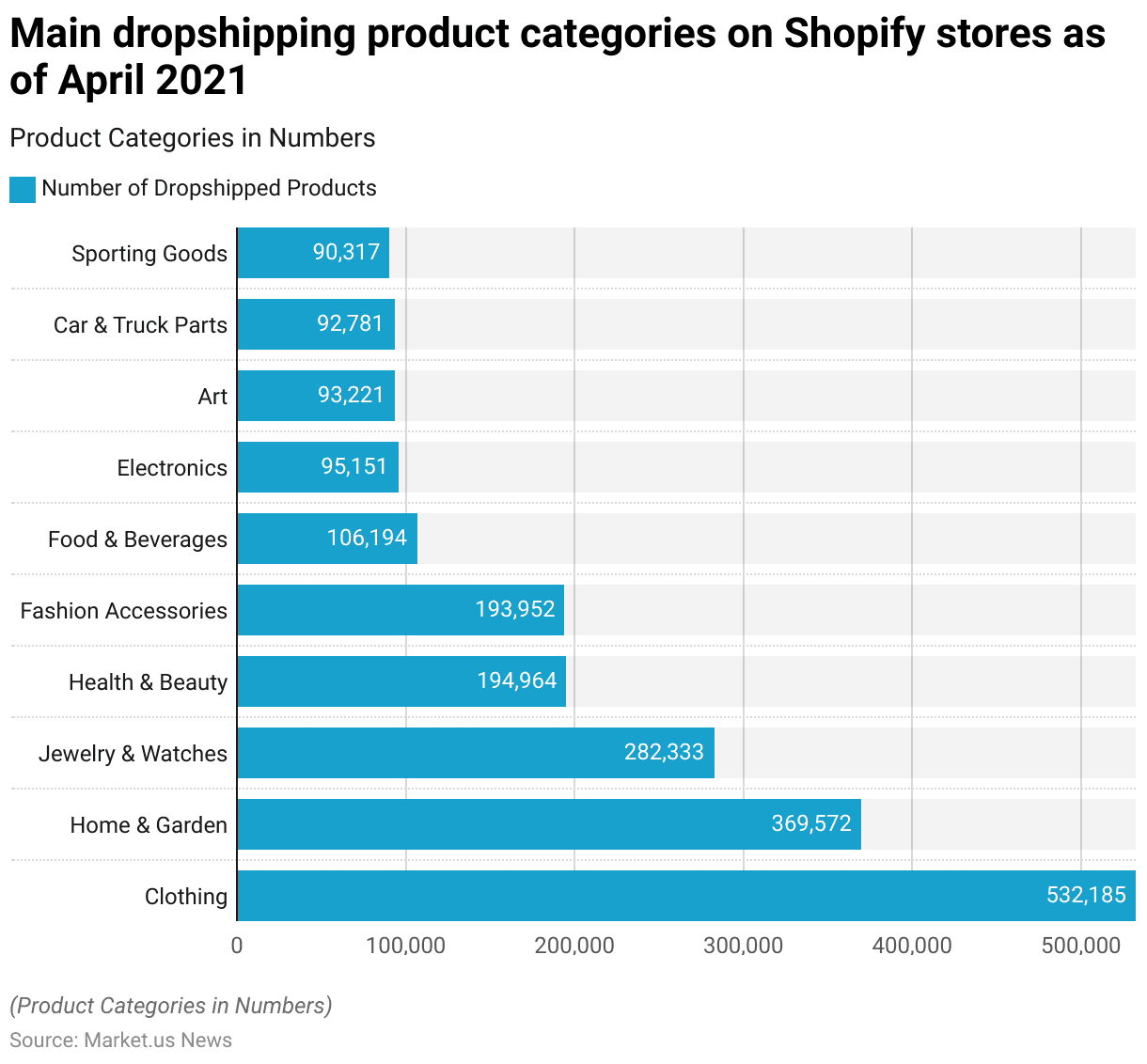

Main Dropshipping Product Categories

- Clothing was the most popular category, with 532,185 products being dropshipped, underscoring its dominant position in the online retail space.

- Home & Garden followed with 369,572 products, while Jewelry & Watches comprised 282,333 products, highlighting their significant appeal among shoppers.

- Health & Beauty products were also prominently featured, with 194,964 items drop shipped. Fashion Accessories were nearly as prevalent, with 193,952 products.

- Further down the list, Food & Beverages saw 106,194 products being drop shipped, and Electronics came in with 95,151 products.

- Art and Car & Truck Parts were closely matched, with 93,221 and 92,781 products, respectively. Sporting Goods rounded out the list with 90,317 products being drop shipped.

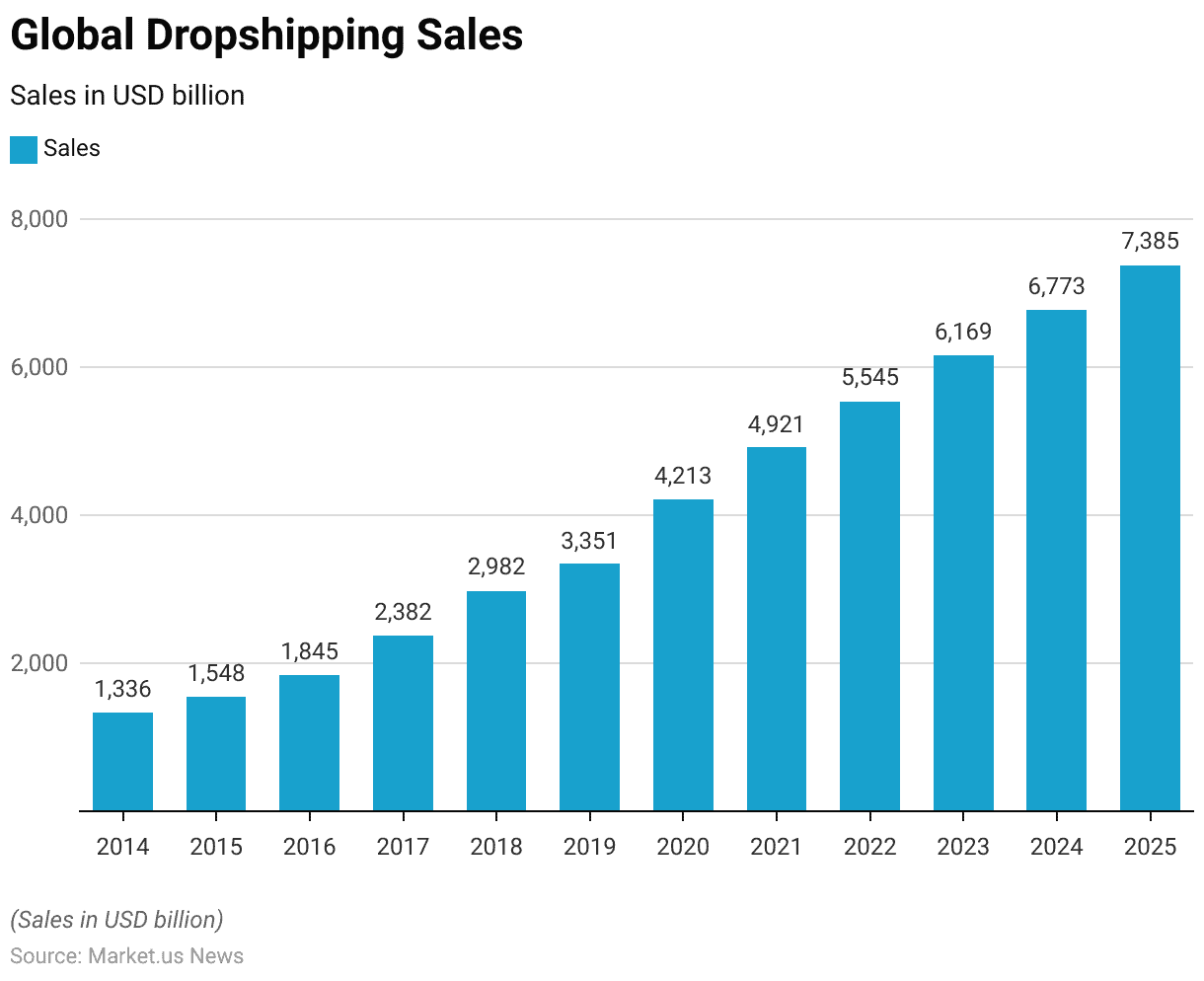

Global Dropshipping Sales

- Global dropshipping sales have exhibited a strong and steady growth trend over the years. In 2014, sales amounted to $1,336 billion and saw a steady increase to $1,548 billion in 2015.

- This growth persisted into 2021, with sales climbing to $4,921 billion, followed by an increase to $5,545 billion in 2022. In 2023, the sales further rose to $6,169 billion.

- Projections for the coming years suggest a continued upward trajectory, with sales expected to reach $6,773 billion in 2024 and $7,385 billion by 2025.

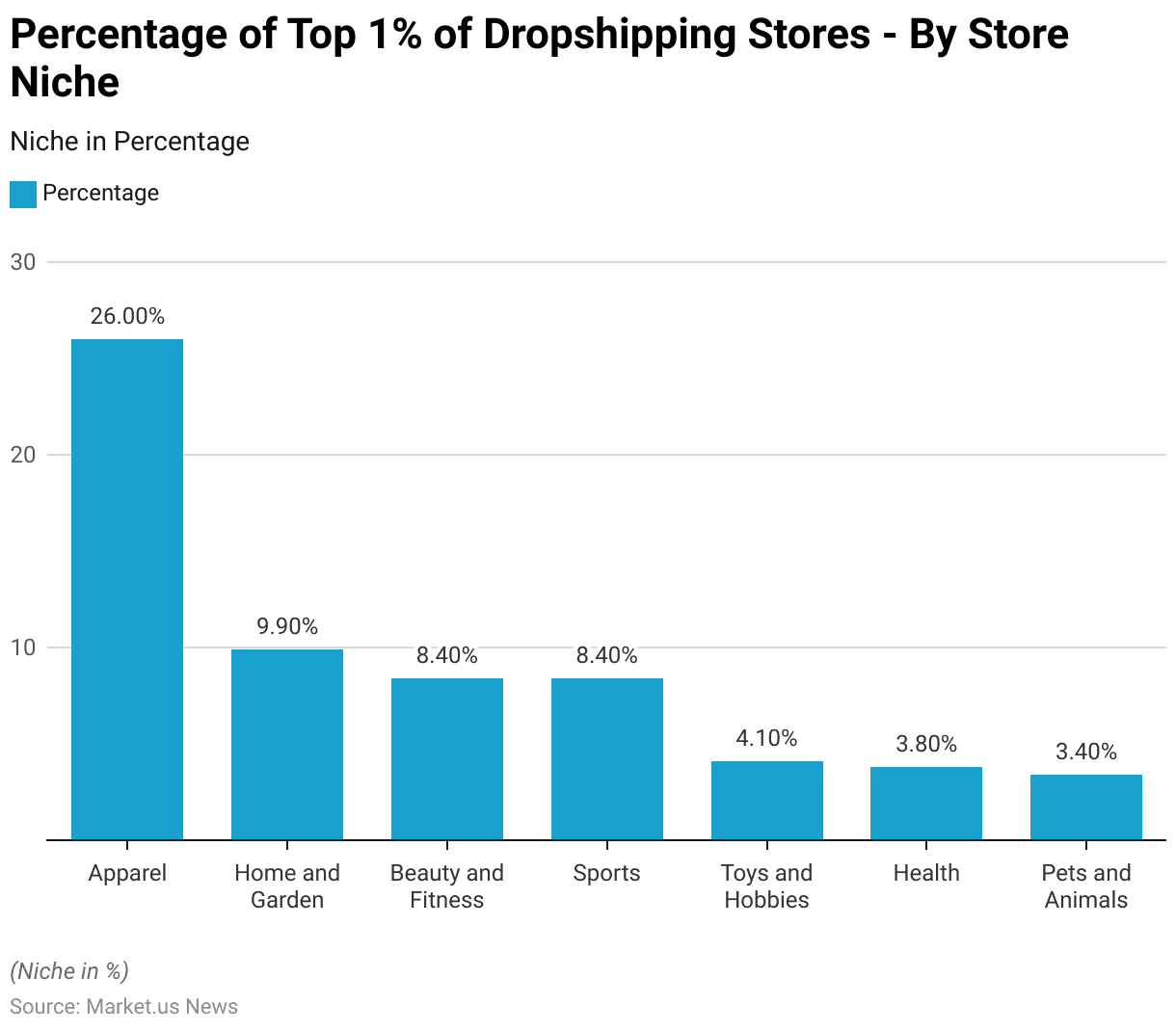

Global Dropshipping Statistics – By Store Niche

- Apparel leads as the most prominent niche, accounting for 26.00% of the top-performing dropshipping stores, reflecting the high consumer interest in fashion and clothing items.

- Home and Garden is the second most significant niche, comprising 9.90% of the top stores, suggesting a strong market for home decor and gardening products.

- Beauty and Fitness, alongside Sports, each capture 8.40% of the elite dropshipping stores, indicating robust demand for products in both the personal care and sports equipment categories.

- Toys and Hobbies represent 4.10% of the top stores, followed closely by Health, which makes up 3.80%.

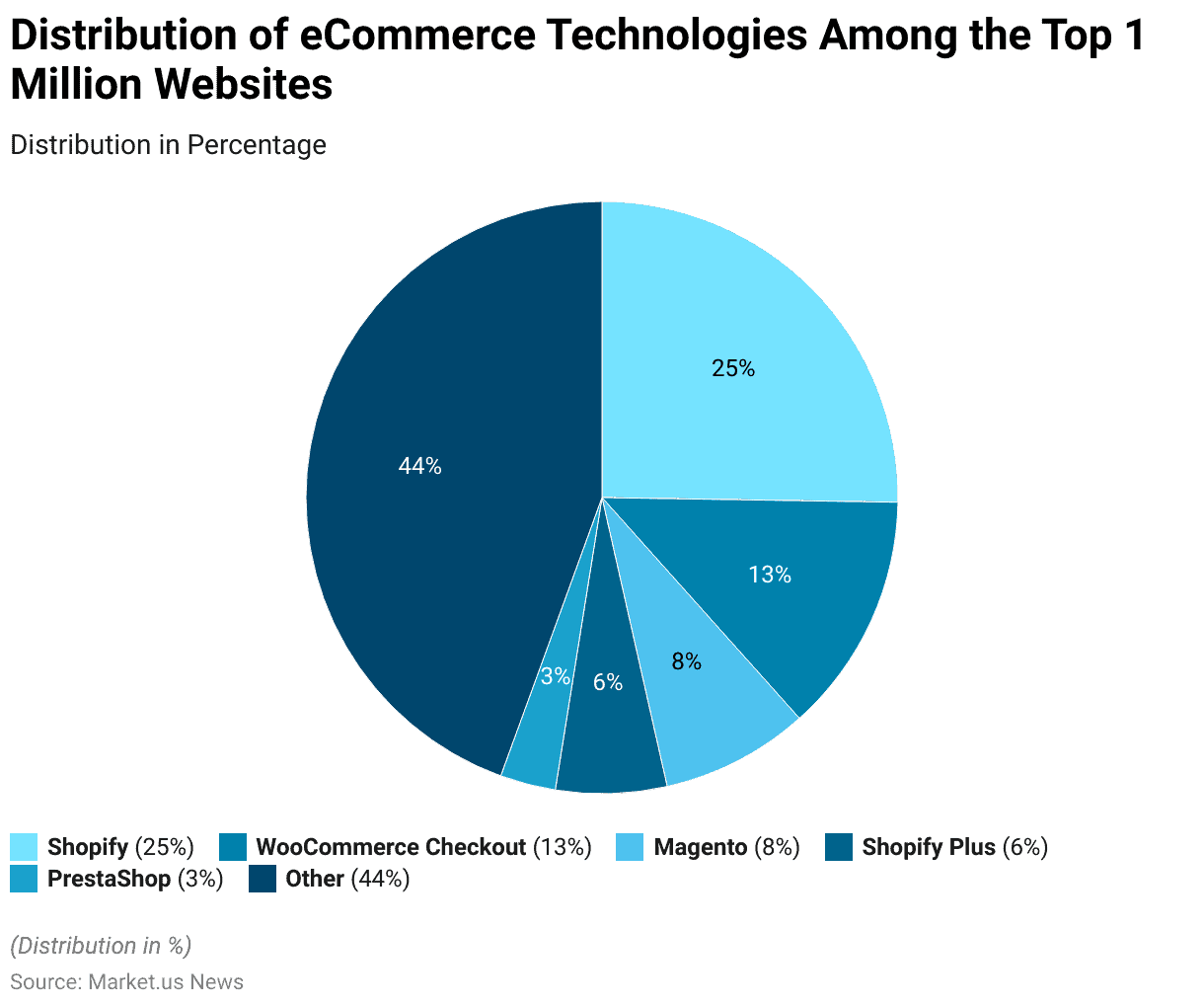

eCommerce Usage Distribution in Sites

- Shopify emerges as the dominant technology, being utilized by 25% of these websites, highlighting its popularity and user-friendly nature.

- WooCommerce Checkout follows, accounting for 13% of the distribution, underscoring its role as a significant player in the eCommerce sector, especially among WordPress users.

- Magento, known for its robustness and scalability, is used by 8% of the sites, while Shopify Plus, an enterprise version of Shopify, accounts for 6% of the usage.

- PrestaShop, another eCommerce solution, is used by 3% of the sites, reflecting its presence in niche markets.

- The remaining 44% of the distribution comprises a variety of other technologies, indicating a highly fragmented market with numerous smaller platforms catering to specific needs and preferences.

Demographics of Dropshipping Consumers

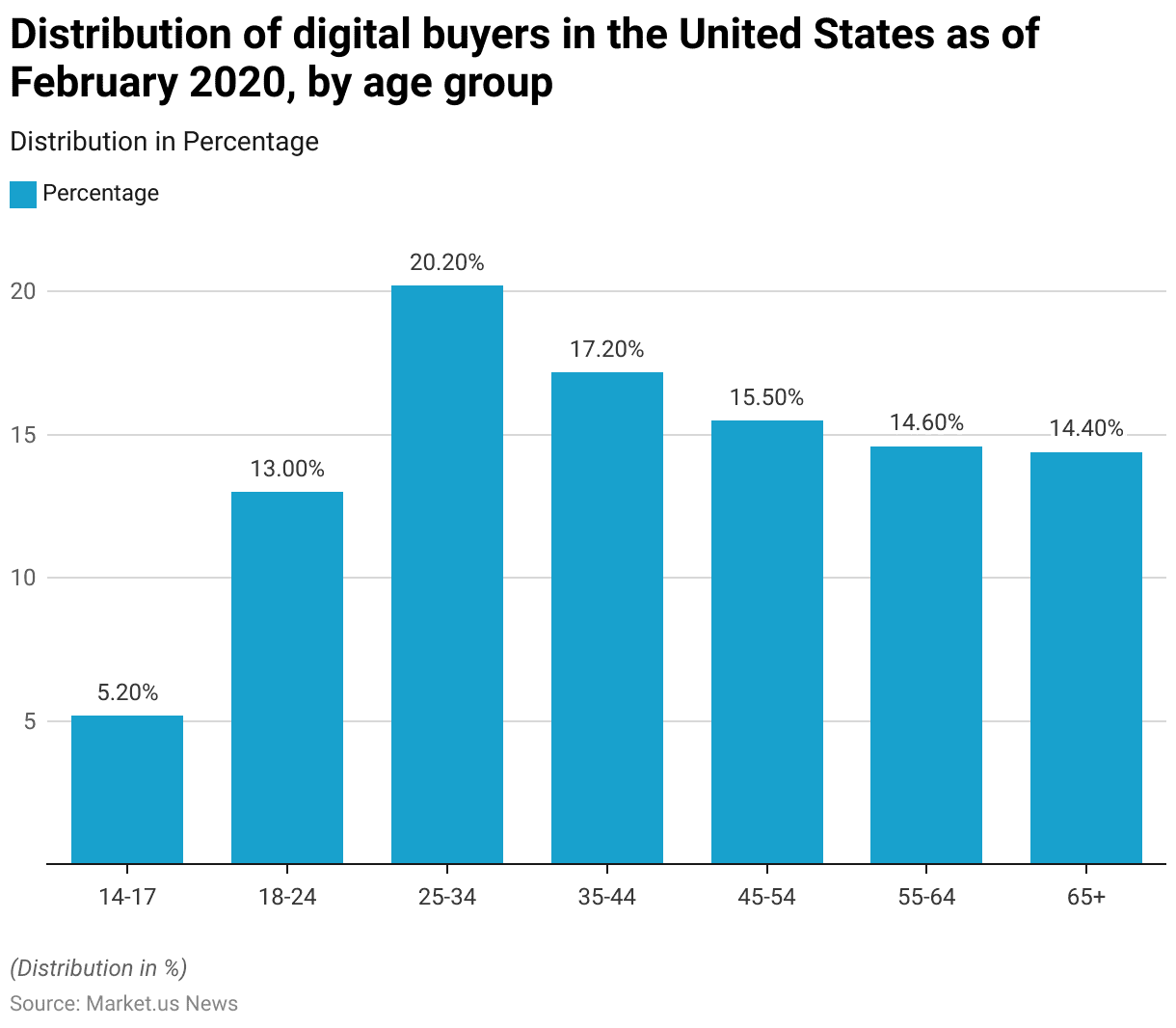

Age Group

- The largest group of digital buyers was those aged 25-34, who accounted for 20.20% of the total, indicating a strong affinity for online shopping among younger adults.

- This was followed by the 35-44 age group, which comprised 17.20% of digital buyers.

- Slightly smaller but still significant, the 45-54 and 55-64 age groups represented 15.50% and 14.60%, respectively, showcasing substantial engagement among middle-aged and older adults.

- The 65 and older group also had a noteworthy presence, making up 14.40% of digital buyers.

- Young adults aged 18-24 constituted 13% of the market, while teenagers aged 14-17 were the smallest group, accounting for just 5.20%.

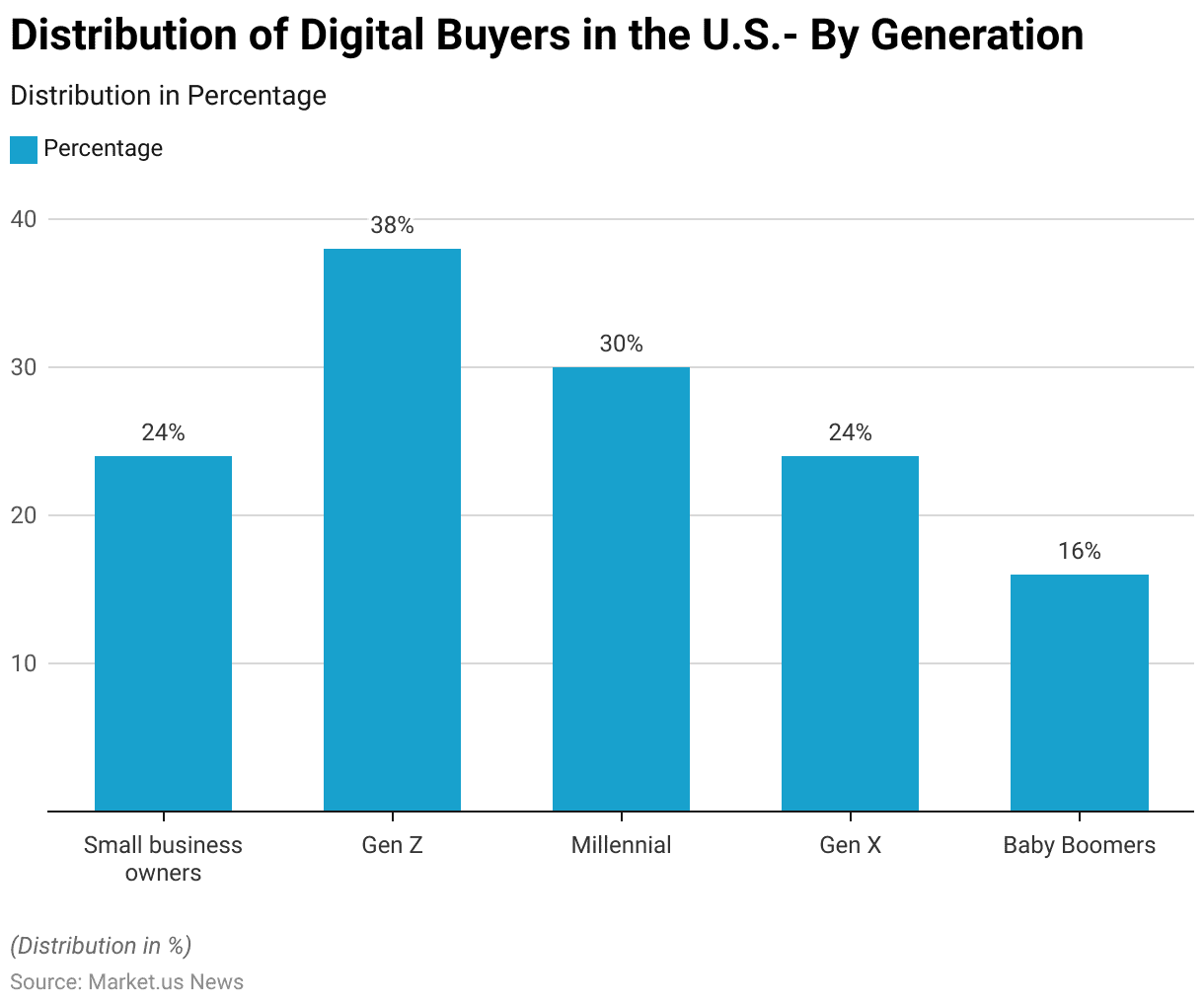

Generation

- Gen Z leads with a significant 38% share, highlighting their strong presence and active involvement in digital activities.

- Following closely are Millennials, who comprise 30% of the segment, underscoring their integral role in the digital landscape.

- Gen X and small business owners each hold a 24% share, indicating substantial engagement from more established generations and entrepreneurs.

- Baby Boomers, though less represented compared to younger generations. Still account for 16% of digital engagement, showing that they remain active participants in the digital realm.

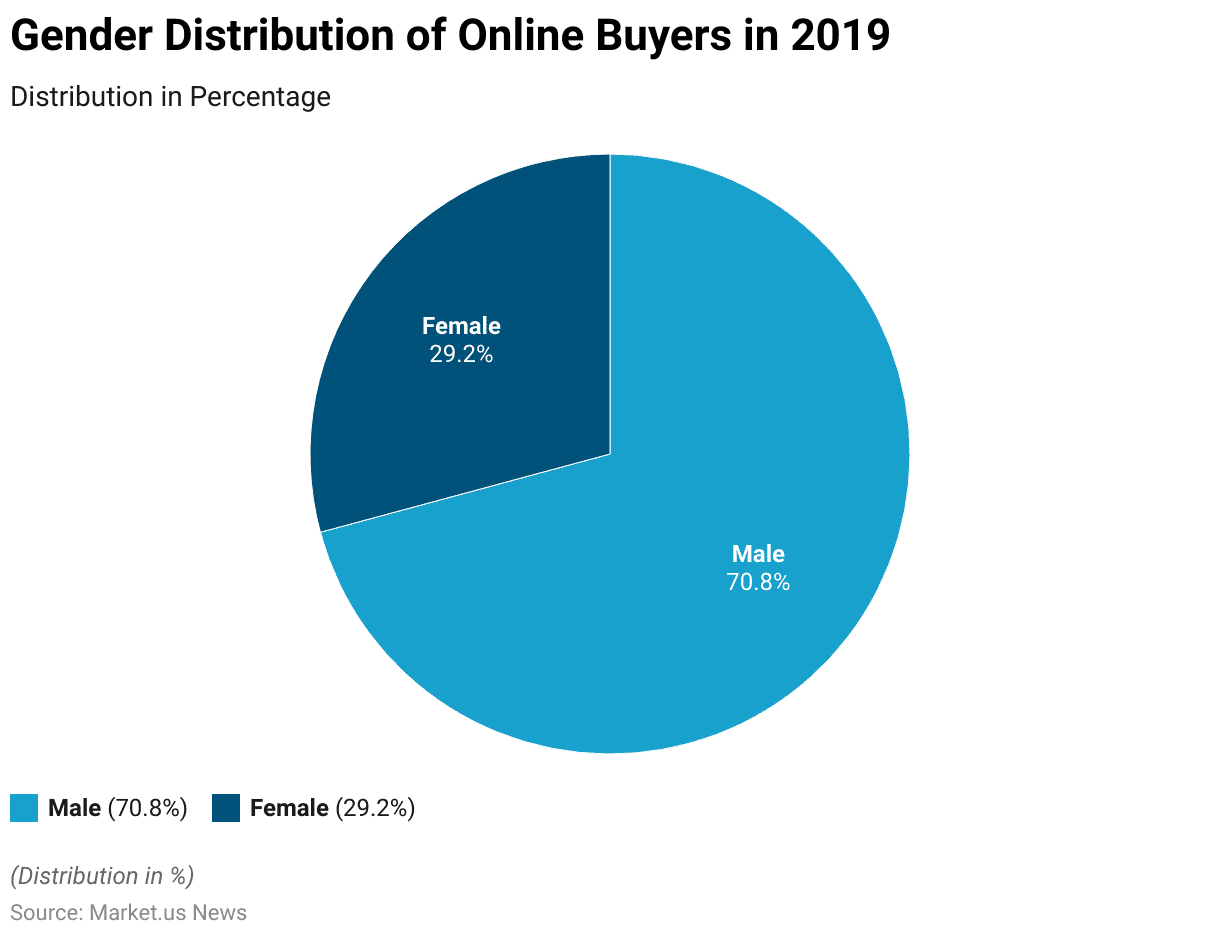

Gender

- The data showed that male users dominated the online buying landscape, accounting for 70.8% of online buyers.

- In contrast, female buyers made up a smaller portion of the market, constituting just 29.2%.

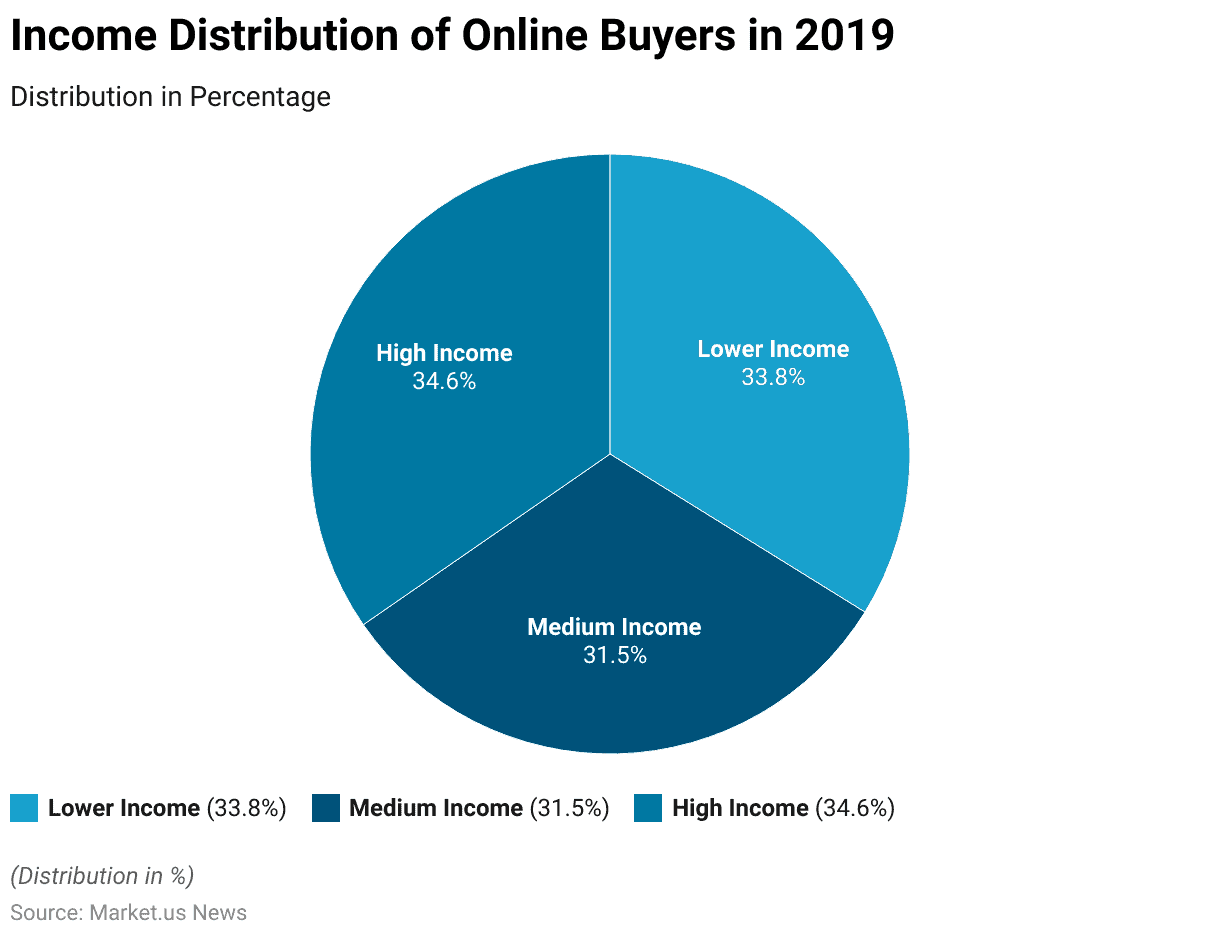

Income Group

- The survey found that 33.8% of online buyers belonged to the lower-income group. Indicating significant participation from this segment in e-commerce activities.

- The medium-income group comprised slightly less, with 31.5% of online buyers.

- Meanwhile, the high-income group represented a slightly larger share, accounting for 34.6% of online buyers.

Retailer vs. Dropshipping Statistics

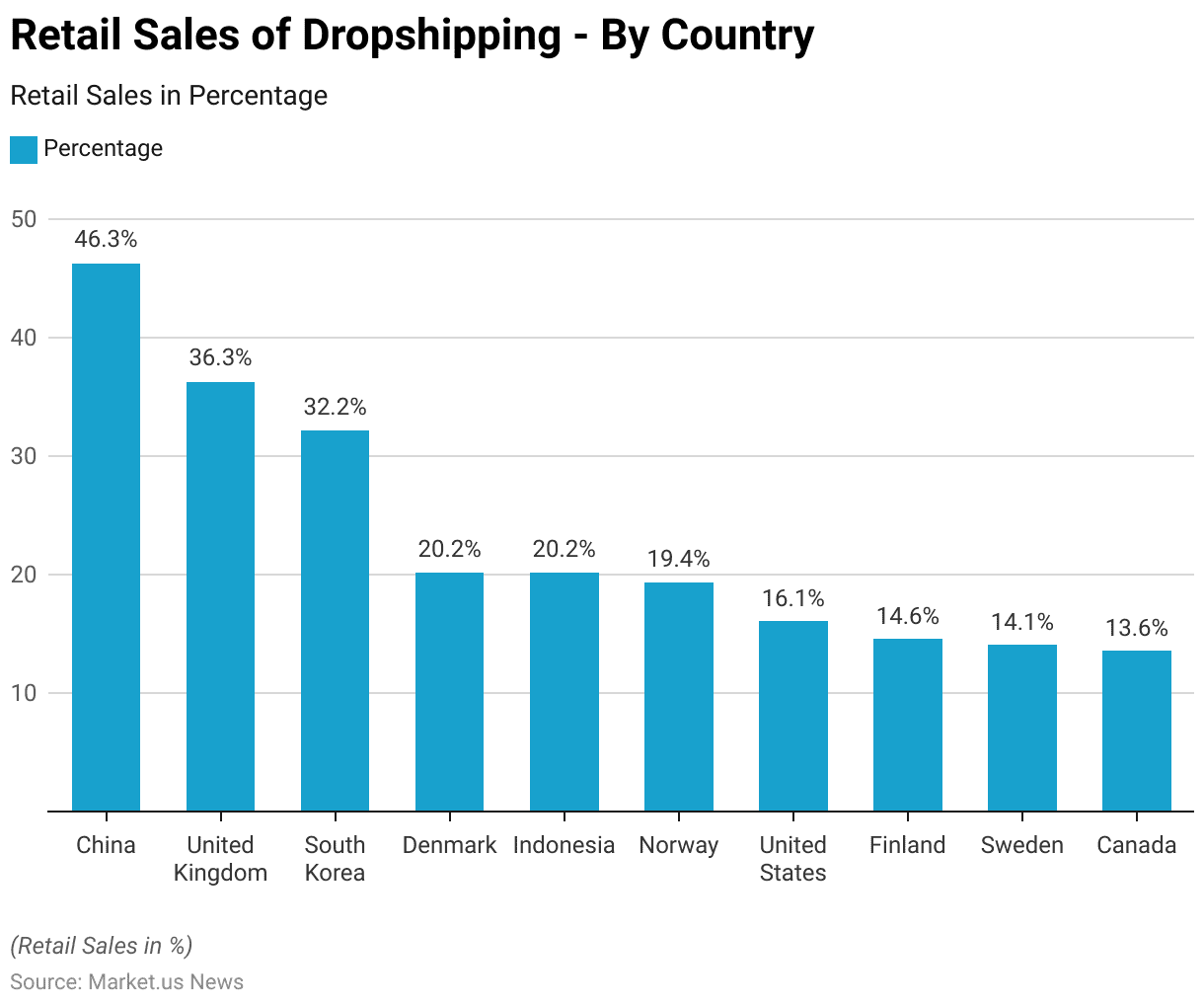

Retail Sales of Dropshipping – By Country

- China leads with the highest percentage of dropshipping retail sales at 46.30%, followed closely by the United Kingdom with 36.30%.

- South Korea also holds a substantial share, contributing 32.20% to the market.

- Both Denmark and Indonesia report equal percentages at 20.20%, demonstrating a strong engagement in dropshipping activities in these regions.

- Norway follows with a slightly lower percentage of 19.40%. The United States also has a notable share of dropshipping sales, accounting for 16.10%.

- In the Nordic region, Finland and Sweden report dropshipping sales percentages of 14.60% and 14.10%, respectively, while Canada rounds out the list with 13.60%.

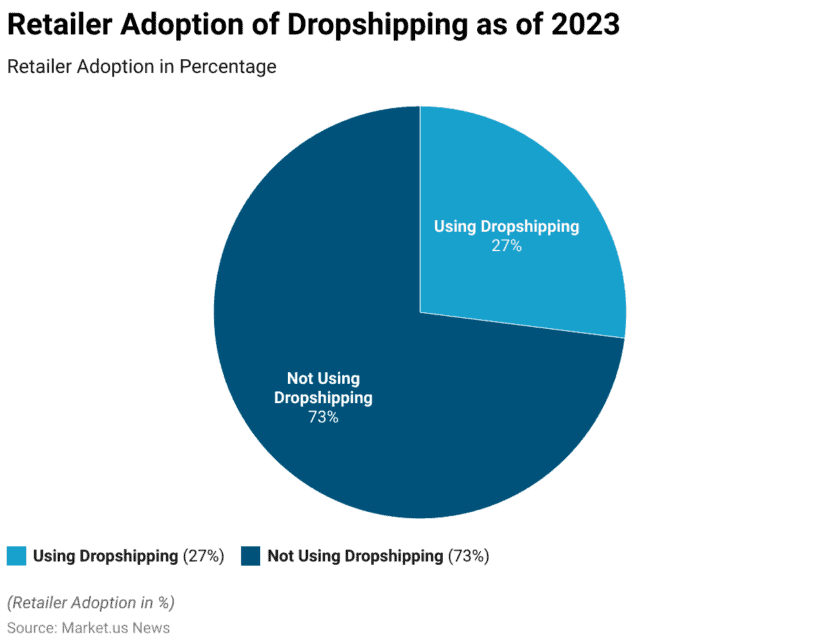

Retailer Adoption of Dropshipping

- As of 2023, the adoption of the dropshipping business model among retailers shows that only 27% are utilizing this method for fulfilling customer orders.

- Conversely, a significant majority, approximately 73%, of retailers have not yet invested in the dropshipping model.

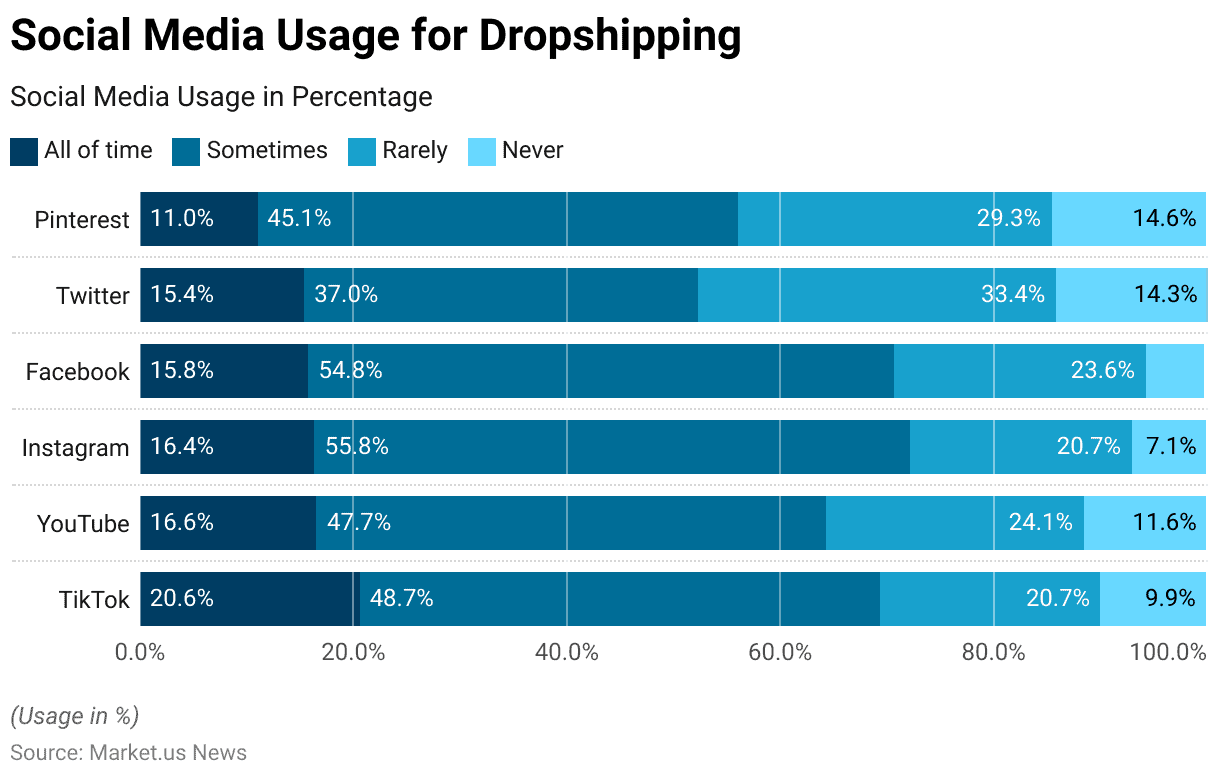

Social Media Usage for Dropshipping

- TikTok is used ‘all of the time’ by 20.60% of drop shippers, with 48.70% using it ‘sometimes,’ 20.70% ‘rarely,’ and 9.90% ‘never’ using it.

- YouTube shows similar usage patterns, with 16.60% of dropshippers consistently using it, 47.70% occasionally, 24.10% rarely, and 11.60% never engaging with it.

- Instagram sees a higher frequency of use, with 16.40% using it all the time. 55.80% sometimes, 20.70% rarely, and a smaller fraction, 7.10%, never using it.

- Facebook usage is also significant, with 15.80% always using it, 54.80% sometimes, 23.60% rarely, and only 5.50% never.

- Twitter, however, has a lower consistent usage rate at 15.40%, 37% sometimes, 33.40% rarely, and 14.30% never using it.

- Pinterest is less frequently used, with only 11% using it all the time. 45.10% sometimes, 29.30% rarely, and 14.60% never engaging with it.

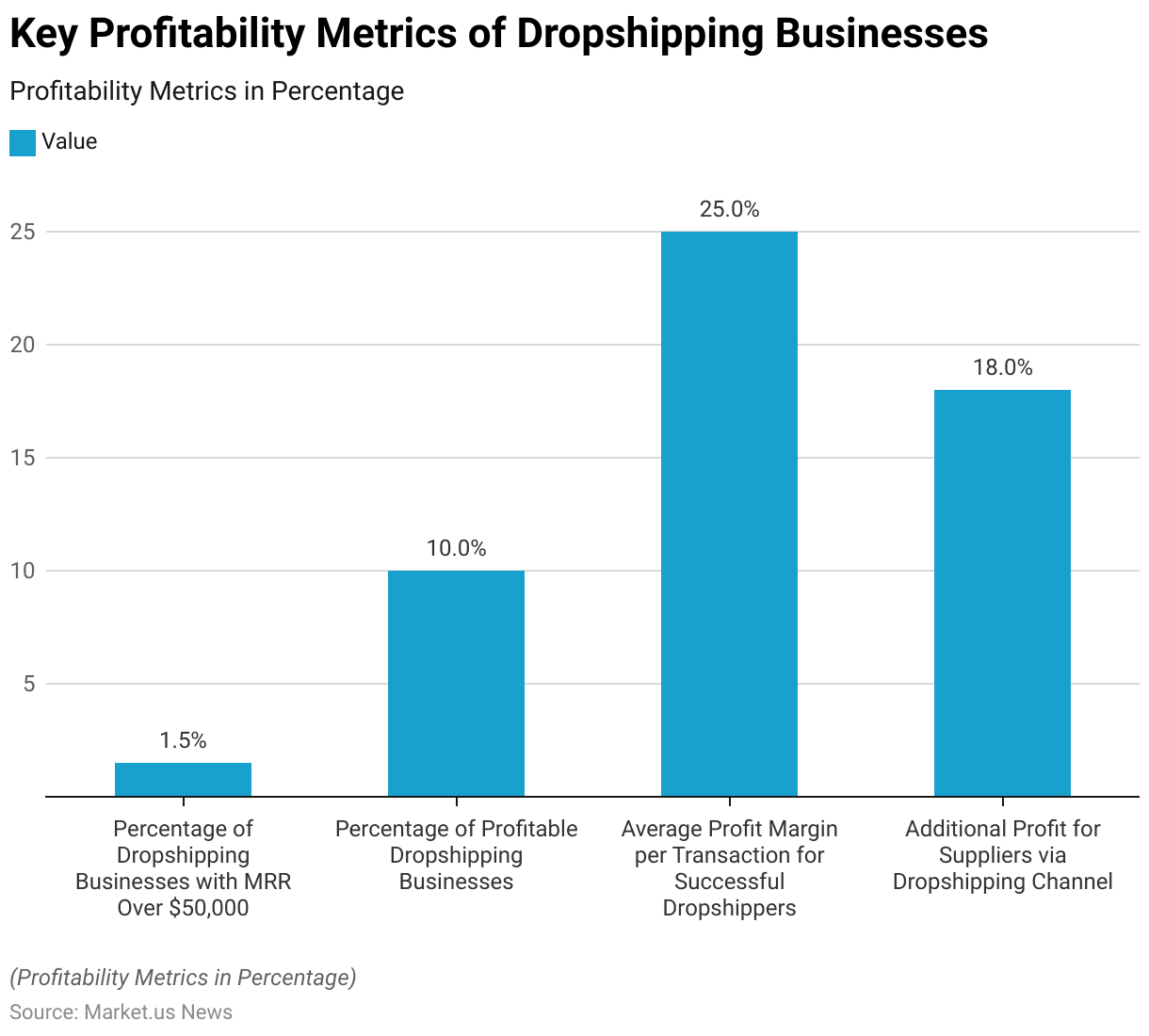

Dropshipping Revenue & Profit Statistics

- DoDropshipping has revealed that only a small fraction, 1.5%, of dropshipping businesses manage to generate over $50,000 in monthly recurring revenue.

- Shopify experts add another layer to this picture, indicating that only 10% of dropshipping businesses turn a profit.

- E-commerce giants like Amazon and Shopify recognize the potential of dropshipping and have developed specialized services that help reduce operational costs and can increase profit margins by as much as 50%.

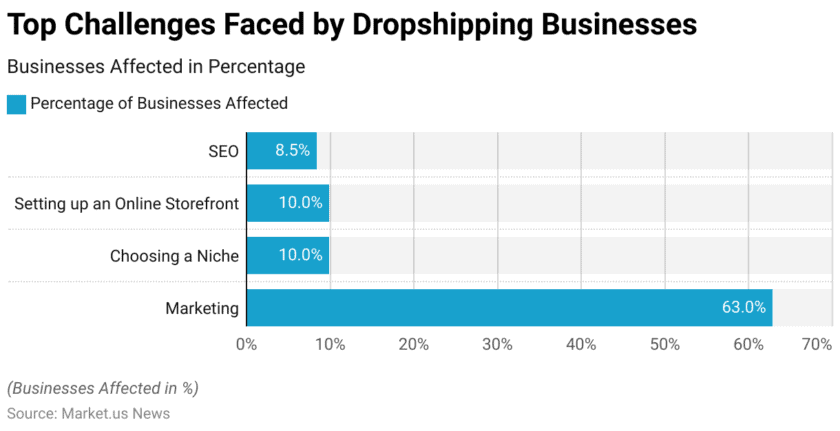

Top Challenges Faced by Dropshipping Businesses

- A study by AliDropShip has identified several key challenges faced by dropshipping businesses.

- The most significant challenge, reported by over 63% of businesses, is marketing.

- Challenges follow this in choosing a niche and setting up an online storefront, each affecting 10% of businesses.

- Additionally, about 8.5% of businesses struggle with search engine optimization (SEO).

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)